RABO: Central Banks May Actually Hike Rates Now

Michael Every notes markets and some participants may be gargling bong water

When 2024 started, the market was screaming about 6 or 7 Fed cuts this year. My response was, “Are they gargling the bong water?”

-Michael Every

By Michael Every of Rabobank via ZeroHedge

Kiwi, Kiwi, Kiwi! Oy, Oy, Oy!

Mr Market has many things to focus on today. There’s:

Chinese firms reintroducing the Mao-era practice of having their own militias;

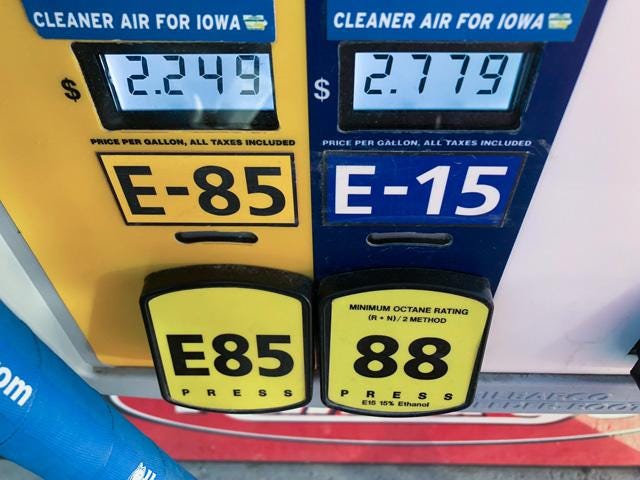

President Biden allowing year-round sales of gasoline with 15% ethanol content, “to avoid potential regional spikes in gas prices” pre-election, according to Oilprice.com, but also a boon to US farmers ahead of the same;

Nvidia earnings - although this isn’t an equity Daily, I note the meme of an elephant, US markets, balancing on a beach ball, Nvidia earnings, being held up two ants, final AI demand;

A warning about the US fiscal deficit, 6.2% of GDP in a growth period, from ex-IMF economist Blanchard, with warnings from others about that being how/why the US is growing;

The Houthis trying to sink a ship carrying grain to Yemen, underlining they are shooting at anything;

Hal Brands, in Foreign Affairs’ ‘The Age of Amorality’, asking if the US has to become more illiberal to save the liberal world order (which is word for word what we predicted in our ‘World in 2030’ report written in 2020);

Von der Leyen bidding for a second 5-year term as President of the European Commission, pushing for not a green but a khaki transition (as a thread shows how much spending Europe needs on defence (e.g., since 1989 Germany has seen its tanks fall from 3,892 > 248, France 1,297 > 200, Italy 1,206 > 200, the UK 855 > 148, and the Netherlands 750 > 16, which are borrowed from Germany; and for fighter jets the figures are UK 840 > 168, Germany 647 > 230, Italy 576 > 204, and the Netherlands 198 > 63 – many of which cannot fly);

Australia announcing plans to double the size of its navy;

The British Royal Navy failing to successfully test launch a Trident submarine; and yet the government committing to downsizing the UK army to 72,000 as planned by 2025.

However, the most important things to focus on right now is the path of rates. When 2024 started, the market was screaming about 6 or 7 Fed cuts this year. My response was, “Are they gargling the bong water?” True, markets were basing that on Fed Chair Powell’s surprisingly dovish December press conference - which prompted me to wonder if he had been gargling the bong water given he must have known he was ringing a bell for a pack of Pavlov’s dogs. Yet here we are, not even two months into the year, and the market has scaled 6-7 cuts back to 3-4, and is even starting to price slim odds of a Fed rate *hike*.

Yesterday, the Reserve Bank of Australia’s February minutes provided a further shock when they noted “…members considered whether to raise the cash rate target by a further 25 basis points at this meeting or to leave it unchanged.” A rate *hike* in an economy where the market had been pricing in a series of imminent rate cuts? And in an economy where the housing market, reliant on short-term mortgage rates based on the Overnight Cash Rate, is the be-all-and-end-all even more than in the UK or US? How can that be?!

The on-hand-but-on-the-other-hand minutes noted the Red Sea crisis was not a big issue(!) and China would export deflation (maybe Australia won’t use tariffs), but that services inflation remained high, wages growth robust (0.9% q-o-q today for Q4), and productivity very weak: they discussed whether “the adoption of AI would support a turnaround in productivity growth”, as if ChatGPT will stop a tradie charging hundreds of dollars to look at a sticky oven door.

Yet while the lack of surety was notable, the Bank thought “the level of aggregate demand remained above the economy’s supply capacity.” And that’s before they discussed planned tax cuts, now shifted to lower-income earners from higher, where, echoing the economic illiteracy of Ben Bernanke, they concluded “the effect would be negligible for plausible assumptions about differences in marginal propensities to consume.” Because poor people spend just like rich ones, don’t they?

Meanwhile, the Reserve Bank of New Zealand, the first central bank to adopt modern inflation targeting, was ahead of the Aussies in turning hawkish. Despite the economy being in a technical recession, a week ago the local market was already making calls that the RBNZ might *hike* twice this year from the current level of 5.5%. Indeed, the date to watch is February 28, when the Bank hold their next meeting: a shock rate hike would send ripples right the way round the rest of Western bond markets.

Our Australia and New Zealand strategist Ben Picton is currently on the ground in NZ, and reports that it isn’t just a technical recession, but a real one. Boarded up shops are quite evident. However, he also notes that there is abundant signs of some doing very well: there are lots of expensive boats in Auckland harbour, plenty of cruise ships, and long lines of tourists at some high-end shops. In short, we might be talking about a K-shaped economy, which we all talked about a lot during Covid, and then immediately forgot after lockdowns ended. However, that winners-and-losers dynamic is evident globally in all kinds of ways.

The RBA and RBNZ really, really don’t want to hike: but they can no longer rule it out. On one hand, that threat might be necessary to cool the market’s heels – which is working. On the other hand, if aggregate demand remains above the economy’s supply capacity, despite the current level of rates, and the government delivers fiscal stimulus, what else is there on the table? (Perhaps the larger question is what central banks do in economies where aggregate demand is weak, but inflation is also still high!)

In short, markets will be hoping the Fed minutes today don’t look like the RBA and RBNZ versions; and they will be waiting nervously to see if they need to shout “Kiwi, Kiwi, Kiwi! Oy, Oy, Oy!” next week.

*****

BOA Looks at Fed Criteria to Cut Rates

In focus The Fed has told us it needs “greater confidence” that inflation is “sustainably” moving toward 2% before it begins any rate cut cycle. While we are not exactly sure what combination of inflation data will give the Fed the increased confidence it seeks, we do have a view on what the Fed means by inflation that is consistent with its target.

More From RABO and BOA on Inflation below…