Housekeeping: Welcome students

Market Rundown:

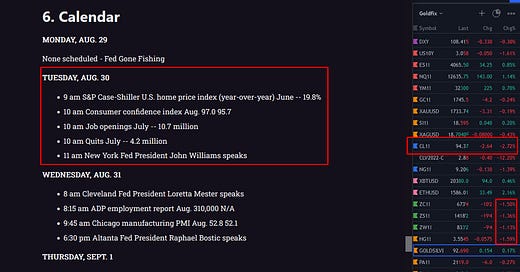

Good Morning. The dollar is down 27. Bonds are stronger and more inverted in what can be called a small disinflationary shift that implies recession taking hold and inflation getting under control. Stocks are bouncing up between 50 and 120 bps. Gold is down $6 after a nice recovery yesterday. Silver is up 2 cents. Crude is down $2.70. Nat Gas is down 18 cents. Crypto is slightly stronger. Grains are weaker across the board.

Excerpts:

GOLD- China: One Small Step for the Yuan, One Giant Leap for the e-Yuan- Jeff.

This is about the Digital Yuan and it is relevant. But it is also relevant to Gold for a different reason. The last time the Yuan was debased like this was in 2014-2015 after the Yen was taken down. Once again the Yen has been taken down aggressively. If it plays out to form, the Yuan will be taken down hard, and then a major rally for Gold can ensue from the competitive devaluations like before. We did charts on this months ago. Will revisit when time permits

WAR UPDATE- Bridges Burnt - TS Lombard

We liked their assessment of the War's potential path in March. They had been very good in laying out the potential paths then. This is sort of predicting, which is new for them. we will see if they are any good at it

TRADING- The Options Observer- JPM

For new students: Some equity option ideas by the bank for their high net worth retail clients.

More at bottom

Zen moment: