Rabo: "More money is going to be spent" the question is how

The only question is if it's spent in a new political-economy which is short-term inflationary, or in an old political-economy, which is just inflationary

Markets will have to adapt – and the ones who read [the] political economy will do it fastest.- Michael Every

Intro: Michael Every Knows

Micheal Every understands the end of financialization as the engine for economic growth is here. He also understands we must build and make things again. But we must also take care to not let the old engine stop working until we’ve finished building the new engine.

He asks what the path forward will be. He asks if we will spend money on the new or the old economy? We know the answer to that. The answer is both.

We will spend on both types of economies and monetize that spending in the hopes productivity returns making the changeover from old engine to new engine not too painful.

This much we are sure of. They will spend money on:

Every’s New Political Economy: financing future growth by spending money now in the hopes it can generate wealth in the future

while simultaneously continuing to finance…

Micheal’s Old Political-Economy: subsidizing consumer demand as palliative care to keep sinking industries comfortable

Paying for all this by…

Monetizing the debt, financial repression, and taxing those that can afford to pay hoping the changeover goes relatively painlessly.

Which Stocks Benefit From the Spending?

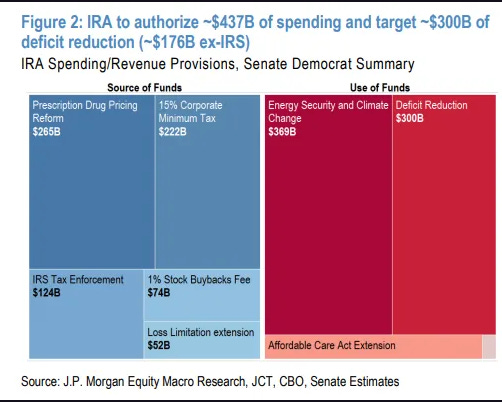

Fortunately we have the answer as to what types of companies benefit and which suffer in this set up. The specific industries that benefit (and suffer) are in the pdf at bottom. The report is entitled Jpm Us Equity Strategy Inflation Reduction Act, Earnings Impact and includes 200 companies involved.

One other thing Michael gets…. How markets adapt to the changeover will make all the difference. That is where the political game is to be played.

Enjoy.

"Unpopulism"

Market comments

Written by Michael Every Global Strategist at Rabobank

The Fed just tweaked its BTFP programme. It’s still being phased out on 11 March, but effective immediately the adjusted rate for borrowing will ”be no lower” than that of reserve balances. This prevents markets arbitraging the BTFP’s typical 4.88% rate vs. the 5.40% rate on reserve balances, with this gap widening due to the market expectation --read ‘salivation’-- of rate cuts. In short, Wall Street was making money thrice: first, via lower bond yields (“because rate cuts”), second on higher everything else (“because rate cuts”), and third because of arbitrage: markets always exploit those variations rather than lending consumer savings to businesses for productive investment, as economics textbook wrongly teach. So, that’s one blow vs. easy money. Another is this morning’s chatter that the BoJ might raise rates before the Fed cuts following the strong US PMI data seen yesterday. If the looming Fed meeting doesn’t clearly open the door for that magical March rate cut, then it looks likely yields can travel significantly higher again, short term.

Continues with full analysis at bottom