To All:

From now on, for active traders, when Michael does these videos, we will send them out very early. The written technical analysis excerpts will be either here, or in the Market Rundown Post depending on when Micheal puts them out.

Brynne Kelly is back after settling into her new position trading Energy at a Hedge Fund to be named later. She’s doing her Morning Energy News Items for that firm’s traders and we are lucky enough to get a copy. See those attached as well.

Best of Luck

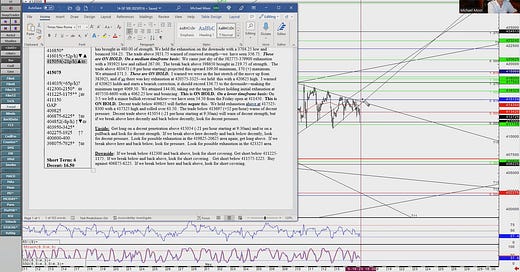

Moor Trading Level Excerpts:

About Michael Moor’s Work: Moor Analytics produces technically based market analysis and actionable trading suggestions. Reports are sent to clients twice daily, pre-open and post close.

Note: Michael puts out specific actionable trading levels twice daily for Gold, the whole Oil complex, S&P 500 and Bitcoin. If you are a serious technical and/or day-trader type we recommend his work without reservation. Go here

Morning Highlights for 5/17/2023

Compiled by Brynne Kelly

Oil prices moved in a flat-to-low range in Asian trade on Wednesday as industry data pointed to an unexpected build in U.S. inventories, while weak economic readings from the U.S. and China also dented the outlook for demand.

According to the API, the US crude inventory rose by 3.7 million barrels last week. However, gasoline inventory fell by 2.46 million barrels, while distillate stock dropped by 886,000 barrels.

On the other hand, China's industrial output grew 5.6% in April from a year earlier, missing expectations by a large margin.

Today’s July WTI Pivot Level = $71.01

NOTABLE OVERNIGHT HEADLINES

*Democrats To Launch Discharge Petition, Aiming To Force Debt-Ceiling Vote – WSJ

*McCarthy says still very apart on debt ceiling talks, but deal possible by end of the week

*Joe Biden cancels stops on Asia trip because of US debt limit stand-off

*BoE Gov. Bailey: Things are looking a bit brighter than they did a couple of months ago.

*Japan emerges from recession on post-COVID consumer rebound

*Chinese New House Prices YoY Actual -0.2% (Forecast -, Previous -0.8%)

*Ukraine Officially Joins NATO Cyber Defense Center, Inching Toward Full Membership

*Over the last six months, the IEA has lifted its forecast for Russian, Iranian and Venezuelan output in 2023 by a combined 1.3 million barrels a day, reaching an annual average of 14.3 million barrels a day.

*Reminder: The next JODI Oil & Gas World Database update is scheduled for tomorrow.

Oil Analysis and CTA Data