Putin May Spark $30 Crude Oil, Risks Another 80% Drop- Bloomberg Report

Oil's Possible Pain is Bitcoin's Eventual Gain

Putin May Spark $30 Crude Oil, Risks Another 80% Drop- Bloomberg Report

Oil's Possible Pain is Bitcoin's Eventual Gain

Housekeeping: Right now we are offering a week free to subscribers. The proverbial “stick” is prices are going up tomorrow. We’ve telegraphed that for a while now and don’t want people surprised. Month-to-month subscriptions included. We are putting in over 70 hours weekly generating professional proprietary analysis and premier 3rd party research. We hope you see the value. Subscribe here

Best

Oil's Possible Pain is Bitcoin's Eventual Gain

Putin May Spark $30 Crude Oil - Risks of Another 80% Drawdown

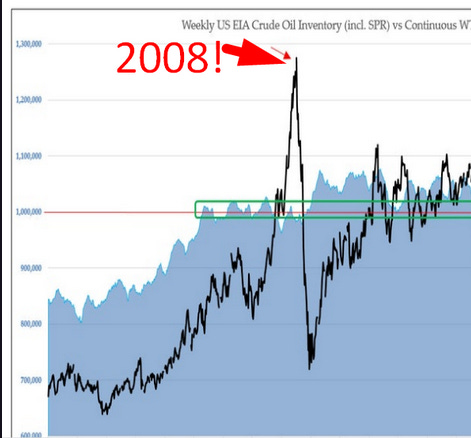

The crude oil market is likely to mirror past reversion patterns from elevated prices. Brent crude has dropped about 80% on three occasions since the 2008 peak. It's possible that Russia's invasion of Ukraine triggers global recession and accelerates electrification and decarbonization trends

Bloomberg Intelligence’s Mike McGLone put out a note yesterday building upon a previous report of his focusing on Oil with an interesting newcomer to that analysis- Bitcoin. First let’s update Oil.

In the report he focuses on the historical precedents governing Oil price reversion. For example, the report notes the massive draw-downs in Oil prices at previous moments in time when Oil climbed to stratospheric highs. Many of our own readers are familiar with parallels to the market behavior post 2008 Beijing Summer games.

From China: Oil's Repeatable Patterns of 2008:

In 2008, it was reported that "the 2008 Beijing Olympic Games will boost China's rampant demand for energy, threatening to push world oil prices beyond current record heights, according to industry analysts".

Back then BNP Analysts said:

"In the lead-up to the Games you are going to see pretty heavy spending in infrastructure - building roads, residential property, hotels - and this is typically energy intensive," said BNP Paribas analyst Harry Tchilinguirian.

Crude prices surged as a result to strike a record high above 130 dollars per barrel, boosted by tightening supplies, under-investment in global production and ongoing unrest in key producer Nigeria. And then it washed out Sound familiar?