Market Rundown | JPM Says to Lighten Stock Positions, Keep Commodities

8:30 am CPI (year-over-year) March 8.4% expected

Good Morning: The US will be reporting March CPI today with a median and average figure at 8.4% - a 1.2% month-over-month increase

The dollar is up 18. Bond are sideways. Stocks are flat. Gold is up $10 from Comex settle (pre number punters all week). Silver is up 15 cents from same. Crude Oil is up $3.60 ( number and Opec statement today flattening). Natural Gas continues to ratchet up. Grains are bid again with Wheat strongest.

Markets are also focusing on expectations of Russian escalation. That may be why you are seeing big moves in oil today.

Biden is getting ahead of potential bad news again. Please do not think he knows anything about the data. He’s just doing a CYA. But it is smart. If the number comes in high, not only will he have hedged himself, but they will come back to him for a follow up comment. If it comes in low.. take credit, right?

Either way, barring a Russian escalation, it will be tomorrow’s headline

6 am NFIB small-business index March 95.5 95.7

8:30 am Consumer price index (monthly) March 1.1% 0.8%

8:30 am Core CPI (monthly) March 0.5% 0.5%

8:30 am CPI (year-over-year) March 8.4% 7.9%

8:30 am Core CPI (year-over-year)) March 6.6% 6.4%

12:10 pm Fed Gov. Lael Brainard speaks at WSJ event

2 pm Federal budget deficit March -- -$660 billion

6:45 pm Richmond Fed Fed President Tom Barkin speaks to Money Marketeers

Cheers

Post Excerpt: Lighten US Stocks, Not Commodities

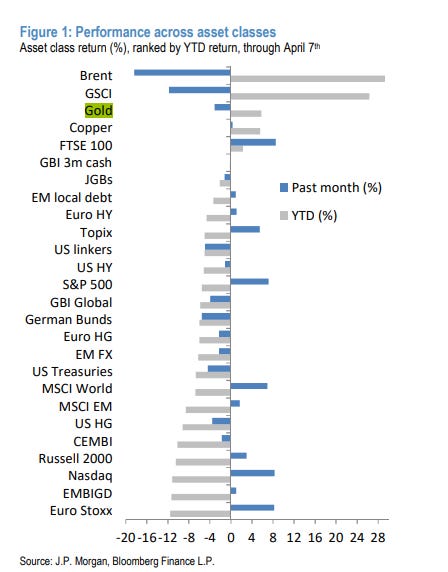

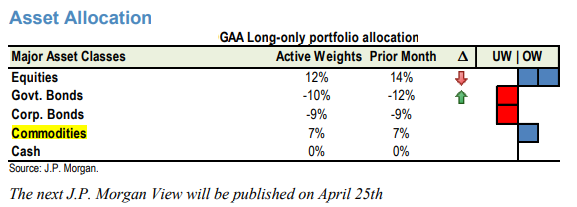

For the last three months, JPM has been advising clients to buy stocks in the selloffs. Now they are telling you to take profits in US stocks, stay long EM stocks and currencies, and stay long commodities.

Take part profit on the equity vs. bond overweight: Given the rally in equities and sell-off in bonds over the past month, we take profit and revert to our equity allocation from 2 months ago. However, we maintain a large equity vs. bond OW.

If bond yield rises continue, they could eventually become a problem for equities, but we believe current real bond yields at around zero are not high enough to materially challenge equities. Given low bond positioning, a further big rise in real yields from here seems less likely