Phase 2 of World Financial Demolition Just Started.

Japan bond yields set the floor for global bond rates. The higher their floor, the higher our floor. The higher our floor, the lower our stocks.

“The Fed has gotten longer term real rates to be positive again, but it needs spot rates to be positive before it stops hiking”

Here is a personal recap of last week’s likely drivers and a forward-looking comment by G.S. on this week’s events.

Contents:

Gold Comment

BOJ Failed Tweak

Fitch’s Downgrade & Increased Treasury Supply

Payroll Miss Low

What Counters This

Positioning

Mike Wilson’s Bearish Lament- PDF

Gold Comment

Funds are still a little too long, but almost done puking

We’d actually like to see some funds get a little short.

The BRICS Summit is keeping players from playing short side (higher lows?)

Bond yields are now in a very real (rate) competition with Gold

What is bad for gold may be very bad for stocks.

Dollar correlations will be a problem between now and November

Gold now on Hartnett’s radar, but it is very early.

As Oil rallies, less fear of Russia selling more Gold

1- BOJ Failed Tweak

The BOJ started this all off the week prior. Permission for JGB yields to rise directly affected global bonds elsewhere to remain competitive. This manifested all last week in the US.

Higher *real* rates— which is what we got last week with inflation worries sliding— makes stocks less attractive and makes Gold have to “compete” with them.

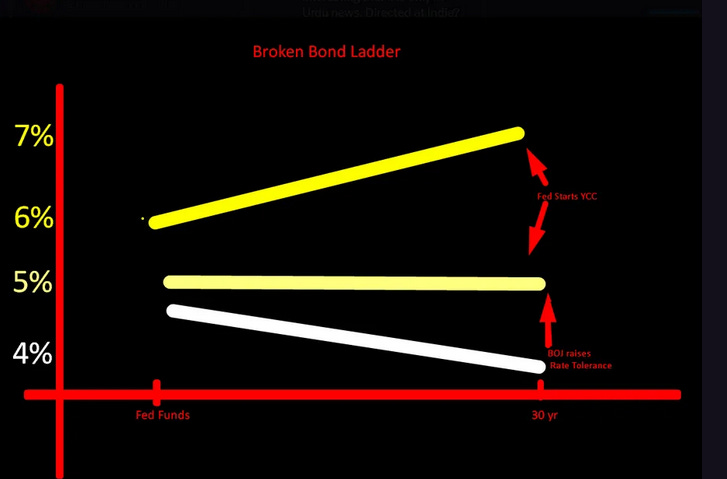

The result in US Bonds is called a “bear steepening” where long bond yields rise while short term rates remain the same. Something we have warned of for some time (e.g.- Broken Bond Ladder) as a definite risk from Fed behavior, and will itself indicate YCC is coming here.

Comment:

The dollar strengthened last week which is very bearish for equities and Japan in general. The BOJ behavior was supposed to attract money because of bond yields going up. Instead, it drove money out of Japan and into foreign bonds that compensated for yield changes. This is very bad, but fixable if the BOJ and the US Fed have the political will.

We Contend: Because the US inflationary crisis was finally handled to the Fed’s satisfaction, that is why Japan tweaked their YCC. The US inflation crisis was over and the US gave the BOJ the greenlight.