Powell Didn’t See Any Indication Of A Downturn, But Still Cut 50 Basis Points

Plus: Fed Path to Neutrality

Powell Didn’t See Any Indication Of A Downturn, But Still Cut 50 Basis Points

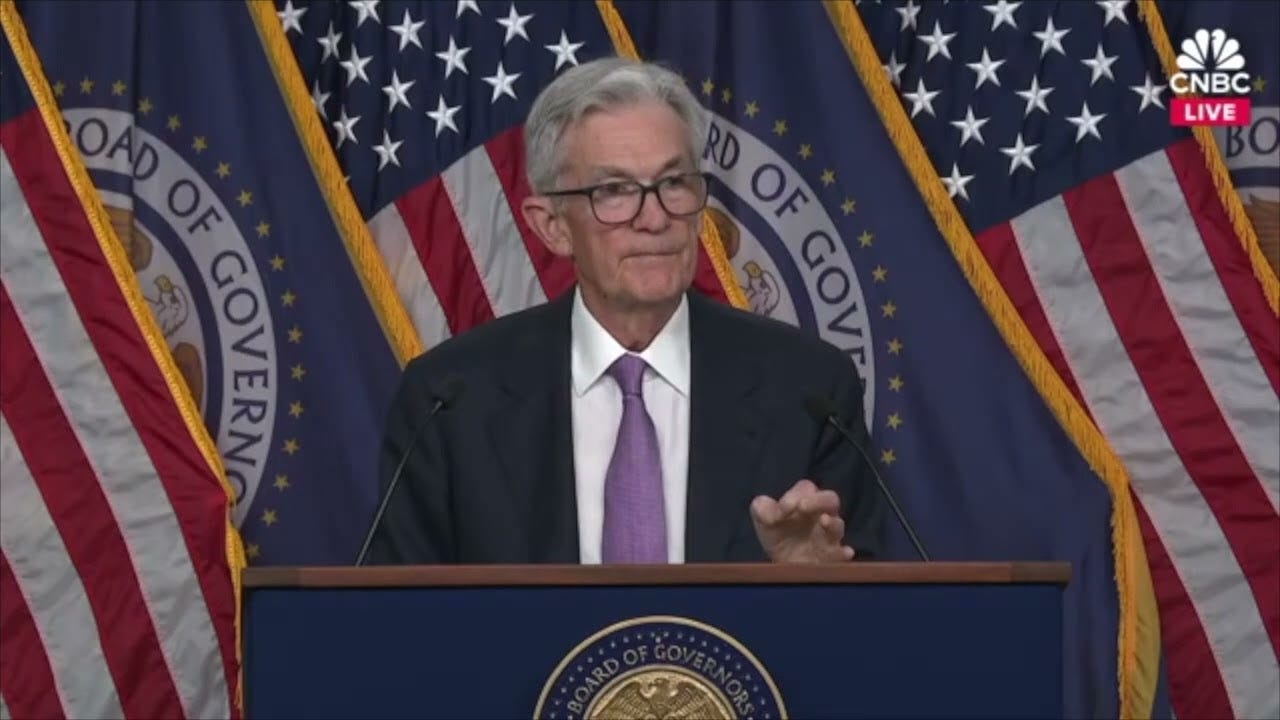

Two weeks ago at Jerome Powell’s press conference following the Fed’s decision to cut rates by an aggressive 50 basis points, Powell said “I don’t see anything in the economy right now that suggests that the likelihood of a downturn is elevated.”

If that’s the case, and he cut 50 basis points when he felt there were no indications of any elevated probability of a downturn, what should we expect the Fed to do if they ever do see signs that concern them?

And what can we expect from the Fed if at some point we don’t just see signs, but we do actually experience an overt recession?

Also worth considering, is that based on the Fed’s latest policy, what exactly are the conditions under which the Fed would actually start hiking rates again?

The interest on the debt has already surpassed the $1 trillion mark, and it’s now larger than the amount dedicated to defense spending. And the total amount of debt is also going to be even larger by the time the Fed ever starts hiking again.

Which means that it’s not going to be any easier to raise rates again in the years ahead. Especially if noted macro analyst Luke Gromen is correct about what he expressed on Palisades Gold Radio in terms of what he feels is the real driver behind the Fed’s actions.

When asked if the Fed might be far more worried about the economy than it's currently letting on, Luke responded:

“I don't think they're worried about the economy.I think they're far more worried about the US fiscal situation than they are presenting to the market. And that to me is the elephant in the room. Which is the Fed's cutting rates because of the US fiscal situation.”

Luke’s an incredibly accomplished analyst, and if he is indeed correct in his statement, that means that even if the Fed does try to normalize rates again in the future, the same challenge they’re facing now will only be further exacerbated.

Of course the markets have already quickly shifted past processing the last cut, and now are looking ahead to what the Fed will do at its November meeting

The odds of another 50 basis point cut were running about 50/50 as of Friday of last week, although that’s come in somewhat since. With the current odds of a 50 bp cut at 37.4% as of Tuesday afternoon.

(courtesy of CME Fedwatch tool)

Another data point to keep an eye on is the Wall Street Journal’s Nick Timiraos (affectionately known as the current ‘Fed Whisperer’), who often seems to broadcast the Fed’s latest intentions before the rest of the market finds out.

In an article on Monday Timiraos notes:

“Federal Reserve Chair Jerome Powell said the central bank would continue to reduce interest rates from a two-decade high to help support hiring and preserve a growing economy. But he suggested officials didn’t currently see a reason to lower them as aggressively as they did at their most recent meeting.

Since their most recent meeting, several Fed officials have suggested the central bank might continue to lower interest rates in more traditional—and smaller—quarter-point increments unless the economy weakens more notably.”

If the economy performs as expected, that would mean two more [quarter-point] cuts this year.”

Ultimately whether it’s 25 or 50 basis points in the next cut is far less important to long-term gold and silver holders than the overall trend, and the obstacles facing the Fed and the US Treasury going forward.

Unfortunately those dynamics are unlikely to change, as some of them are mathematically (and in today’s climate also politically) impossible to resolve. But that doesn’t mean that we can’t recognize them and prepare in advance.

As much of the world is currently doing with gold in particular right now.

Premium Bonus: CA Chief of US Strategy discusses the path for Fed Rates to hit neutral

Safe-haven demand has helped Treasuries rally amid the Middle East conflict, benefiting the intermediate sector.

Fed Chair Jerome Powell has signaled a gradual approach in easing policy, with two 25bp cuts at the two remaining meetings this year as a baseline.