Context COMMENT: if things are different then this whole analysis will be useless.. But if they are not, this analysis will be likely very important. You will be informed better.

What do we mean by “different”

We mean if the CENTRAL BANKS STILL PERCEIVE THEMSELVES TO BE IN CONTROL.. THEY WILL KNOCK IT DOWN ONCE AGAIN. This does not mean they are in control.. it means they are as usual, winning a series of battles while losing the war.

Central Bank Activity

CBs do not run marathons.. they run series of sprints only when needed. And this week they are needed to dissuade that fund money that has yet to go into Gold after next Friday. They are not in the market every day all day.. But they show up for the awards ceremonies.. And as ZH noted last week.. They are “busy” again.

Behaviorally this time it is not different yet. Circumstantially it is very different. Gold “wins” when the bullion banks themselves lose faith in their naked emperor. Not a minute before.

It is all perception. and if the banks weren’t shorting it again, we’d say FUCK IT MOON.

GoldFix Key Points:

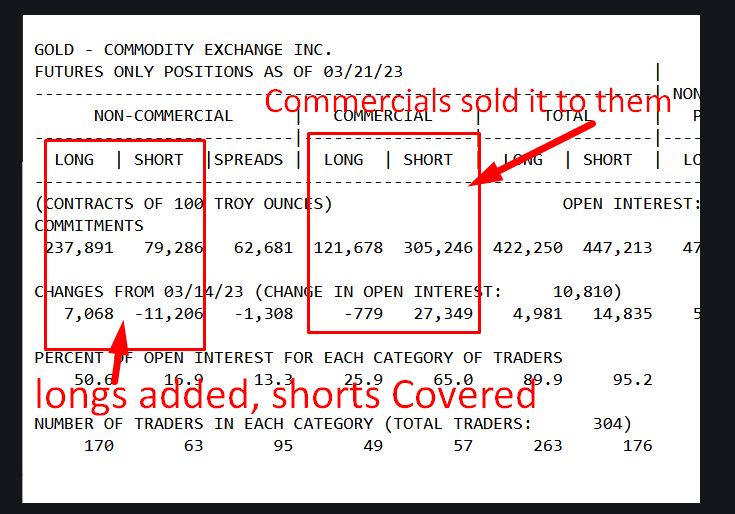

AFTER SHORT COVERING CTA’S USUALLY QUICKLY BUY/reverse in GOLD. THEY ARE UNDER INVESTED IN FUTURES RIGHT NOW WHICH NORMALLY MEANS THERE WILL BE BUYING IN A SIDEWAYS MARKET.

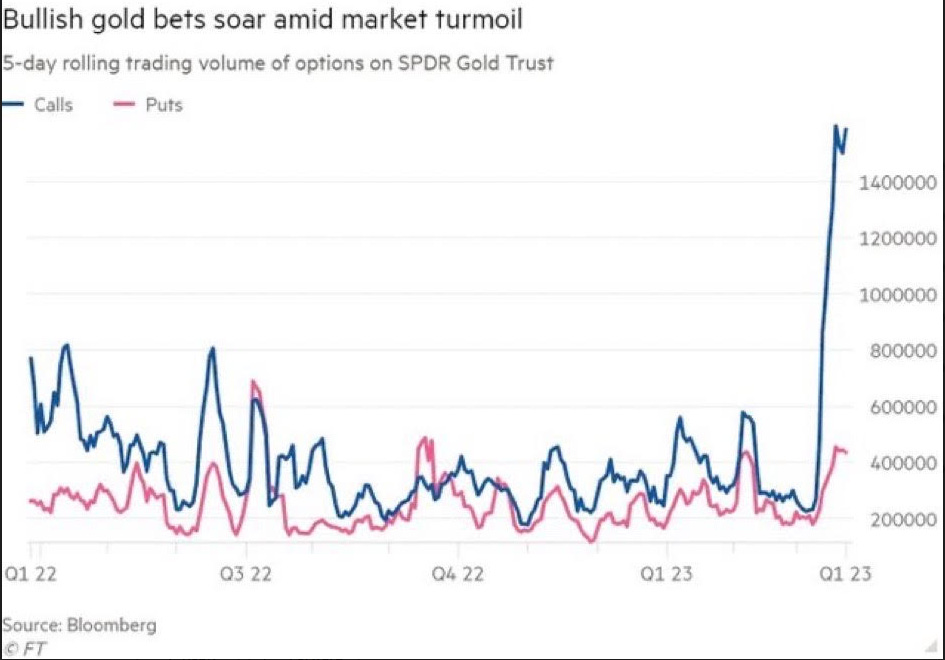

BUT THESE SAME TYPES ARE WAY OVER INVESTED IN CALLS.. THAT IS WORRISOME AND IS KEY TO US BEING NOT INSANELY BULLISH.. BUT BY NO MEANS BEARISH. WE CALL IT THE SUBSTITUTION EFFECT

This happens frequently when players lose money one way.. they do not buy futures at such high levels.. they balk and use options instead.. this is actually a reflection of fear and lack of funds to play. We know this set up well. The heart is willing.. but the wallet is unable.

Behaviorally these types will likely do 1 of 3 things from here either way.

In a selloff:

They will buy futures on the first dip.. which we may have gotten Friday

They will sell the second dip

Their call buying will continue even as the market is cratering

If bearish: SELL A CALL SPREAD.. DO NOT BUY A PUT SPREAD WITH VOL IN IT

In a rally:

They will definitely chase with futures and calls now.. especially if new banking news

They will keep buying all the way up. and NOT buy significant dips if reversing anymore

They will not take profits.. but the bigger players are much more likely to do so.

If bullish: buy futures above perceived stop levels and expect flows to take it higher… But a long wick on the time frame you prefer to look at is a warning.

Buy a dip if you want.. but know your stop loss. DO NOT BUY CALLS. THEY ARE ROACH MOTELS NOW IF WRONG.. IF YOU ARE LONG.. SELLING A COUPLE CALLS MAY BE GOOD IF YOU KNOW WHAT YOU ARE DOING

GREEN RECTANGLES!!!!!:

Gold is the only commodity they are buying now in every category. That is because of Panic, not greed. That is also why they are under buying it at the fund level. NOONE HAS EXTRA MONEY TO PLAY.. THAT IS WHY THE CALLS ARE BEING BOUGHT

The banks are selling it again with no fear… something to keep in mind.

As always: this is a trade, not an investment now