Market Rundown | JPM on Platinum, Goldman on CPI Expectations, S&P Levels

Nobody ever, ever, ever writes on Silver.. Wonder why?

Housekeeping: Good Morning

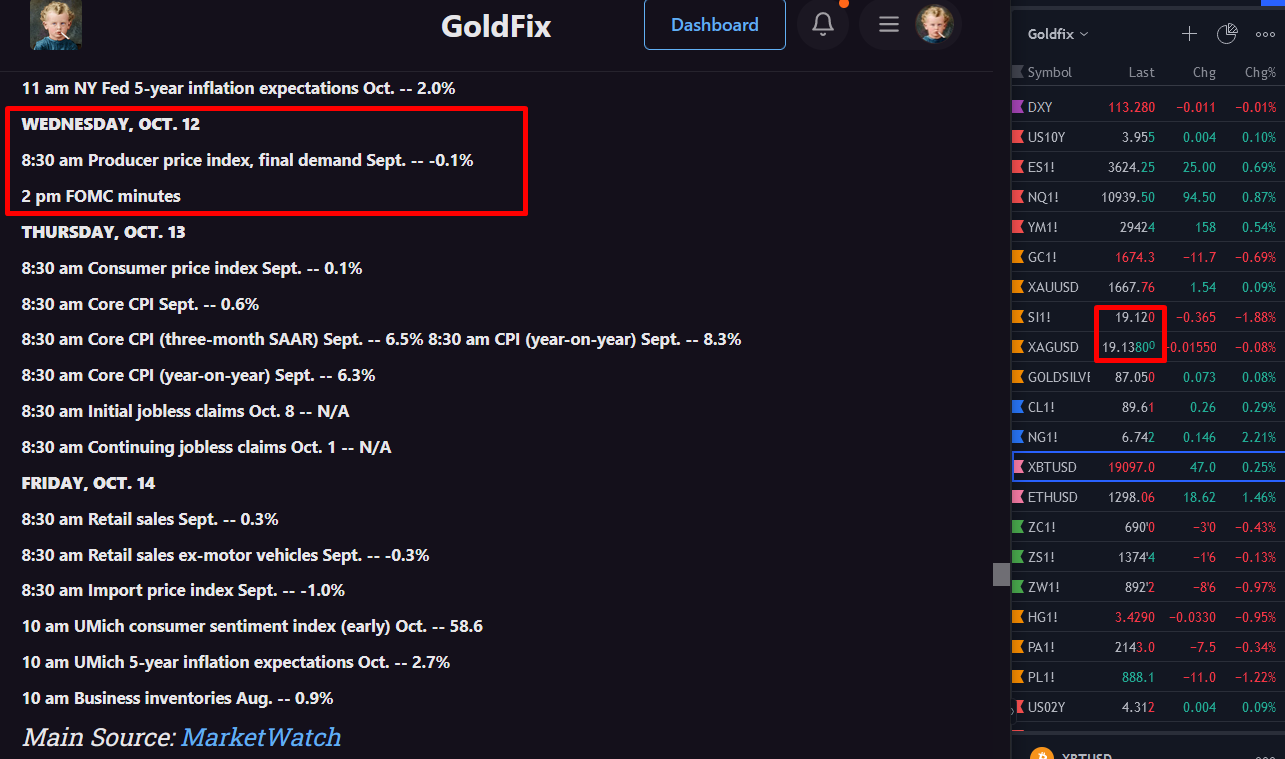

Market Rundown: PPI Today

The dollar is flat so far. Bonds are unchanged. Stocks are up 55-95 bps. Gold is up $3 and Silver is up 4 cents after yesterday’s late day drubbing post Comex close. Crude is up 30 cents. Natural gas is up 12 cents. Crypto is slightly bid and grains are down between 20 and 100 bps.

Today was PPI, one of the big three inflation indicators this week. The other two being CPI and UMich. It just came in mixed as we write this.

PPI 0.4% M/M, Exp. 0.2%PPI 8.5% Y/Y, Exp. 8.4%PPI Core 0.3% M/M, Exp. 0.3%PPI Core 7.2% Y/Y, Exp. 7.3%

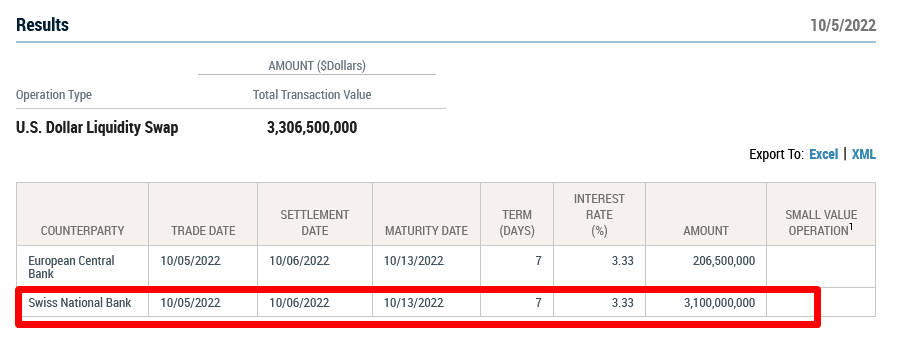

Pivot Comment: We think the Fed will continue to silently bailout those in need while keeping rates firm via its dollar swap window. At least until one of our criteria are met for a Pivot.

You just cannot have monetary ease while you have fiscal spending like this and expect economies to come out the other side alive. Hence No Pivot

Conversely, Powell knows he cannot have rates keep going up while stocks keep going down and come out of this with his own career alive- especially with the mounting pressure on him by various CEOs and political wonks. Hence Pivot.

We shall see which wins out. The main event, CPI is tomorrow for Fed watchers.

Excerpt:

JPM on Platinum:

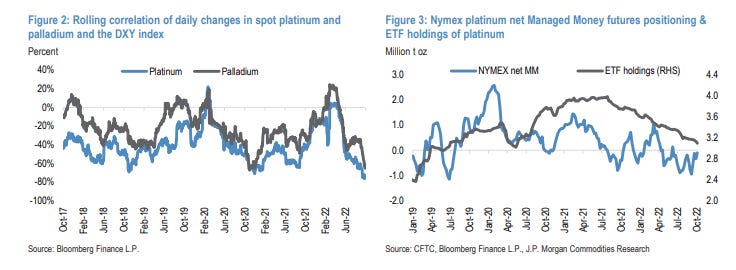

Tighter fundamentals have insulated both platinum and palladium from some of the more outsized price declines we have seen in other industrial-linked metals like copper and aluminum, though the weight of a strengthening US dollar and other more bearish precious fundamentals have nonetheless taken its toll recently, particularly on platinum (Figures 2 & 3)

Goldman on CPI:

We highlight three key component-level trends this month. First, timely auction data suggests that used car prices likely fell about 2.5% in September, while reduced dealer incentives suggest new car prices likely rose about 1%. Second, we expect education prices to increase 0.5% this month, as schools pass through higher costs to consumer prices at the start of the new school year.

Third, we expect rents to increase by 0.7% as the official index continues to catch up to the price levels implied by alternative web-based measures of asking rents on new leases.

CONTINUES AT BOTTOM