Housekeeping: We will be off the rest of today and tomorrow and thought this best to get in your hands now if you are prepping for the CPI number. Cheers

Summary:

CPI inflation is expected to come in at 9.0% by more than one bank

Many are now expecting this to be a top and are extrapolating a decrease in the months ahead.

We offer some longer term comments

The Expectations

Goldfix on the Bank Analysis:

The fact that these banks are all on the same page implies they are probably right for the next month or quarter. Maybe off by a month, but generally right

However, the fact that they are all on the same page after 3 months out is not a good thing. These types are good at turnarounds in trend ( after missing it 3x running) but horrible in that they tend to extrapolate trend forever until proven wrong.

To be fair, how can these banks know any better than the Fed, which has itself stated they “now understand better, how little they understand”.

Powell is saying here: ‘We now know that we know very little about inflation.’ so they recognize their ignorance, but they are still ignorant. Not a good look.

Our belief in the Big Big Big picture is this:

1- Inflation will have turned a corner lower soon for now...

2- It has done this in the past with catastrophic results as officials pat themselves on the back (1970’s) and become complacent and will continue to be sticky as long as Oil remains higher…

3- Inflation is already as high or higher than it was in the mid 1970s using the metrics from back then…

4- We haven’t even experienced wage-price spiral yet, (a big part of 1970s), and Powell is rightfully desperate to make sure that doesn’t happen on his watch…

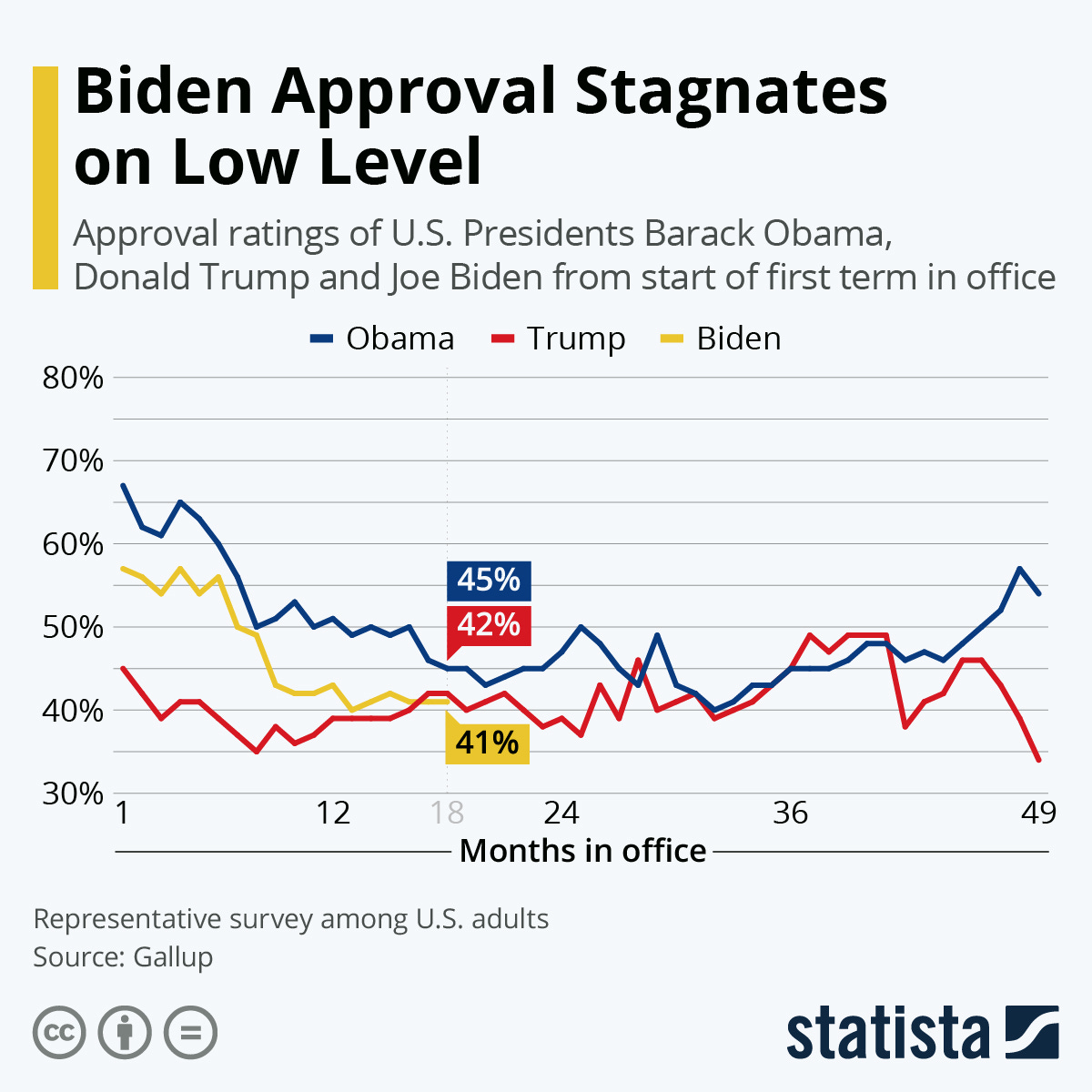

5- The political nature of this is killing Biden, and therefore the inflation will be fought as midterms come up and for as long as it stays in the news headlines…

6- But, the moment we get real crash risk realized, with recession headlines replacing inflation headlines the Fed will turn dove again and Powell will have to reverse or risk bigger problems like hyperstagflation…

7- But for this week, expect a lot of media coverage of CPI

If it is low: “Have we turned a corner?”

If it is high: “How bad will it get?” and “Have we turned a corner?”

Politics and Market Rehab

Biden Will ultimately blame the Fed when all else fails

The Fed is doing what Biden wants, and what we need right now.

But once the recessionary numbers come in and The Fed does nothing, and stocks crash then Powell will be able to point to Biden and say “I told you so”

Then we get the next round of a QE rescue until recession is out of the headlines

The markets are on a cocktail of sleeping pills and coffee to take them off an addiction to heroin and cocaine. It might not be enough this time.

The Bank Analysis

SG, GS, UBS: Fed officials are confronting pessimism on the economic outlook and the highest inflation rates in decades.Inflation is immediate, employment strong and the recession threat remains a risk at the current juncture. The policy decision is to push higher on rates. We have a 50bp hike for July in our forecast, but the decision to be made is for a 50bp or a 75bp hike.… continues