Oil, Gold, Silver Retail Positions Lopsided | Russia Uses Rule of Law to Win

Market Rundown

Good Morning.

Markets are reflecting a slight ease in anxiety over Ukrainian pressures. The Dollar is down slightly. Bonds yields are flatter again reflecting tightening and recession. Stocks are broadly higher; no doubt a needed breather from the last few days. Gold is down over $10 at the bottom of its recent range. Silver is down 15 cents. Copper is nowhere. Oil is softer but calm so far. Crypto is tracking stocks this morning. Lowe’s Cos., TJX Cos., EBay Inc. and Hertz Global Holdings Inc. are among the companies reporting results. Cheers

Russia Using The Rule of Law to Win

Self promotion alert: Today, Financial media will tell you how the sanctions are disappointing and less than harsh. Here’s what we said Monday:

Not sure how effective these can be with the exceptions of Oil and Natural Gas being protected from sanctions. But nevertheless this is what was said

We assessed this likelihood 2 days ago before they were announced. That was based on analysis of previous statements by Potus, EU statements, and the economic situation. Here’s the headline of our post yesterday: Why Russian Sanctions Will Be a Joke

What’s Next?

Here’s what we think will happen next, or at least how things will be portrayed. The West will say these sanctions are just the beginning. Last week they stated they would ‘sanction very harshly if Russia invaded Ukraine’. Did Russia jsut invade Ukraine? Nope.

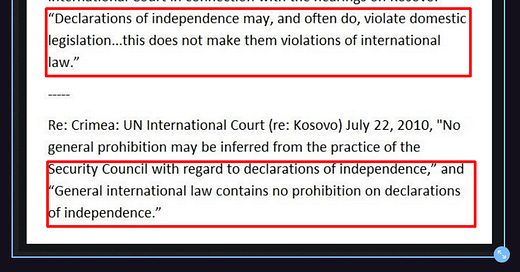

What did Putin do? He got himself invited to breakaway republics of the Ukraine. And that is not a violation of international law. There is plenty of precedent.

This is a legal game now sadly, and Putin is no dummy. The west abides by the Rule of Law. So Putin will simply not violate the Rule of Law. This gives the West cover to say: “Well, technically he didn’t invade, so no harsh sanctions”.

That is how everyone keeps doing what they are doing. Oil and Gas flows from Russia to Europe, the US legally saves face, and Russia gets its buffer from Nato. Next unknown is the boundaries of the breakaway republics… This is far from over. We’re just showing the path everyone secretly wants, but won’t admit it to themselves yet.

Podcast

CTAs need the market to bail them out now…

Guidance

Initial sanctions against Russia announced by the U.S. and its allies yesterday are seen as less severe than expected. While they have been described as a “first tranche” of measures, they fall well short of what some analysts were expecting. In Europe, the most significant move came with the halting of certification of the Nord Stream 2 gas pipeline. President Vladimir Putin said he remained open to diplomatic solutions as long as Russian interests are guaranteed. Ukraine urged its citizens to leave Russia and the country moved toward declaring a nationwide state of emergency. Today is Defender of the Fatherland Day in Russia, a national holiday. - Bloomberg

Zen Moment.. Not today

Premium: Oil, Gold, Silver CTAs Positions Very Lopsided

CTA’s are very Long Oil and Gold. Not as long as previous peaks in Oil. Longer Gold than usual. Short Silver actually. We have discussed the importance of CTA flows as the new retail several times.

Oil Longs Need Another Catalyst

While prices have been overwhelmingly buoyed by supply-side forces stemming from operational risks, driven by sustained underproduction from the OPEC+ group, with extreme weather also playing a role, these pillars of support show signs of waning…

Gold Longs Need More Buyers

The rise in Russia risk premium catalyzed a breakout from gold's wedge pattern, bringing in some chartist demand and sparking a substantial CTA buying program, but a path towards deescalation could also be a catalyst for….