The Broken Bond Ladder

Goldilocks And Her Evil Twin

If the Fed intends to fight inflation on the demand-side in part by getting mortgage costs up (they are) and house prices down (they will), real rates will likely get even stronger. Higher real yields will continue to put downward pressure on stocks well after the current liquidity dearth is digested. Long term yields will continue to rise

Then, if inflationary data does continue to come out, they can raise rates on the short-end without drawing attention by inverting the yield curve. It is a clever game that avoids the Neo-Bond Vigilantes over which Zerohedge presides. But make no mistake about it, the Fed will be raising into a recession.

Give it a name (we have): Anti-Goldilocks, Hyper-stagflation, etc. But it is almost exactly what happened in reverse of the 1990s. Killing inflation as Volcker did combined with the supply-chain logistics and technological revolution that came after are what enabled the Goldilocks economy of the 1980s and 1990's.

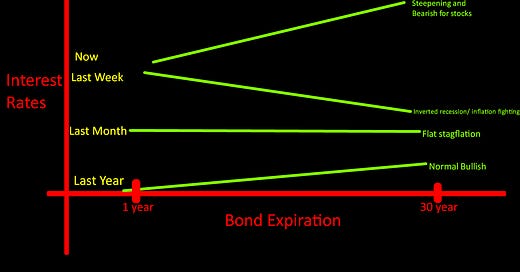

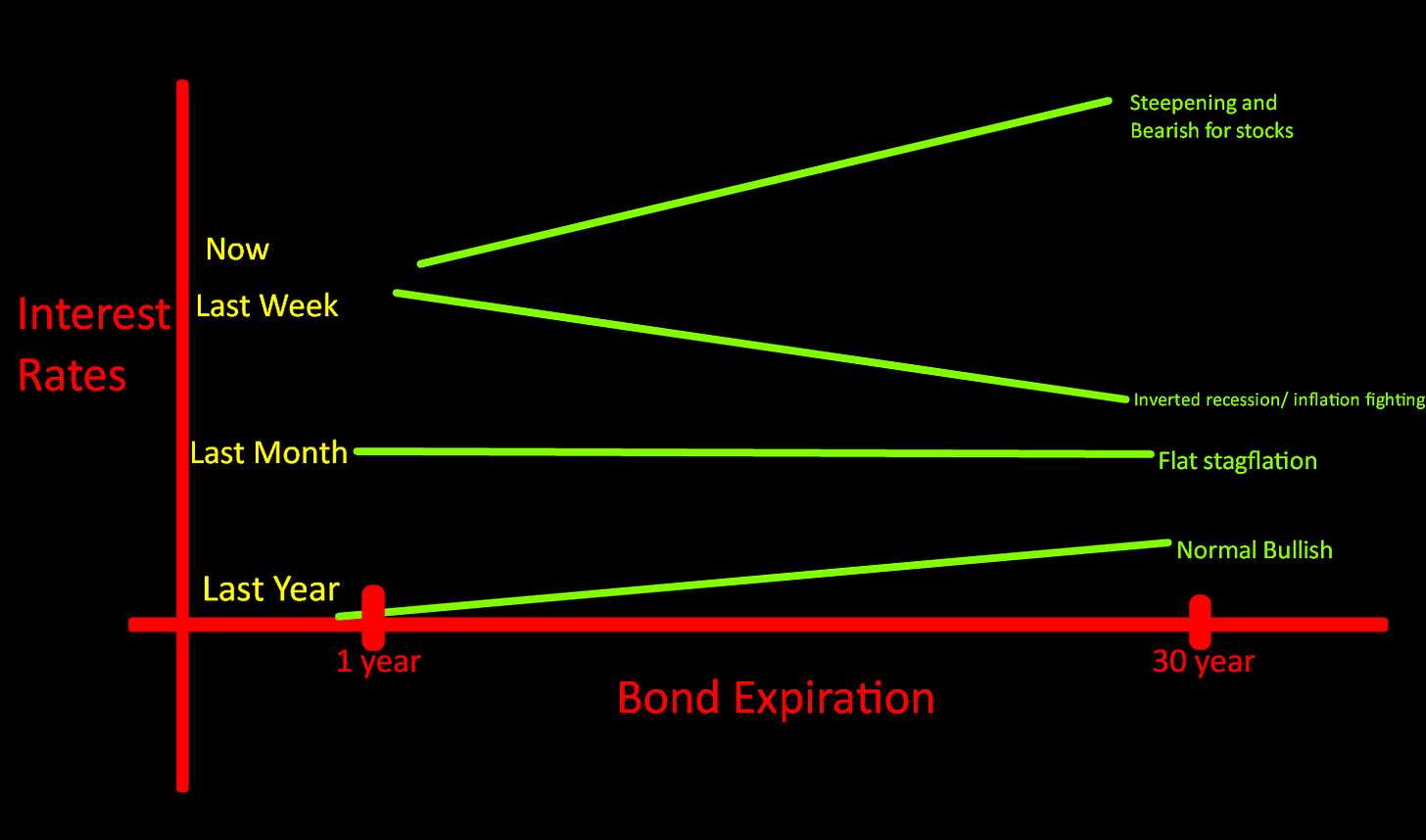

Bonds: The Broken Ladder Effect

During the Goldilocks era that Clinton enjoyed, technology created secular goods deflation so powerful the Fed couldn't lower rates fast enough as inflation waned. That created the biggest bond bull market of all time. The Bond yield curve ratcheted ever downward as the Fed lowered rates in reaction to that behavior. But now,that goods deflation tailwind has become a headwind, as Zoltan Pozsar recently said.

Currently, fractured supply-chains from War/Covid whatever (cemented by reactionary Mercantilism) create secular goods inflation so potentially persistent the Fed risks chasing inflation higher. Essentially the opposite of what the Fed enjoyed during the 1990s. This is what the opposite of Goldilocks could look like in a graph: a ratcheting yield curve rising ever higher until mercantilism is undone, global trust is restored, and inflation is truly stopped.

Less of Everything, Except Savings

Among other things, the liquidity increases that helped buoy markets on the way up, another feature of Goldilocks, when withdrawn will destroy market depth and increase volatility on the way down. The net effect at grass roots if this happens will be reduced global complexity. Shrinking globalization, less financialization, lower standards of living, smaller trade circles, rise of nationalism, smaller social safety nets etc. Less leverage in every way, everything, and everywhere.