Labor Supply of Newly Immigrated Workers

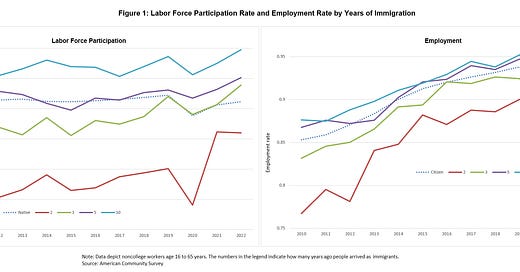

Since the end of the pandemic, monthly payroll employment growth has been surprisingly high, with 205,000 jobs added per month on average in 2023, which the Bureau of Labor Statistics notes here. Meanwhile, earlier this year, the Congressional Budget Office (CBO) raised its projection of net imm…