Housekeeping: Here’s a quick synopsis of what happened yesterday in no uncertain terms. Also of very important interest is what BOAs Hartnett said this morning. He summed up both the big picture and the little picture extremely well. More on that at bottom.

Market Rundown:

Good Morning. Several things are top of the mind today and frankly we are not sure what people will get the most out of after yesterday’s incredible reversal. So best to go with the Q & A concept when figuring stuff out. There are only a couple of good write ups on the various drivers of the CPI event. Two of which are at Zerohedge. Here is ours intended as complementary to theirs in summary.

What Happened Yesterday?

CPI came out at 8:30 hotter than expected and stocks crashed which makes sense from a macro economic perspective as higher inflation means higher rates for longer.

Stocks opened at 9:30 and made their low for the day right then and there.

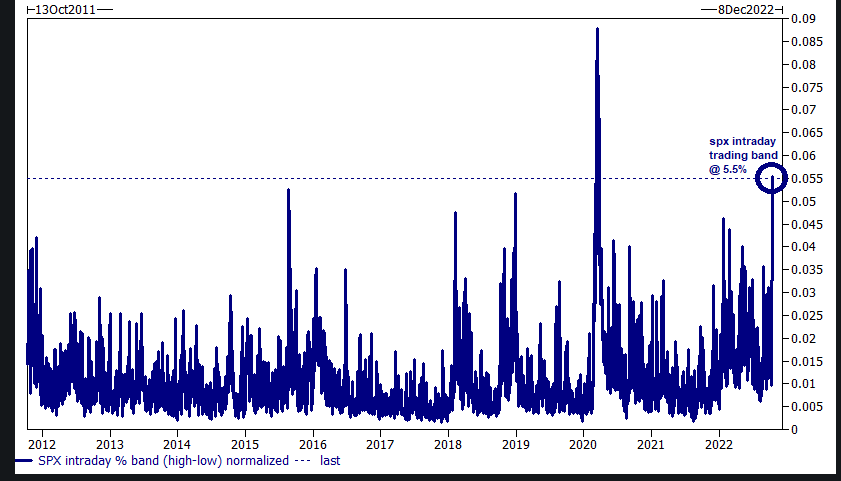

Then with no headline to trigger other than the CPI itself, stocks had the most astounding reversal anyone has seen since March of 2020.

Why such a massive rally if VIX was so low this time?…

Why did it happen?

There was no discernible public event or news that inspired/triggered the turnaround. There were indicators that something like this could happen, but nowhere near the magnitude that it did. One such indicator was market participants were the least long they had been in a logn time. Bottom line is, everybody was already short that wanted to be short…

CONTINUES AT BOTTOM

EXCERPT: BOAs Hartnett sums it up nicely.

The Big Picture:

Wall St disorder of 2022 reflects painful "regime change" as bullish deflationary era of peace, globalization, fiscal discipline, QE, zero rates, low taxes, inequality gives way to inflationary era of war, nationalism, fiscal panic, QT, high rates, high taxes, inclusion (Chart 4); 2020s secular investment theme is inflation; long-term charts of bonds, Swiss franc, tech, dollar-pegged Hong Kong stocks (Charts 5-8

The Smaller Picture:

2022 a simple tale of “inflation shock”causing “rates shock”which in turn threatening“recession shock”& “credit event”; inflation shock ain't over...Sept CPI was hot& bond yields rose (expect critically in credit-event UK); core CPI has averaged 0.5% MoM past 3 months...if sustained, core CPI still 5-6% YoY late-spring 2023(Chart 9); good news (one reason 3000-3600 the buyzone for SPX) is inflation mathematically set to fall and critically inflation to flip from “unanticipated”in 2022 (so bearish) to “anticipated”in 2023(which will be less bearish, all other things equal).

CHARTS AND MORE AT BOTTOM