Market Rundown | JPM Says Stay Away from Tech, Bonds Aren't Done Selling Off

"Still too early to own duration: Bonds’ valuations are more attractive"

Market Rundown:

Good Morning: The dollar is down 9 ticks. Bonds are soft at he long end. Stocks are softer. Gold started out weak, but has turned positive on no real news. The coincident moves were the dollar softening and bonds dropping a little more as it reversed higher. Meanwhile, Silver remains soft. Have a good day.

FOMC Minutes at 2p.m. ETPost Excerpt:

JPM on Bonds: ‘ It will get worse’

The direction of travels is likely to remain higher for yields given high inflation and tightening central bank liquidity. … however, inversion is not the death knell for the cycle, but rather the beginning of the countdown to the end.

We’re not so sure about it being the countdown to the end. Not being doom and gloom. But inversion with 30 yr rates this low is not common. It risks long term rates going much higher if the inversion doesn’t strangle inflation ASAP. More on that this weekend.

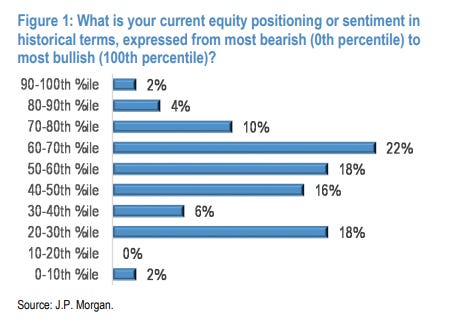

JPM on Stocks: ‘Don’t Buy Tech’

Still too early to own duration: Bonds’ valuations are more attractive after their recent sell-off, but not yet compelling, especially vs Stocks.

Continues at Bottom...Podcast:

Zen Moment: