"Solvency issue is NOT solved by liquidity solution." Academy Securities

The U.S. Actions So Far

'Time Is Not Our Friend': Solvency & Liquidity Meet Liquency & Solvidity

Peter Tchir via Academy Securities

We are hearing a lot about Liquidity and Solvency right now. Often people talk about them as though they are two different things. That can be true at times, but in many cases, there is a complex relationship between the two. That is particularly true for financial companies and banks, which is where this discussion is centered.

Solvency & Liquidity

Let’s start with extreme and obvious examples.

Liquidity issue. I borrowed $100 to fund a deal with someone to pay me $110 back next week. The person I borrowed from needs their $100 repaid today. I need to borrow from someone for a week to make it through to the $110 payment. That is a liquidity issue, and if for some reason the market won’t lend to me, it is a problem. But, a simple loan, or access to a lending facility from a central bank, solves the problem. Liquidity issue is solved by a liquidity solution.

Solvency issue. I borrowed $100 to buy an asset. That asset got destroyed and I have no insurance, so now have nothing. I can borrow as much cheap money as possible but my problem doesn’t even begin to go away. Solvency issue is NOT solved by a liquidity solution.

The real world is never so simple. Enough liquidity can mitigate solvency issues, over time.

Liquidity, over time, can help with a solvency issue, but it depends on:

The strength of the liquidity solution (we will examine the Swiss solution versus what the U.S. delivered Sunday night – was it really only 4 days ago? It seems much longer)

The magnitude of the solvency issue. Balance sheet, or more precisely, equity capital can be rebuilt over time.

I think the Long-Term Refinancing Operations (LTRO ) were an interesting example.

Basically it allowed European banks to buy new assets (government bonds) and secure financing up to the maturity of those bonds (max 3 years I think) generating positive carry.

That helped support European short dated sovereign debt at the time, as a “new” buyer emerged. That helped the bank balance sheets as a whole as there was less fear about sovereigns being able to issue enough debt to cover their maturities.

Over time, that small dribble of daily income adds up, shoring up the bank’s balance sheet.

Done with enough “umph” up front to help the underlying bond markets and with enough “juice” for the banks to gain extra profit over time, this helped a lot. But it is definitely “threading the needle”.

Which brings us to where we are today.

Liquency & Solvidity

In the U.S. we had Sunday night sessions to deal most directly with Silicon Valley Bank and Signature Bank. The solutions provided were meant to help the entire banking sector, especially regional banks that were feeling the pressure as attention turned from SIVB to other banks that some people thought might be vulnerable. We covered some of this on Saturday in I Like Mid Banks, I Cannot Lie, and What We Know Post Intervention and on Bloomberg TV Monday Morning.

Yesterday CS dominated the headlines, ending the day with a plan announced by the Swiss National Bank that we will analyze as well.

The analysis tries to balance the solvency and liquidity issues and with the solutions provided so far.

The U.S. Actions So Far

I’m sticking to a B+ sort of score. They acted boldly and quickly which is good. But the core problem “unrealized bond losses” hasn’t been sufficiently addressed. At least not in my view of where we are on the continuum of solvency and liquidity.

Guaranteeing all deposits, of any size, immediately. That was bold and strong and should solve the bulk of the issue linked to depositors pulling money out because they were afraid of the risk of keeping it at XYX bank. Some will still take money out of XYZ bank because of ongoing concerns or the optics of keeping it there. Some customers are cash flow negative and will see their balances decline for reasons other than concerns about the bank. About 90% of the current “bank run” problem should be addressed by this.

Hurting bondholders. Bondholders were “primed” in the Silicon Valley Bank and Signature Bank deals. Deposits above the FDIC insured amount, in theory are unsecured creditors and are pari passu with bondholders. Well, the depositors just got preferential treatment, meaning that if there is not enough value to fully pay off all creditors, bondholders will get less of a recovery. Say there was $100 of deposits above the FDIC amount and $100 of bonds. Say recovery of assets was $180. Under the “old” regime (before Sunday), both the depositors and bondholders would have received $90 as they were equal. Now the depositors are getting $100 and the bondholders are only getting $80. Subordinating bondholders to ensure full payment of depositors had many immediate benefits, but likely some longer term costs. Could this have been handled better?

Political Soundbites. Whether it is “banker bailout” or “criminal investigations” or some other aggressive political soundbite, they are not helping the situation For the banks in question it makes any potential buyer think about the political backlash. For the rest of us, it makes us wonder about the commitment to the solutions (which is maybe why some will take money out of banks, even after the guarantee).

The Lending at par facility. This needs its own section.

Borrowing vs Par for “underwater” Bonds

This is the liquidity solution provided for banks. For up to 1 year, banks can post a high quality bond as collateral and receive a loan based on the par value of the bonds.

Let’s say a bank owned $100 of a Treasury against a $100 deposit they had received. That bond is currently at 80 cents on the dollar. If the depositor withdrew, the bank had to sell that bond to pay back the depositor (super simplified, but good enough for what we are trying to illustrate).

The bank would only raise $80 by selling the bond, so would have to sell other assets or effectively take money out of their equity capital to pay the other $20. There are issues with bonds in available for sale, versus held to maturity accounting etc. but the crux of the matter was the assets earmarked for depositors aren’t currently valued high enough to pay back depositors.

One “good” thing is that the bonds in question are liquid and are at virtually no risk of not getting paid back fully according to their original terms. That is very different than in 2007 and 2008 when the assets were of dubious and deteriorating quality.

So, with the new facility, when the depositor requests $100, the bank doesn’t have to sell the bond at a loss. They can pledge it to the facility and receive $100 for that bond and now, instead of paying interest to the depositor the bank pays interest to the facility for a year.

This helps the “liquidity” issue:

The bank gets $100 it had earmarked for a depositor even though the assets that were earmarked are not currently worth $100.

By pledging the asset as collateral, they don’t “taint” the hold to maturity nature of the asset, making the accounting easier.

This compounds the NIM (and solvency) issue:

As far as I can tell, the cost of using this facility is more expensive than paying the rate paid on deposits. So, unlike, say LTRO, this causes larger interest margin losses (or reduced profits) to flow through earnings, not stabilizing the capital base.

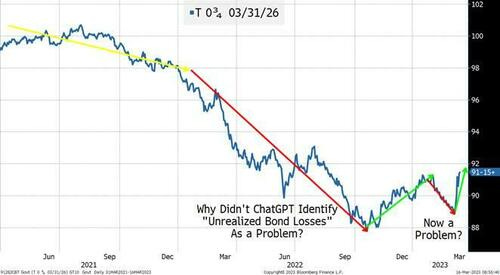

Let’s use one of my “favorite” bonds – the 0.75% Treasury maturing 3/31/26 that was issued on 3/31/21. I like this bond because I could see an institution getting deposits in March of 2021, buying a 5-year treasury with those proceeds (still seems aggressive to me, but at least I’m not embarrassed with that as a scenario, unlike 10-year treasuries which just makes me wonder why they stopped teaching the S&L crisis in business school). But let’s look at this bond.

One question that I asked myself, hoping to bolster my case for banks, was if the recent rebound in treasury prices “solved” the problem of unrealized losses on bond portfolios. The answer, is, sadly, as a bull, no. It has done very little. This bond which now only has 3 years to maturity is still wroth only 91 cents on the dollar. Up from recent lows of 89 and well up from the lows of last September when it was only worth 88. (I did, out of curiosity check out the 1.125% Treasury of 2/15/31 (issues 2021) and it is at 84 today, up from 81 earlier in the month, but saw its lows as 79 last October. Why was no one talking about unrealized bond losses in September last year, when in all likelihood they were worse? There may have been people writing about it, but it wasn’t on my radar screen and I don’t remember seeing it as a discussion topic. Maybe deposits weren’t declining back then, but they were (just check out the SIVB deposit charts in Saturday’s report).

There will be time for questioning how this wasn’t a problem and then became a problem another day.

According to the terms of the program, here’s what would happen.

The bank gets $100 for the bond worth 91 cents.

The bank pays the one-year overnight index swap rate plus 10 bps (I think this is around 4.7%). But let’s say 4.5% to keep it simple.

The bank, assuming this bond is in an not available for sale book (and is using accrual accounting) will earn 0.75% income on the bond for earnings purposes for a year (they should be carrying it at book yield, which if they bought at new issue was 0.75%.

The bank will have negative net interest margin of 3.75% (i.e. lose 3.75% on par on this bond over the calendar year it is in the facility). This is a far big hit to NIM than if they were just paying the deposit rate (I haven’t seen a deposit rate near 2% let alone 4.5%).

That is better than losing 9% today by selling the bond, but doesn’t help their capital base (or solvency issue).

All else being equal, at the end of the year, the bond should be at a higher price (the pull to par effect of going from 3 year to 2 years). This helps a bit, but between the carry and the likelihood that the bond is still significantly below par a year from now, nothing has been done for the solvency concerns.

If this was originally a 10-year bond, the pull to par effect of going from 8 to 7, is even less helpful.

The lending program buys some time, but does absolutely nothing for the bank’s capital, and if anything, banks will be worse off having to use this program versus retaining deposits.

Bottom Line on U.S. “Intervention”

The key to any level of success will be if banks can retain deposits. Keeping deposits reduces the negative carry (versus using the facility) and over time, the pull to par effect helps (if they can keep the net interest margin losses to a minimum), but even that is only really helpful for portfolios that didn’t go way out the maturity spectrum.

I think it buys the weakest banks time to shore up their capital – either through a capital raise or a merger.

If that can occur, then the banks the next wrung up will be fine. As the “fire break” works, you don’t need further protection.

The question are:

Do the weakest banks know they are the weakest banks? Seems obvious, but probably isn’t to those in the crosshairs.

Will they accept capital at valuations the buyers are willing to pay? That is a bigger concern and we saw, certainly with Lehman, the ability to squander time, which turned out to be precious, in search of a better deal.

If those questions get answered “correctly”, we should be off to the races.

If those questions don’t get answered “correctly” expect more pressure on the weakest banks and for the vortex of weakness to suck more banks into it.

I think we have a few weeks (not months, but weeks) before the patience of the markets and the reprieve the Fed/FDIC/Treasury bought us starts to fade.

I’m optimistic that we see capital issues addressed, via the private sector and that paves the way for a rebound, but sooner than later is a key, even for me as an outspoken bull.

The “European Solution”

I’ve run out of time and energy, so will be brief here.

Addresses liquidity but not any solvency concerns. Solvency concerns are being downplayed as non-existent, but markets aren’t that kind.

Too narrowly focused. It is a very “Swiss” centric solution – Swiss national bank and of course UBS is mentioned, and they seemed to suggest that reassuring talk is an important part of their plan (never forget what Jean-Claude Juncker said). With the CS backdrop, the EU went ahead and hiked 50 bps – highlighting the regional nature of the solution so far – that will likely get tested by markets.

Winners and Losers. As soon as discussion starts about good banks and bad banks, about a Swiss Bank versus a Global Bank, the powers that be start picking winners and losers. Equity holders, Tier II capital holders, etc., are unlikely to fare well and may do worse than whatever natural course plays out. Again, these are all background discussions, but don’t seem comforting.

I give a C- to the Swiss efforts so far as it is too localized, does nothing for capital, and starts to hint at intervention in ways that your rights as a certain type of investor, might not be given their due course.

While I give the U.S. a few weeks before markets will demand action, I expect by early next week, the luster of the Swiss solution will be gone, without something more substantive.

Time is Not our Friend!

The solutions in the U.S. and in Europe bought time. How much time is yet to be determined, but only some time and it is up to various institutions to use that time to fix the problem – capital concerns.

I’m optimistic we get good resolution on that front, but that is what is needed from here!

original at bottom