Housekeeping: One day a week GoldFix shares exclusively with its members an extended excerpt of Moor Analytics professional technical analysis for energy. The rigor and methodology are the point for GoldFix subs. This is top shelf stuff even if you aren’t a subscriber to his work. It’s worth a listen if you are an active technical trader.

Morning Energy Podcast Clip

OIL RECOVERS ON OPEC THREATS. NAT GAS TRACKS EUROPEAN CRISIS

Energy had a rip of a day yesterday. Crude started extremely weak taking cues from multiple drivers including Iran talks...

According to Bloomberg:

Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said “extreme” volatility and lack of liquidity mean the futures market is increasingly disconnected from fundamentals and OPEC+ may be forced to cut production.

What they are saying to the uninitiated is this: You are using futures markets to drive oil prices down artificially like you do in Gold and Silver and we know it. As ZH notes in this post: oil is now a Jekyl and Hyde market.

GoldFix Comment:

Historically, when OPEC speaks this bluntly its either from being very weak like in the 90s, or form very strong like in the 70s. This time, they have Chinese demand behind them, Russian tech, and are a lot smarter when it comes to concepts like rehypothecation. We think they are coming from strength, even if it is false. The East knows that once pricing power legitimacy is eroded in the west, then all deals will gradually naturally be done in something other than dollars. That is what is happening now. Less deals are being renewed for long term in dollars, putting the hegemonic strength in jeorpardy. In oil, Demand is much more important dictating price on the physical side die to its constant use. For now, China is the growing demand side and willing to buy more in yuan.

This also only exacerbates the dual nature of markets now. Less good collateral means more bifurcation between futures and spot as Zoltan Pozsar had warned in February. Here is an excerpt from: Gold: "A crisis is unfolding. A crisis of commodities"- Zoltan Pozsar:

Zoltan goes on to explain how he came to this conclusion paralleling previous crises. These include but are not limited to events like the Southeast Asian crisis of 1997; subprime, Bear Stearns, and Lehman Brothers in 2008; and secured funding against good collateral to RV hedge funds during 2020. In all instances a backstop was provided. Somebody had to underwrite the “put” that saved the markets from an abyss. Every time in those instances it was the US Fed that did this. Not this time. Why?

The collateral underpinning the system is not financial this time. It is real. War, sanctions, and the ensuing chaos has split markets along spot versus derivative lines. Geographically: East vs West. Collateral: Real vs rehypothecated. Guess who owns the collateral that is being used to leverage western finances? Russia and China.

The thing is, the crisis is not getting better; it is spreading further. Markets are growing further and further apart. Divorce court is in full swing now. And if it continues (it will) without being addressed properly you will see pricing power in the West erode and grow in the East. Which means: financial collapse globally, more splitting of trade, and more draconian protective/mercantilist policies enacted. That will remove dollar hegemony 1/2 the world.

Meanwhile in Natural Gas land…

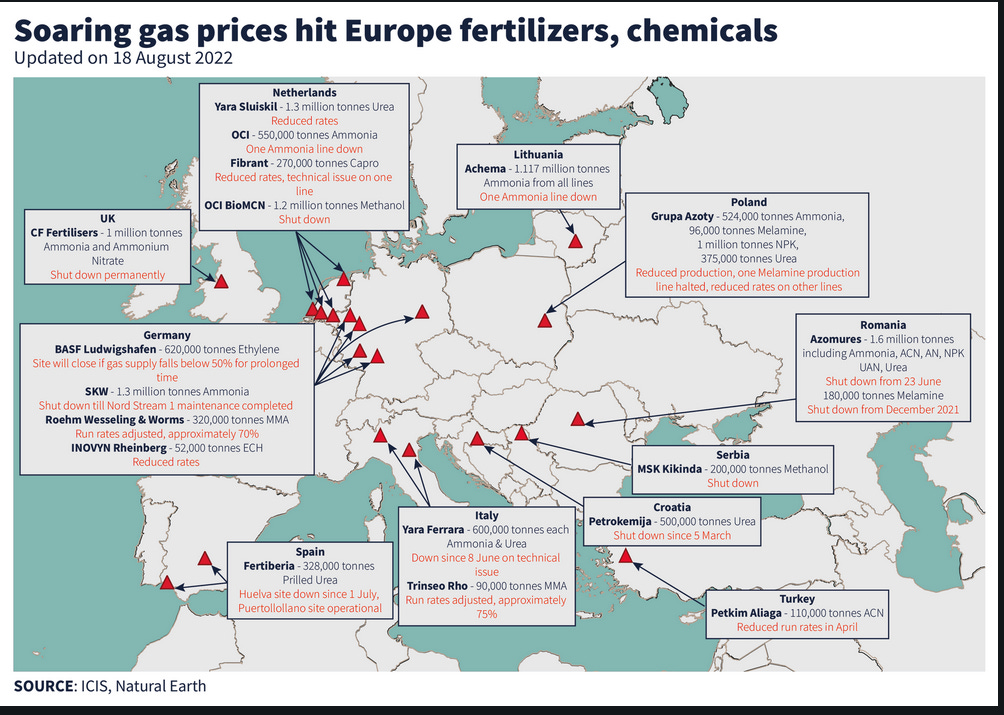

Record natural gas pricing for Grupa Azoty has driven the company to halt some caprolactam, polyamide 6 (PA6), and nitrogen fertilizers production. As one trader put it, all EU plants are going down one by one.

About:

Moor Analytics produces technically based market analysis and actionable trading suggestions. Reports are sent to clients twice daily, pre-open and post close.

If you have more interest go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free trial