Market Rundown:

Good Morning. The Dollar is down 4 ticks. Bonds are flat. Stocks are up between 40 and 60 bps. Gold is up $7 from Comex settlement. Silver is up an additional 20 cents. Crude is again up over $1.50. Natural Gas is higher by 14 cents. Crypto is soft which is slightly odd given the stock bounce.

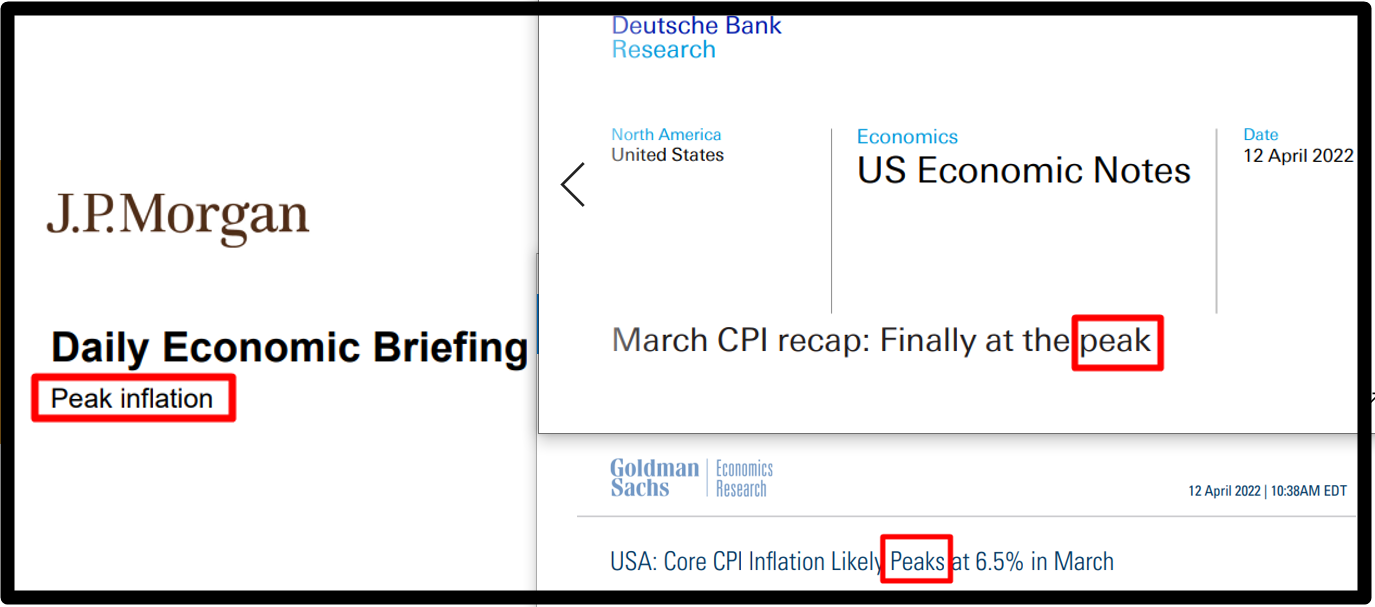

Comment: CPI Came in hot but not surprising yesterday. Used cars have peaked. Housing may have peaked. Service sector inflation is starting to rally now. All the big banks have jumped on the bandwagon of calling this the top in inflation.

We would remind everyone this is nonsense and spin. Inflation may have peaked this year. But you do not go around saying that the day after a CPI number and while a war is ongoing. Call us in 4 years. In meantime These “peaked” calls will be disavowed in a 6 months. So sad given the recent nonsensical “transitory” debacle.

Inflation also “peaked” in 1974.

8:30 am Producer price index final demand March 1.1% 0.8% Cheers

Post Excerpt: 3 Banks ‘Independently’ Agree. Worst is Over

JPM

US fuel and food CPI continue to surge and the 1.2% jump in March prices aligns with the inflation surge seen across the globe. However, the March CPI report also showed core inflation moderating to a 0.324% m/m pace, the smallest gain since last September. Core goods prices fell 0.4%m/m as used car prices declined 3.8%m.m, easing for the second straight month.

The rapid increase in house prices is having a marked impact on consumer price inflation

Goldman Sachs

The composition of the report was firm in absolute terms, as most of the miss versus our forecast was explained by a larger than expected decline in used car prices (-3.8% vs. GS -1.5%), but we note a deceleration in shelter categories

DB

The March CPI data came in a bit below our expectations, with headline and core CPI posting monthly gains of +1.24% and 0.32% respectively. Relative to our forecast heading in, the major reason for the downside miss was used cars and trucks,

which fell by 3.8% from February and alone subtracted more than 20bps from the core print…