**MUST READ: Russia Gets Real About Gold as a Settlement Unit for Payment

BRETTON WOODS 3 IS HERE

“We completely believe after this war is over, money will never be the same regardless of who wins. Compromises will be made on both sides.”

Today:

BRICS Proposed Gold Use in Food Pricing

Zen moment: Truck Ahoy

GS: Australian Lithium and Gold mining

Hartnett’s weekly report

BRICS Member Proposes Gold For Food Pricing

The proposed alternative global payment system for food security involves using a special payment unit backed by gold. Gold has historically been considered a reliable and stable asset, (even if it is only kept by Central Banks because of tradition as Bernanke says) making it an ideal candidate to back digital currency used in this system in lieu of dollar trust. Further, it will be accommodative of foreign countries not even in the BRICS.

Bottom line: if successful, Russian Wheat will be priced in Gold, not dollars

The proposed system gets pretty specific, touching on the following:

Gold as a Reserve Asset

Determining the Value of the Unit of Account

Gold Trading Standards

Scaling and Collateral Expansion

These concepts analytical necessities and inform us this is the bleeding edge of Gold-use if Russia and the Brics have their way. This is the next proper step they would take if they ant to be taken seriously. Remember the last proper step that we were pounding the table on as a signpost: **Massive: Gold Gets Closer to Centralized Clearing in BRICS Solution to SWIFT

This is the next massive signpost

Article: Russian Food Payment Proposal

[B]anks have been managing their paper gold books with one assumption, which is that [Nation] states would ensure gold wouldn’t come back as a settlement medium. -Zoltan Pozsar

Economists of the CMASF on what Russia needs in the field of finance to feed half the world

Translated from the Original Russian; H/T @Lozion

Solving the problem of food security in developing countries is one of the key topics of the Russian-African summit, which opens on July 27. Oleg Solntsev, Ilya Medvedev, Irina Ipatova, Denis Pekhalsky, Gleb Krivenko from the Center for Macroeconomic Analysis and Short-Term Forecasting (CMASF) in an article for Kommersant show that this task requires the creation of an alternative global payment system with the participation of Russia, and demonstrate what it is should and may be.

The question is ripe

I would like to hope that the focus of discussions at the Second Russian-African Summit, which opens on July 27 in St. Petersburg, as well as the August BRICS summit in Johannesburg, will find a place in the formation of new, alternative to existing global payment and settlement systems. This question, as they say, is overdue. And this is determined not only and not so much by geopolitical factors as by economic necessity.

1. Without this, it is no longer possible to ensure global economic (including energy, food) security.

This is clearly evidenced by the failure of the “grain deal”, when, due to barriers from Western banks, insurance companies and payment systems, significant volumes of grain and fertilizers from Russia were not delivered to end consumers. Thus, according to EXIAR Director General Nikita Gusakov, the shortage of fertilizers from Russia has led to underproduction of agricultural products, which would be enough to feed 20 million people.

At the same time, the problem of malnutrition and hunger (mainly in developing countries) remains quite acute: according to UN estimates, in 2021 the number of hungry people reached 830 million and by 2030, despite the growth in global food production, this number will not decrease significantly. One of the reasons is the instability of the price conjuncture of food markets, as well as payments and supplies to developing countries.

2. The need to eliminate the large-scale redistribution of investment income to large developed countries from developing ones, which perpetuates the gap in wealth and levels of development.

The number of countries paying net investment income is 4.5 times greater than the number of recipient countries. Basically, the former include countries with developing and transitional economies (including all BRICS countries). The average level of their net payments is 3.7% of GDP (median - 3.3%). This is, on average, higher than their annual economic growth rates, in other words, the additional volume of value added created per year through the payment of investment income is on average completely redistributed abroad.

Among the recipient countries, if we do not consider offshore and territories - "investment portals" (Hong Kong, etc.), the majority are developed economies. Moreover, only four countries - the United States, Japan, Germany and France - account for about 80% of the global net investment income received. These countries are not only major direct investors, they also play the role of global payment centers and issuers of major world currencies.

The payment by developing and transitional economies of significant payment rents not only means an outflow of income, it also leads to a long-term undervaluation of the purchasing power of their currencies. This, in turn, limits their ability to independently acquire technologies, advanced equipment, and intellectual assets on the world market.

3. The need to protect against the potential instability of major world currencies due to their excessive emission in recent years, financial bubbles, and in some cases, a large-scale imbalance in the foreign trade of the issuing countries.

Where to look for a solution?

Mutual payments in the national currencies of partner countries cannot be a long-term solution. Sooner or later, an attempt to build settlements based on national currencies will stumble upon limitations in the form of low liquidity of their markets, legislative restrictions on convertibility, a high level of exchange rate risks, as well as an imbalance in mutual trade, leading to the accumulation of chronic (and potentially bad) debts.

Due to the high volatility and limited capacity of the markets, classic cryptocurrencies cannot be such solutions, and private stablecoins, due to insufficient security of the security.

The currency of one key developing country, the Chinese yuan, will have political restrictions on its use in international trade (particularly with India).

The way out seems to be the formation, within the framework of one or another association of countries, of a system of cross-border payments using multilateral clearing and a special payment unit in the form of a digital currency, the conversion of which into national currencies in domestic markets should be guaranteed by the central banks of the participating countries.

The use of a digital currency platform will provide a high, significantly superior to traditional payment systems (for example, SWIFT), settlement speed, their reliability and confidentiality, cost savings, independence and equality of each of the participants, protection from third-country sanctions.

The implementation of mutual settlements using a special payment unit with a transparent principle for determining its value, combining flexibility and sufficient stability of the proportions of exchange with national currencies, will minimize the exchange rate risks of participants in the settlements, and will determine the fair nature of the exchange. The trust of system participants in a special payment unit should be based on the provision of issued obligations with a security asset collateral, as in the case of a classic stablecoin. But at the same time, the possibility of converting into these assets must be real and confirmed by the sufficiency of the corresponding reserves.

Multilateral clearing will reduce the requirements for the amount of digital currency balances and, accordingly, the amount of protective assets pledged, which will limit the costs of ensuring the stability of the system.

The prototype of such a system can be the European Payments Union (EPU), which existed in the 1950s as a clearing system between the countries of Western Europe, which functioned on the basis of its own currency - epunit, the value of which was tied to the international price of gold, while the exchange rate of the national currencies of the participating countries in relation to to epunit was established by the countries independently.

New System Architecture: Foundation

Calculations by V. Salnikov and A. Gnidchenko (CMASF) were used.

However, as the experience of the ENP shows, in order to launch such a multilateral system, the motivation to simplify and increase the reliability of the payment system is not enough - it needs to be linked to the solution of pressing economic problems of a high level of priority. For example, epunite was used to establish cooperative ties within the framework of the European Coal and Steel Community.

It is reasonable to lay the idea of ensuring food security at the basis of the new settlement system for developing countries. This topic is significant for the post-Soviet countries and China, and is one of the key items on the economic agenda for India and African countries.

For the purposes of synergistic strengthening, it is advisable to combine the development of payment infrastructure with other international projects and services that create a full-fledged food security ecosystem. For example, the fast-growing Eurasian Agroexpress project for accelerated delivery of agricultural products, which is already actively used by the main buyer - China, can be expanded to more countries (recently agreed to include India, Iran and the United Arab Emirates) to create a scalable payment and logistics system for seamless delivery.

The configuration of the payment zone proposed by us is optimal in terms of its scale and balance of agro-industrial (food, fertilizers, agricultural machinery) trade flows with multilateral clearing. The full composition of the proposed configuration is formed by 21 countries (see Fig. 1):

largest Asian countries: China, India;

EAEU countries — Russia, Belarus, Armenia, Kazakhstan, Kyrgyzstan;

key countries of Southeast Asia - Thailand, Malaysia, Indonesia, Vietnam;

six African countries, including the largest - South Africa, Nigeria, Tanzania, Ghana, Madagascar, Uganda;

four countries of the Near and Middle East: UAE, Iran, Syria, Oman.

With this composition, clearing will provide approximately 80% of mutual trade in the zone (see Fig. 2). It is noteworthy that even countries that are generally unbalanced in terms of trade within such a zone become balanced (for example, India).

The optimal configuration of the agro-industrial payment zone turns out to be quite large-scale both in terms of trade volumes (the share of mutual trade in the zone from the trade of participating countries with the whole world is about a third), and the size of coverage - about 4 billion people live in the countries of the zone, more than half of the population Earth. Cereal and meat consumption in the zone accounts for approximately 40–45% of global consumption.

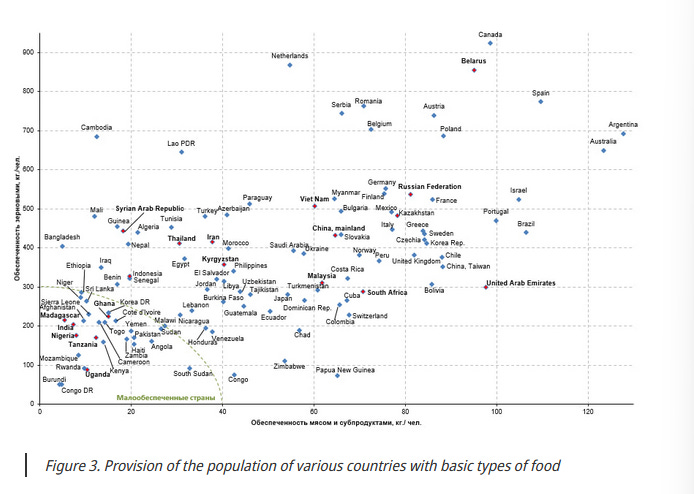

At the same time, the zone includes countries that experience a shortage of food resources. These include primarily the countries of Africa and India (see Fig. 3).

As security for a special unit of account, it is advisable to choose gold as a trustworthy asset traded in almost any country, through which it is possible to determine the exchange rates of national currencies to the unit of account (an alternative is through a cross rate from the dollar price of gold and the dollar to the national currency). At the same time, the annual gold production in the countries of the optimal zone is more than twice the annual demand for gold to ensure non-clearing settlements.

For the purpose of guaranteeing the fulfillment of obligations for the full repayment of digital currency balances, the participating countries form a reserve fund in which collateral assets are stored - physical gold and (or) gold-backed non-fungible tokens (NFTs) issued in accordance with the requirements accepted in the system. The amount of a participating country's contribution to the reserve fund affects the size of the debt limit set for each country, while the limit exceeds the amount of the contribution.

Architecture of the new system: interior and exterior

To ensure the system's performance, several additional conditions must be met:

1. First of all, it is necessary to work out mechanisms to limit the exchange rate risks that arise when a new means of payment is tied to gold. The value of gold against the currencies of emerging markets is more volatile than their rates against the US dollar.

This problem can be solved in two ways.

First, the value of the unit of account should be determined not on the basis of the instant spot price of gold, but on the basis of an average over the previous period (for example, a rolling year). In this case, as calculations show, the volatility of this value against the currencies of developing countries will drop sharply and in most cases will become close to the corresponding volatility against the US dollar.

Secondly, a "built-in" exchange rate risk insurance system can be created - in the form of options for exporters and importers to purchase / sell a unit of account against their national currencies. Based on the estimates using the Black-Scholes formula, the cost of such options for most currencies of potential participants will be in the region of 2% of the contract value. Half of them, that is, on average, about 1% of the cost of the contract, can be paid by the system being created. The source of funds for the system will be service fee income. At the same time, the fee income of 1% will retain its multiple competitive advantage in terms of costs compared to traditional systems such as SWIFT (commissions of 2-4%).

The system participant will have to pay the other half of the cost of the contract on their own. Such contracts, in principle, could be quoted by market-maker banks from the countries of the zone. These countries account for 56 banks out of the 200 largest in the world (mostly in China and India - 33 and 9, respectively; in Russia - 2). These banks could well master the offer of financial products for insurance of exchange rate risks in the required volume.

2. Creation of institutions for the settlement of problem debts. Since clearing in the system is incomplete and there are countries with chronic trade imbalances, there is a risk of default on payment obligations (as was the case in the history of the ENP). Therefore, it will require its own system of restructuring sovereign troubled debts - a kind of analogue of the Paris Club of creditors. This system will offer soft conditions for restructuring: perhaps a debt-for-investment swap or participation in promising assets.

3. Unification of trading standards in the gold markets. Countries that do not have their own gold mining or significant reserves should be able to purchase it from other countries in the zone with minimal transaction costs. Gold trading can be carried out on the basis of the platforms existing in the zone: Shanghai, Mumbai, Dubai, Moscow. To do this, the standards of gold trading on these sites must be harmonized and then unified. In order to actively warm up, entry barriers to these sites for all countries participating in the system should be lowered and large liquid players (banks of the global top 200) should be attracted from these countries.

4. Building around the idea of ensuring food security and a limited number of participating countries should be typical only for the initial stages of the development of the system.

The goal should be to further scale the system both in terms of the composition of the participating countries and in terms of coverage of commodity flows. In particular, other countries that need to solve the problem of low food security (including African countries) may gradually enter it. This will slightly increase the imbalance in mutual payments, but when it becomes more mature, it will be able to withstand it. The provision of a unit of account with gold should also be applied only at the first stages. When the zone begins to scale significantly, the gold backing will not be enough. Then it will be necessary to expand the collateral to include, for example, government securities of the key, largest and, at the same time, solvent countries.

What will it give?

Thanks to the proposed alternative system of payments and settlements, the participating countries will be able to receive: firstly, cheaper and more stable supplies of agro-industrial products (food, fertilizers, agricultural machinery). This effect can be especially noticeable when coordinating the development of the payment system with logistics initiatives (Eurasian Agroexpress, the North-South transport corridor, etc.).

Second, additional opportunities to stabilize food prices. Over time and as the relevant markets develop, the funds used to subsidize foreign exchange options can be redirected to the formation of an intervention grain fund of the participating countries. It can work by analogy with the state grain fund of Russia, as well as with the food fund of the EAEU that is being created. Calculations show that the stock of wheat that can (at a fee of 1%) be accumulated in such a fund over 2 years is approximately equal to the standard deviation of its annual consumption by the countries of the zone from the long-term trend. This means that from the second year of operation, such a fund will be ready to compensate for the excess or shortage of wheat in these countries.

Thirdly, the growth of South-South trade and investment due to the simplification of ties between the countries participating in the payment system. The emergence of unclearable imbalances can encourage parties to look for new common ground, whether it be increased trade or investment projects aimed at unlocking a country's food security potential. For example, Africa has a significant mineral resource base for the production of fertilizers. The growth of FDI in the countries of the continent will not only provide domestic demand with fertilizers, but also form a stable supply to other countries in need to increase the cultivation of crops.