This is why Gold rallied so aggressively Friday.

Citi Drops Rate Cut Bomb, Says Fed Will Cut 8 times for 2 full percentage points

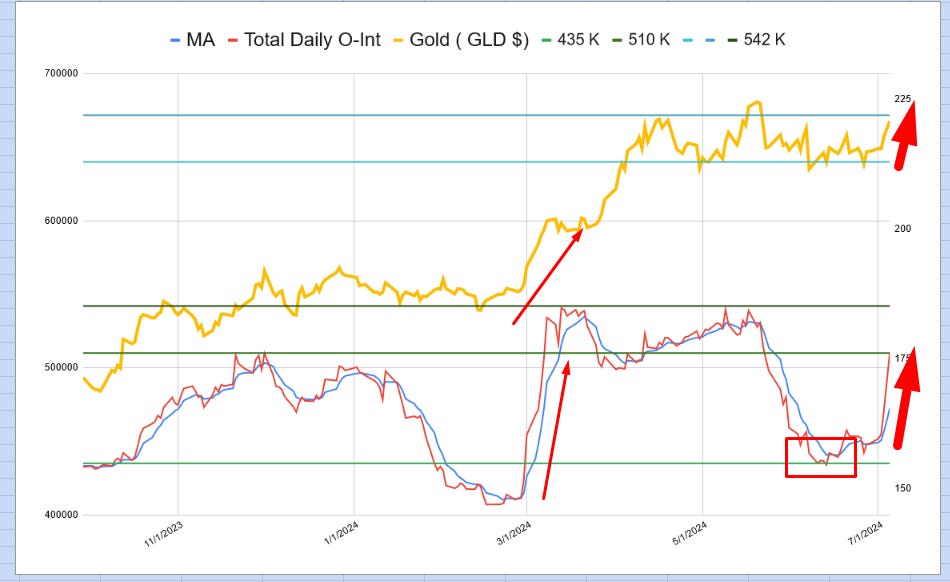

Since open interest cratered a week or so ago we were looking for signs the Macro Discretionary players were positioning a re-buy in our golden renaissance.

Gold price and Open Interest…

The June 30th close was not inspiring. However, given the fact that China was again absent buying for the month, to hold unchanged in June only a stone’s throw from ATH was nothing to sneeze at absent PBOC demand.

Monthly close was not bad but offered no insight…

Macro Discretionary buying did return on July 1 and bought all week, adding a kicker on Friday in the wake of the mixed, but net negative Jobs report.

The New Gold Cycle…

Why so strong? We thought it was the market beginning to discount the necessity of a pre-election rate cut as handicapped by Steven Blitz in his commentary The Fed May be "Inching Towards a July Cut".

Citi Drops Rate Cut Bomb

But it was not just that; It was this. Citi announced on Friday at 4:02p.m. they expected the Fed to cut in September and then an additonal 7x in the coming months