Market Rundown | JPM on Curve Inversion, Recessions, and a 15% S&P Rally?

Expect a recession.. also expect stocks to rally

Housekeeping: Lost of talk on yield curve inversion and what it means. We think Sunday might be a good conversation on if/why/how this affects economies, markets, and policy.

Market Rundown

Good Morning. Yesterday late in the day and today Ukrainian President Zelinsky rattled Oil and Gold when he said Russia is sending new forces, that Kyiv was being encircled and there was no real progress in the day prior’s talks. Most markets reacted as you’d expect ( war fear) but muted. Oil and Gold however responded strongly.

We’d note that this is how markets start to get when there is no real news to report but updates are presented as fresh news. Everything is “breaking” now as opposed to “Here’s the latest update”. Expect a lot of this type news reporting and resulting market gyrations. Remember Brexit?

The dollar is down 62 (you’d think it would be stronger given the Ukraine comments), Bonds are nowhere for a change, Stocks are softer slightly. Gold is up $24 (leaving the selloff from yesterday well behind) , Silver is up 48 cents, Oil is up $4.30 ( undoing yesterday’s dive and more). Grains are firmer, but Wheat was last to rally. Crypto is moving in sympathy with stocks this morning.

Premium Excerpt

JPM on Yield Curve Inversion and Recessions

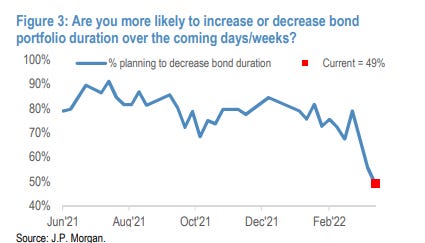

Overall we find too much negativity rather than too much complacency in markets and stay with a pro risk stance in our model portfolio. Major central banks’ hawkishness and in particular the Fed’s and the ECB’s hawkishness is often mentioned as an argument by those advocating a bearish stance. We disagree. First, we are at the beginning of a monetary policy tightening cycle, and as mentioned above, the historical experience from previous tightening cycles beginnings is positive for both equity and credit markets.- MK

There has been a lot of commentary on the yield curve inversion the last few days as the MSM gets onboard with what independent news sites…

continues at bottom…

If you enjoyed this piece, please do us the HUGE favor of simply clicking the LIKE button!