Housekeeping: ***Buy a hat, mug or sweatshirt to support Independent Media***

Things are Happening Faster Now

Featured Posts on News Sites :

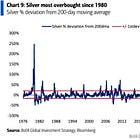

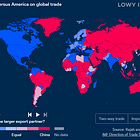

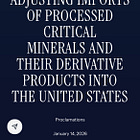

Scottsdale Mint-Metals Exec: Silver Physical Market Under Strategic Pressure ZeroHedge- Will Index Rebalancing Kill Silver's Rally? Yahoo:- Presidential Proclamation on Metals

Featured Analysis:

MSA Update: Gold Opens $4,655 Silver at $92.70

Gold surged toward $4,655 while silver held near $92.70 as metals extended a structurally driven advance. Michael Oliver’s MSA framework argues that mining equities are emerging from decade-long suppression, silver remains historically restrained versus gold, and weekly volatility reflects acceleration rather than exhaustion. Relative breakouts in XAU versus the S&P, leadership from silver miners, and improving platinum ratios point to a sector-wide re-rating that remains early in its cycle.

Breaking: HK–SGE Deal Advances Gold’s Collateral Repo Path

Hong Kong and the Shanghai Gold Exchange will launch a cross-border gold clearing system, creating a central infrastructure for custody recognition, delivery certainty, and settlement efficiency. Officials frame the move as market development, but its strategic impact is deeper. Interoperable vaults and clearing corridors allow gold to function as institutional collateral, not merely a reserve asset. The agreement directly supports gold’s evolution into repo-eligible liquidity within emerging multipolar financial architecture.

News & Analysis:

ICYMI

Coming Soon/ Chat:

Data on Deck: CPI, PPI

MONDAY, JAN. 19None scheduled, Martin Luther King Jr. holiday

TUESDAY, JAN. 20None scheduled

WEDNESDAY, JAN. 2110:00 amConstruction spending (delayed report)Oct.--0.2%+10:00 amPending home salesDec.--3.3%

THURSDAY, JAN. 228:30 amInitial jobless claimsJan. 178:30 amGDP (first revision)Q34.3%

FRIDAY, JAN. 238:30 amPersonal income (delayed report)Nov.0.4%++8:30 amPersonal spending (delayed report)Nov.0.4%++8:30 amPCE index (delayed report)Nov.--0.3%++8:30 amPCE (year-over-year)--2.8%++8:30 amCore PCE indexNov.0.2%++8:30 amCore PCE (year-over-year)--2.8%++10:00 amConsumer sentiment (final)Jan.54.09:45 amS&P flash U.S. services PMIJan.52.59:45 amS&P flash U.S. manufacturing PMIJan.51.8

Charts and Final Market Check:

***Please buy new mugs and sweatshirts in additions to our hats and support Independent Media***

MONDAY, JAN. 19None scheduled, Martin Luther King Jr. holiday

TUESDAY, JAN. 20None scheduled

WEDNESDAY, JAN. 2110:00 amConstruction spending (delayed report)Oct.--0.2%+10:00 amPending home salesDec.--3.3%

THURSDAY, JAN. 228:30 amInitial jobless claimsJan. 178:30 amGDP (first revision)Q34.3%

FRIDAY, JAN. 238:30 amPersonal income (delayed report)Nov.0.4%++8:30 amPersonal spending (delayed report)Nov.0.4%++8:30 amPCE index (delayed report)Nov.--0.3%++8:30 amPCE (year-over-year)--2.8%++8:30 amCore PCE indexNov.0.2%++8:30 amCore PCE (year-over-year)--2.8%++10:00 amConsumer sentiment (final)Jan.54.09:45 amS&P flash U.S. services PMIJan.52.59:45 amS&P flash U.S. manufacturing PMIJan.51.8