Core Takeaways

Every complex option structure is built from butterfly components

Options are modular, like Legos

Butterfly = largest coherent structure

Requires precision, not just direction

Balances cost, risk, and probability

I. Teaching Framework

Different learning styles:

Abstract (numbers first)

Visual (graphs)

Hybrid (spreadsheet + structure)

Target audience:

Adults with basic options knowledge

Can do math

Want application, not definitions

Goal:

Understand how option structures evolve logically from a simple bullish view.

II. Starting Point: Bullish on Gold at $5,000

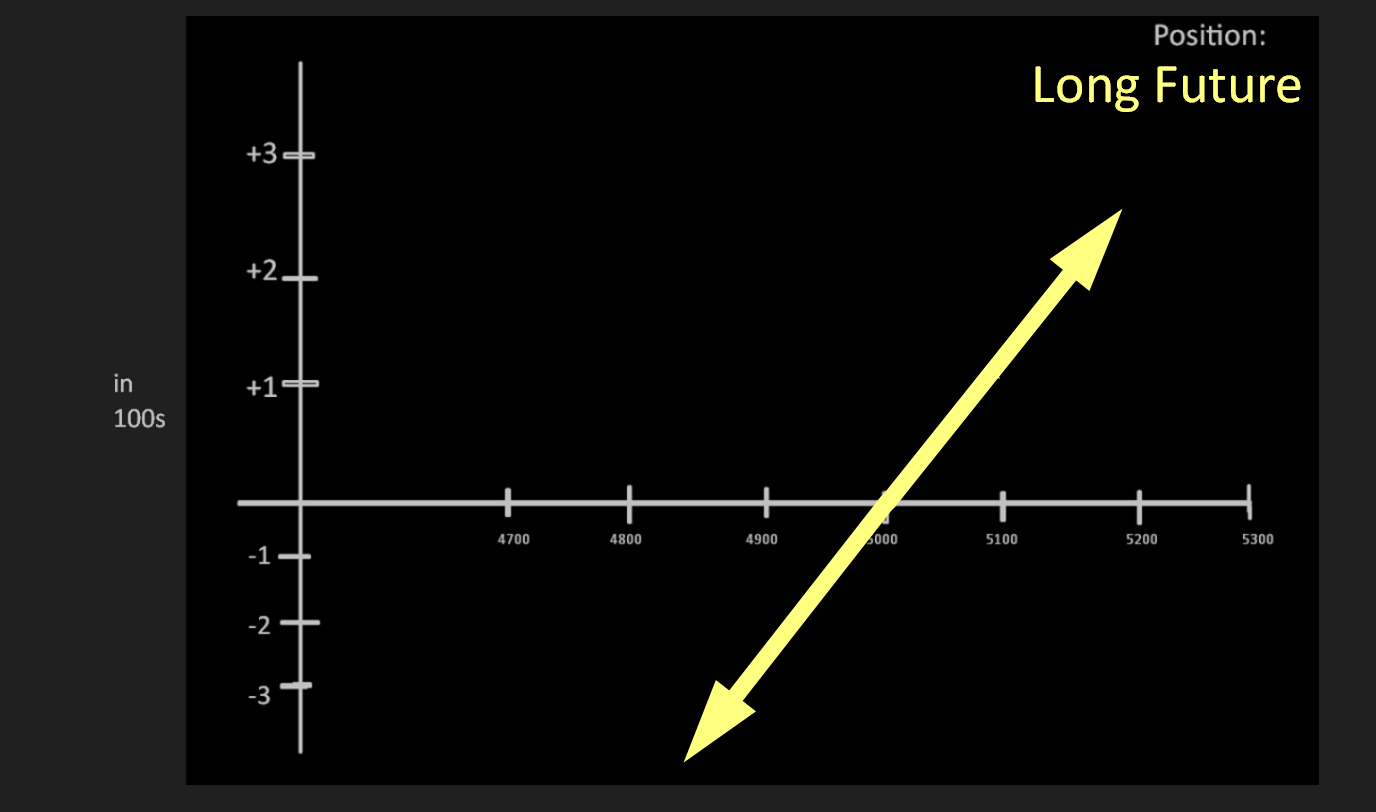

A. Long Future / Long Stock

Linear P&L

+$1 for every $1 up

−$1 for every $1 down

Unlimited upside

Unlimited downside

Key Concept: Pure directional exposure.

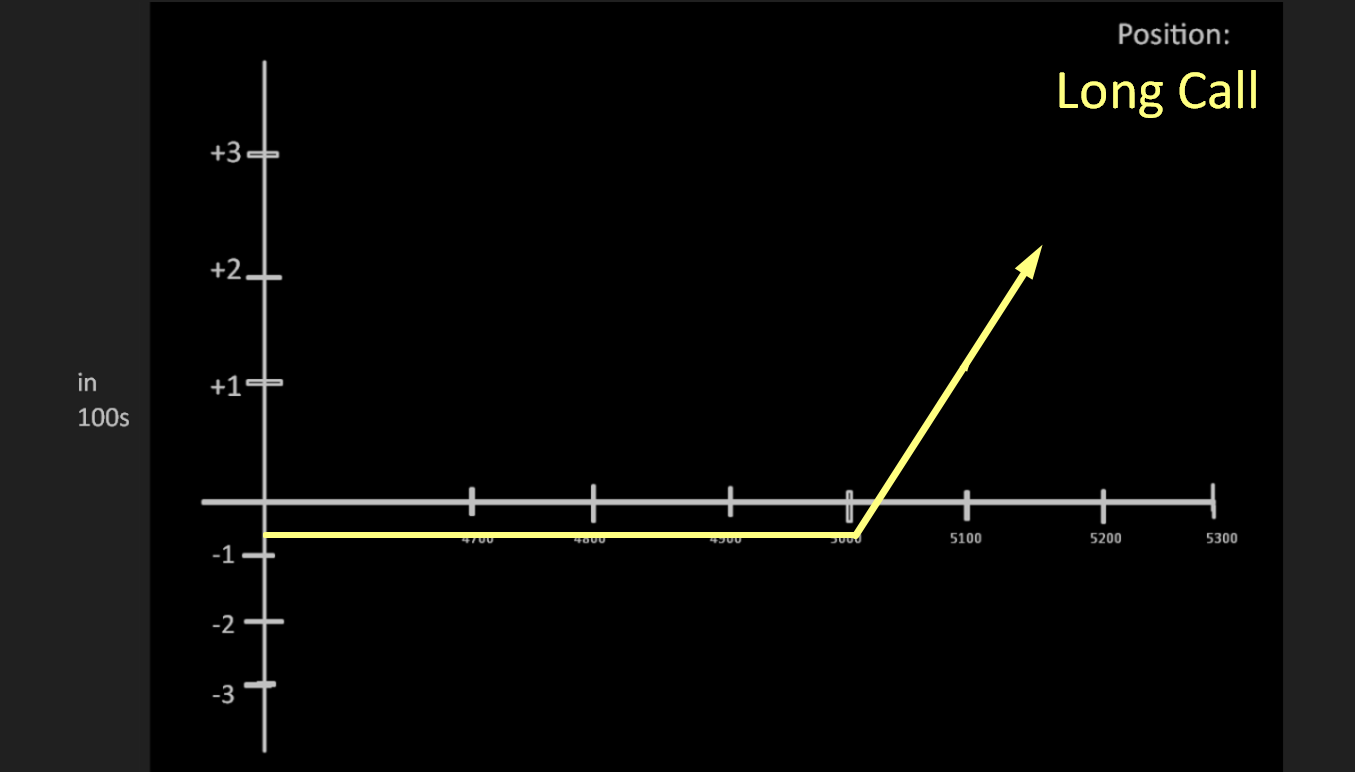

III. Reducing Risk: Long Call

Buy $5,000 call

Downside limited to premium paid

Break-even above strike + premium

Retains unlimited upside

Trade-off:

Defined risk

Requires capital outlay

Needs move beyond break-even

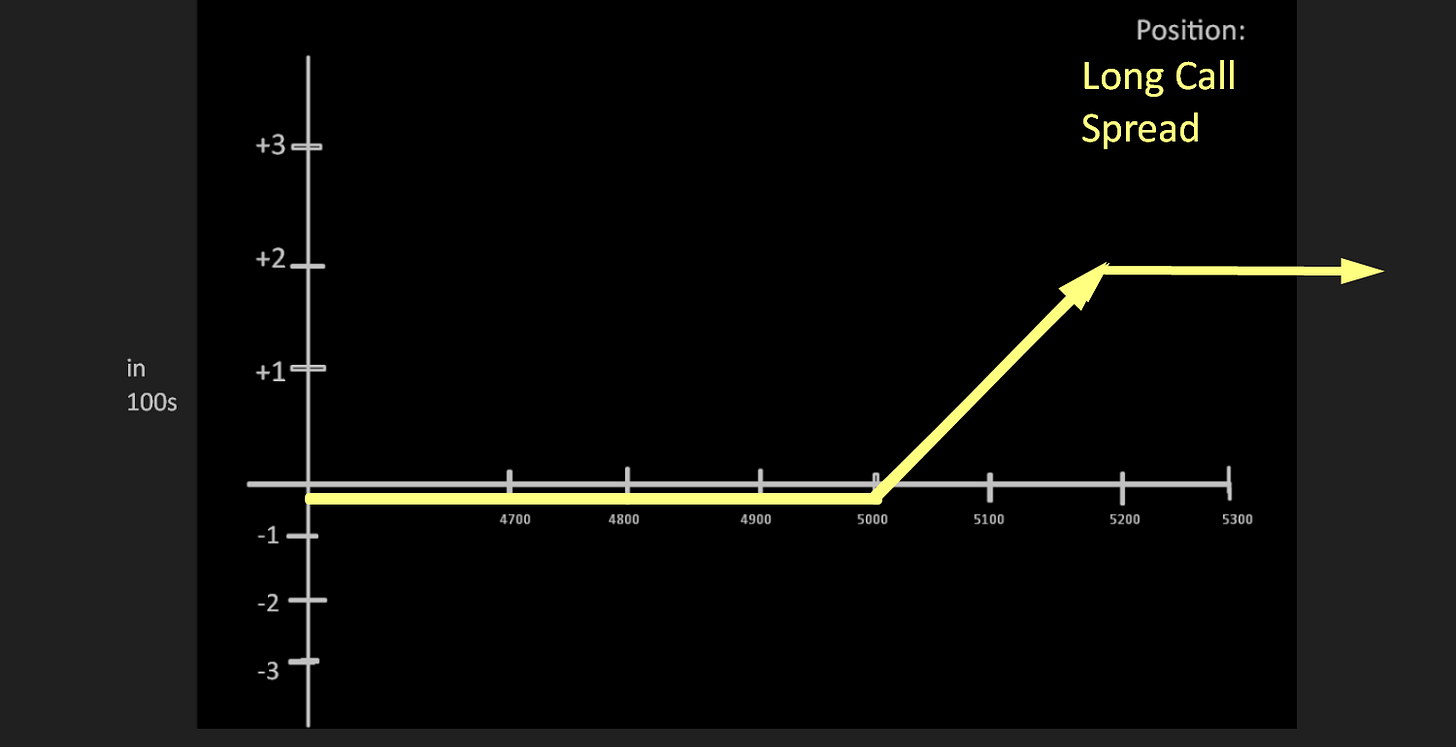

IV. Reducing Cost: Call Spread

Buy $5,000 call

Sell $5,200 call

Lower premium outlay

Profit capped above $5,200

Trade-off:

Sacrifice unlimited upside

Cheaper structure

More efficient if target is defined

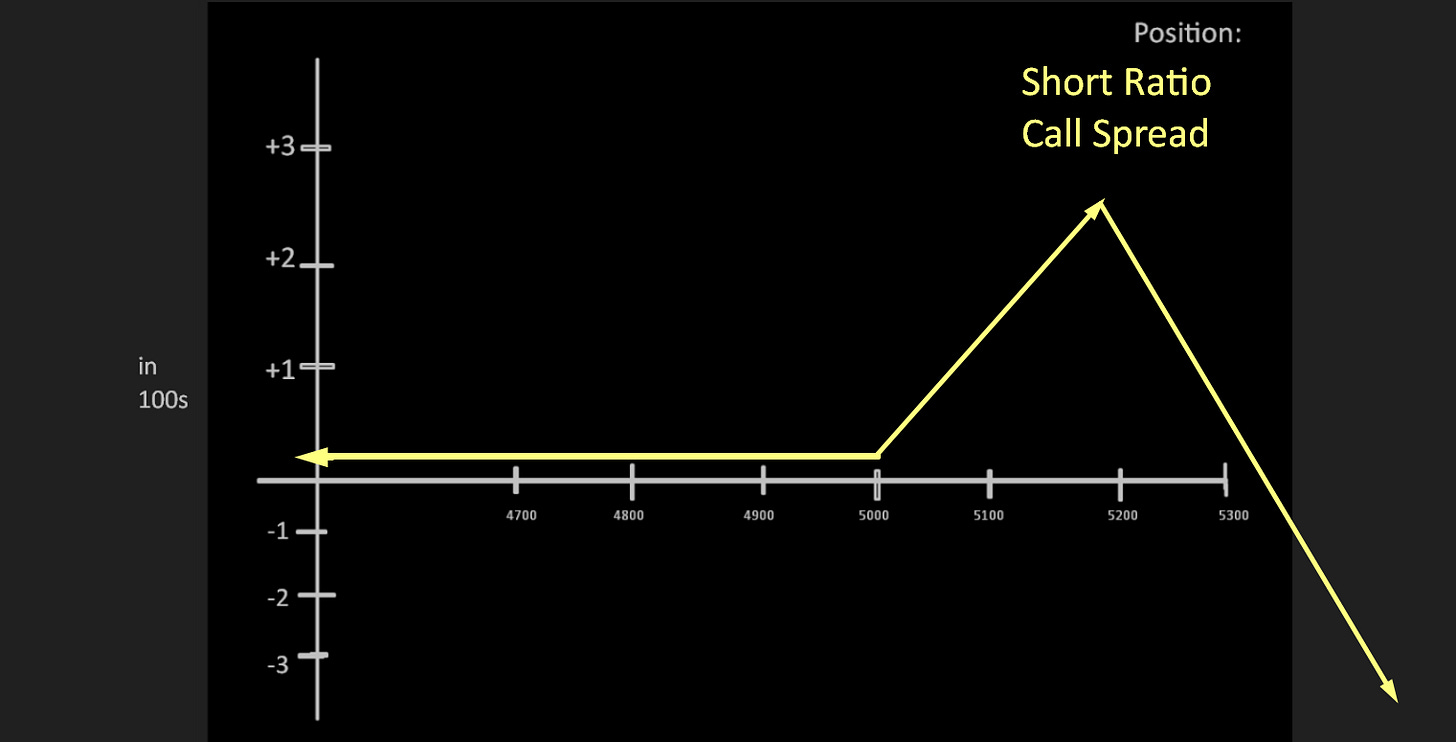

V. Increasing Premium: Ratio Call Spread

Buy 1 $5,000 call

Sell 2 $5,200 calls

Collect more premium

Max profit near $5,200

Unlimited risk above

Reality Check:

Margin intensive

Risk accelerates above short strike

Clearing firm constraints

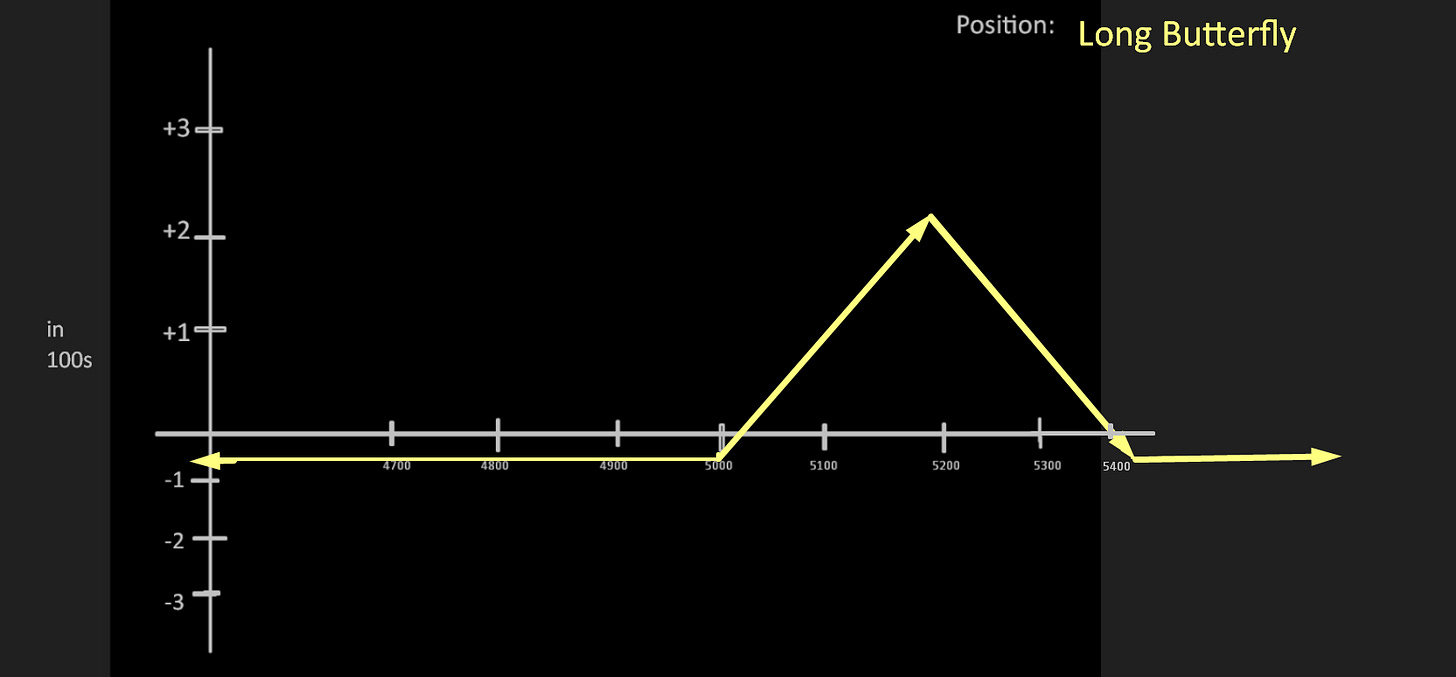

VI. Containing Risk: Creating the Butterfly

Buy $5,000 call

Sell 2 $5,200 calls

Buy $5,400 call

Structure:

Long wings

Short body

P&L Characteristics:

Defined risk

Max profit at $5,200

No unlimited exposure

Profits confined to range

VII. When to Use a Butterfly

A. Before the Move

Strong belief market settles near a precise target

B. During a Trade

Long call already profitable

Market reaches target zone

Convert position into defined-risk structure