Special: Basel 3 Still Doesn't Recognize Gold as Money!

Not a "High Quality Liquid Asset" Despite the Facts

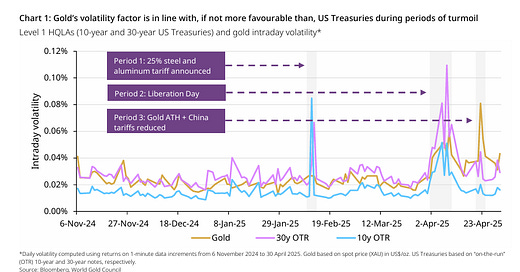

During the three most recent periods of extreme market volatility gold traded i) the same or more volume as 10 year US Treasuries ii) at lower volatility and iii) with narrower more consistent bid/ask spreads than bonds. Yet according to Basel 3 Liquidity Coverage Ratio (LCR), Gold is still excluded from EU Bank liquidity buffers while US Treasuries remain more trustworthy for liquidity— Therefore undermining Gold’s status as Tier 1 Capital. We explore why this is happening and why it is not justified.

Contents (1100 words)

Money in All But Name

Basel’s View Gets a Reality Check

Gold Handles Stress Better

Gold has Better Bid-Ask Spreads

Gold is More Liquid Than Bonds Now

Gold is Misclassified

Bottom Line: A Misalignment Worth Fixing