Housekeeping: Off tomorrow. Be well. [Microphone modulation was too high in places. Prepare your ears. Some Profanity]

Intro:

Once in a blue moon we get multiple reports on CTA flows for Gold and Silver for side by side comps. These are the big 5 reporting banks who dominate the investment fund landscape.

That presented us with a rare opportunity to cross reference and weigh the pros and cons of each in context of while analyzing the gold market for next week.

This is a Masterclass level report walkthrough on how to read and weigh the massive content in the Goldman, BOA, and TD Ameritrade reports to help traders make their own decisions using Gold as the focus.

Includes key report slides

Approximate Timestamps

Warm up

Zoltan: 4 Defintions of Money

Int. Rate Risk in US and Fed ease risk

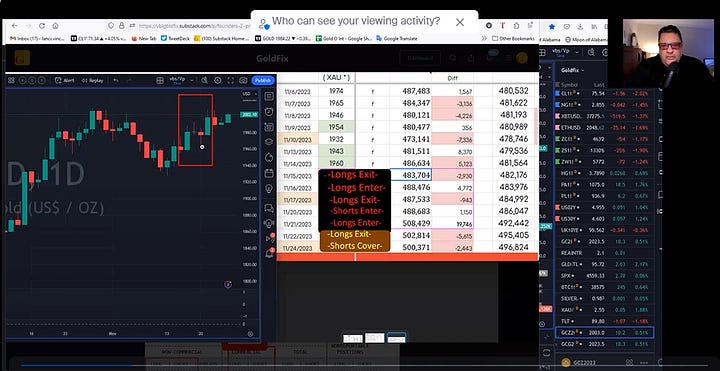

GoldFix Gold Flow Analysis

Data Walkthrough process

Trading levels and biases

How to read Open Interest changes in Gold

0:39- UBS

0:49- Bank Of America (detailed)

0:56- Deutsche Bank

0:58- TD Ameritrade (detailed)

1:13- Goldman Sachs (detailed)

Up/Down/Flat

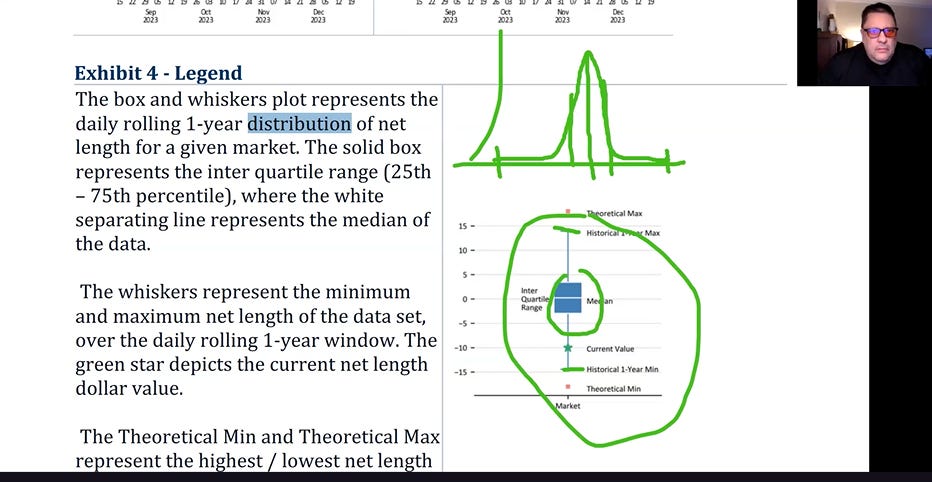

Whiskers/plot (with a false start)

Seasonal use.

Silver vs Gold

1:45 Q&A- Side by Side Bank Comps

1:47 What truly makes a bank good

Why Goldman is the best in Commodities

GOLDFIX FLOW ANALYSIS