Housekeeping: Good Morning

Trump Tariff Risks Spark Turmoil in Global Gold Market

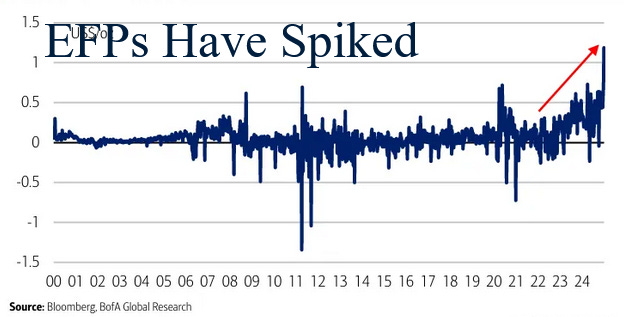

Here is a breakdown of a story in which Bloomberg reported the prospect of universal import tariffs under U.S. President-elect Donald Trump were driving unprecedented disruption in the global gold market.

A key indicator of bullion demand in London has hit historic highs, reflecting growing unease among investors and dealers alike.

U.S. Precious Metals Surge Amid Tariff Speculation

Just as we reported just last week in Silver EFPs: The Canary in the Mine

Right now, the EFP is currently discounting a lack of physical delivery available in the USA. Here’s how…

With CME futures currently trading in a steep contango to LBMA—where futures prices exceed spot prices by far more than normal…

Selling futures for physical positions seems like an attractive trade to take advantage of an “unnatural” differential between the cross-Atlantic venues.

But, that is potentially a big mistake. Should tariffs materialize, EFP pricing will rise further, adding to price and commensurate delivery problems.

In recent weeks, U.S. prices for gold, silver, and other metals have significantly outpaced international benchmarks. This divergence stems from heightened fears that precious metals could become collateral damage if Trump follows through on campaign promises to impose tariffs of up to 20% on all imports. The anticipation of these tariffs has triggered a global scramble for bullion, as major dealers rush to reposition metal in the U.S. before any policy changes take effect.

Lease Rates Signal Intensifying Demand

A sharp spike in London lease rates this week underscores the growing urgency in the bullion market. Lease rates—representing the return for loaning bullion from London vaults—typically hover near zero. However, one-month rates have surged to an annualized 3.5%, the highest level since at least 2002. This unprecedented move reflects surging demand for bullion in London’s vaults, with similar dislocations seen in the silver market.

Market participants now warn of a potential scarcity of freely available metal to satisfy dealers’ demands. Robert Gottlieb, a former precious metals trader and managing director at JPMorgan Chase & Co., the world’s leading bullion dealer, summed up the situation:

“The markets are in total dislocation. There seems to be a scarcity of available stocks in both gold and silver.”

Arbitrage Challenges and Market Risks

Bullion-dealing banks like JPMorgan and HSBC play a critical role in maintaining price alignment between London and New York. These banks, alongside hedge funds and high-frequency trading firms, frequently engage in arbitrage trades to stabilize price spreads. When futures on New York’s COMEX exchange trade significantly higher than London prices, they sell U.S. contracts and buy London metal, aiming to restore balance.

However, this strategy is becoming increasingly precarious. If spreads continue to widen, investors seeking to unwind arbitrage positions risk substantial losses. Efforts to buy back New York futures contracts could trigger a self-reinforcing cycle, pushing prices even higher.

The Path Ahead

As the markets brace for potential U.S. tariffs, the bullion landscape remains fraught with uncertainty. Soaring lease rates and supply constraints highlight the fragility of the current system, with ripple effects that could extend far beyond gold and silver markets. Investors and dealers alike face mounting challenges as they navigate the fallout of a possible seismic shift in U.S. trade policy.

Attached: The First Takereport by an important bank on potentiality of Universal and other Tariffs:

On the universal tariff, Trump’s comments and his memo on trade policy suggest action is not very likely in the near-term. Asked if he would impose a universal tariffon all countries, Trump responded that “I may, but we’re not ready for that yet” thoughhe then defended the concept of the universal tariff