Good Morning. This special piece is for hardcore metals persons.

We’re going to tell you a story that needs telling for precious metals investors, those who believe markets are manipulated, and people like ourselves who know the Metals Market structure has been cooked since our first ZeroHedge guest article about it in 2010 detailing formative experience with manipulation

This is a story we knew about for some time, but folks just weren’t ready to listen Now, because of Michael Lynch filling in a couple important puzzle pieces.. we can tell you.

First, Michael shows you what happened and why ASE prices likely skyrocketed. Then we tell you how and why it transpired going back to Covid.

Contents:

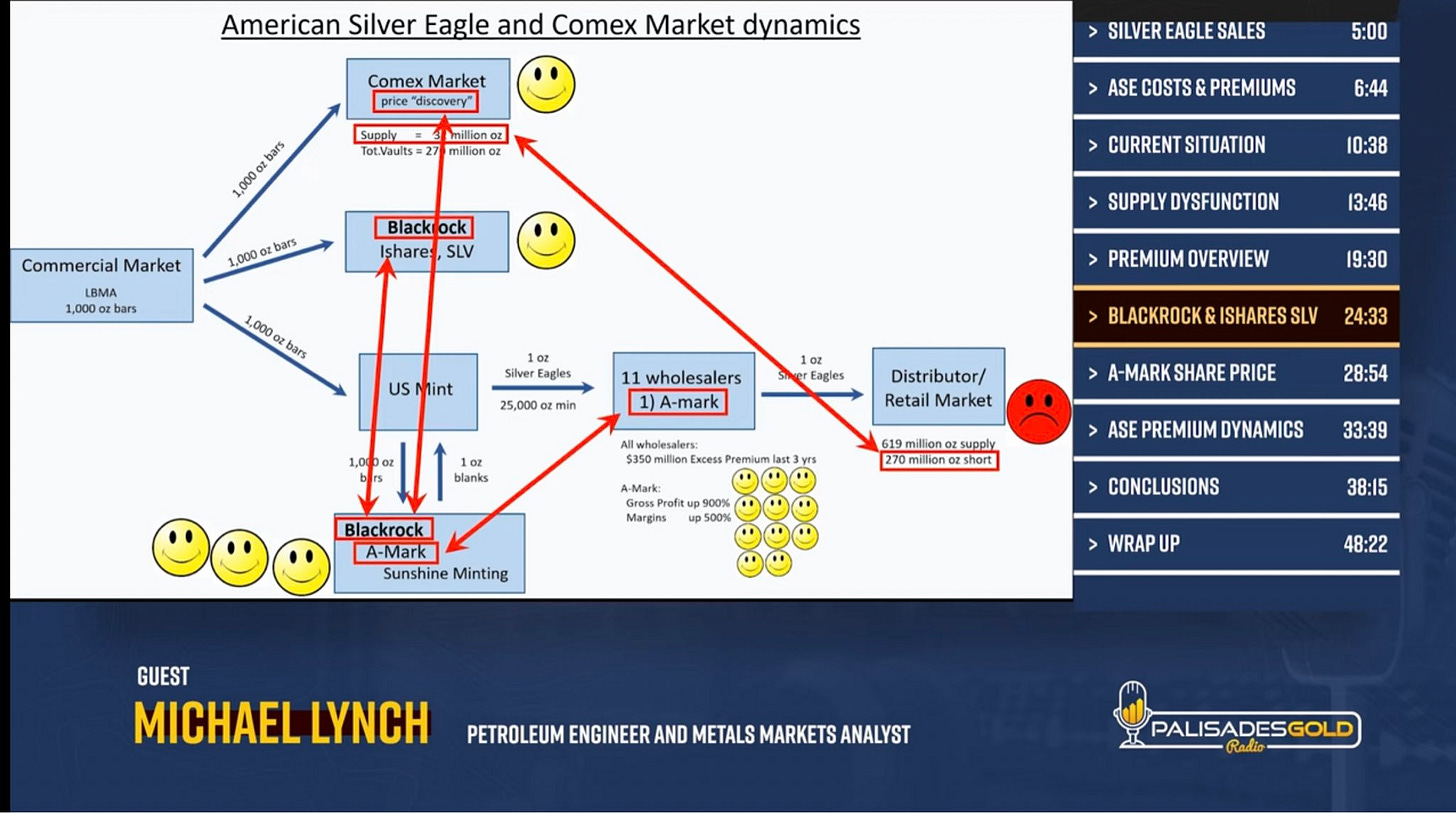

BlackRock And Silver Eagle Production

The Whole Story on Silver Eagle Premiums

The March 2020 Pandemic Comex Squeeze and DoT Panic

Comex Only Please

Coin and Blank Makers Get Smart

Enter BlackRock

1- BlackRock And Silver Eagle Production

Michael Lynch, a member of the group Silver Degens—themselves the core behind Wall Street Silver— speaks under cover with Tom Bodrovics of Palisades Radio. You may remember Micheal from an excellent guest-post here:

Michael then did more research into the logistics of Silver coin production after this and found that the problem in part is the refinement of blanks which was discussed in this space a long time ago in cursory manner.

We opined then it was part of why the March 2020 market moves occurred. And lead to what has happened the past 3 years to coin premiums. But we did not drill down on the specifics.

Michael has supplied a very important part of the puzzle here. We fill in the rest.

Michael’s Summary:

The Mint has been unable to meet demand due to alleged production issues with blanks, but some suggest Blackrock is manipulating the market through Ishares SLV Trust.

Silver stackers can avoid premiums by buying larger bars instead of Silver Eagles.

A solution to the Mint’s shortage would be to bring production in-house, giving them more production flexibility.

Micheal Lynch

Twitter: https://twitter.com/DtDS_WSS

Substack: Michael Lynch: on Gold and Silver

Next: Here’s how this all started and why Michael’s analysis is correct.

2- The Whole Story on Silver Eagle Premiums

**The following is a product of research, extensive communication and experience with principals in the Refinery and PM Financing industry in the US and EU. The sources were reliable, the information is accurate but not exact. **