Info

”This isn't an hour of doom porn, but rather a sober look at how real markets and market players respond to incentives over time and in response to policy.”- Tom Luongo

Description:

This is Part II of the discussion between Tom Luongo, Tom Bodroviks of Palisades Gold Radio and myself. We all take turns trying to walk through mechanisms by which a market shifts from one place to another and why that has massive implications for the US dollar and the global economy. The original Palisades Broadcast can be found here

Main Points From This Episode:

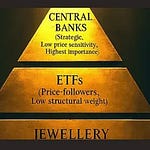

- How demand for gold and other commodities is moving east, and with it the businesses like, storage, refinement, and manufacturing

- Tom Luongo believes the dumbest thing Trump ever did was putting shock and awe sanctions on Iran, as it took away the convenience premium of the dollar and forced Iran to create an infrastructure that incentivised people to use other currencies.

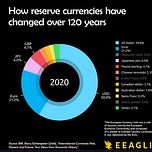

- Why we're watching an incremental process play out away from the U.S. dollar.

Time stamp approximations also via Tom B.

0:00 - Introduction

0:44 - Gold Convertibility

15:19 - Major Wars & Currencies

22:40 - Western Foreign Policy

29:43 - BRICS+ Changes

33:23 - Gold C.B. Bookkeeping

43:55 - Digital Euro & FedNow

54:00 - Debt Ceiling & Biden

56:24 - Powell & End of Libor

1:03:42 - Dollar Demand & Flows

1:07:25 - Preps & Slow Collapse?

1:10:08 - Wrap Up

More:

Palisades: Website & Newsletter

Part One here