JPM: 50 Point Rate Hike in March Likely Not Needed- Analysis

Housekeeping: Right now we are offering a week free to subscribers. The proverbial “stick” is prices are going up today. We’ don’t want people surprised. We hope you see the value. Subscribe here Best

[We were] not conceptually wrong [in our inflation analysis] but it is taking so much longer for the supply side to yield than we thought- Jerome Powell

In JPMorgan’s latest economic letter it outlined their takeaway from Chairman Powell’s two day Congressional testimony. Before we dive into that. Here is Powell’s key points from that prepared speech.

In Powell's prepared testimony, released around 0830ET on Wednesday, the Fed chairman affirmed that the central bank plans to hike rates after the March FOMC meeting, although Powell's language was noncommittal on the magnitude of the hike.

"With inflation well above 2% and a strong labor market, we expect it will be appropriate to raise the target range for the federal funds rate at our meeting later this month," Powell said Wednesday in his prepared remarks before the House. "The process of removing policy accommodation in current circumstances will involve both increases in the target range of the federal funds rate and reduction in the size of the Federal Reserve’s balance sheet."

Here are the Bloomberg headlines which summarize the speech best:

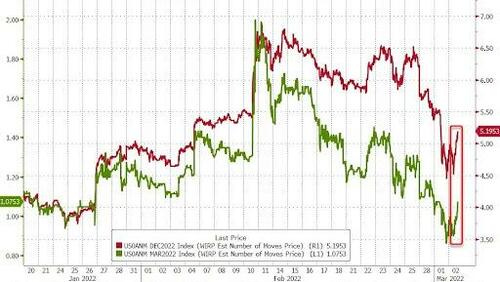

POWELL: WE EXPECT RATE HIKE IN MARCH WILL BE APPROPRIATEPOWELL: UKRAINE WAR'S IMPACT ON U.S. ECONOMY 'HIGHLY UNCERTAIN’POWELL: LABOR MARKET EXTREMELY TIGHT, INFLATION WELL ABOVE GOALPOWELL: BAL. SHEET SHRINK TO BE PREDICTABLE, MAINLY VIA RUNOFFPOWELL: FED BALANCE SHEET SHRINKING TO BEGIN AFTER RATE LIFTOFFPOWELL: REMOVING ACCOMMODATION INVOLVES RATES AND BALANCE SHEETPOWELL: FED WILL USE TOOLS TO STOP INFLATION GETTING ENTRENCHEDPOWELL: EXPECT INFLATION TO DECLINE OVER YEAR, WATCHING RISKSPOWELL: JOB OPENINGS HARD TO FILL, WAGES RISING AT FAST PACEPOWELL: IMPROVEMENT IN LABOR MARKET CONDITIONS ARE WIDESPREADPOWELL: WILL NEED TO BE NIMBLE TO RESPOND TO EVOLVING OUTLOOKNothing about what was said was surprising. But his tone under questioning seemed like he was regaining his footing in the inflation narrative. Meanwhile, expectations for March trended back towards a hike of just 25 basis points.

The Report

Chair (Pro Tempore) Powell’s two days of Congressional testimony didn’t materially change the message coming from the Fed. Whatever lingering talk there was about a 50bp move in March should be silenced by his advocacy for a 25bp move in two weeks. He did, however, retain the option of a larger move in the future if “inflation comes in higher or is more persistently high” than the FOMC’s forecast.

On the issue of the Ukraine invasion…