Housekeeping: We provide, you decide right now.

Personal note: Vince has accepted an offer to teach Options and Futures for MBA candidates at UCONN this fall.

Value Proposition: Gentle reminder that students pay over $3k for a semester. Goldfix Founders lectures are 1/10th of that for a year. Bonus: think of the entertainment potential when these rookie students join us old guys on Sunday. ;)

"The EU will soon announce its energy roadmap and has reportedly shifted its short-term focus from decarbonization to energy security. Goldman Sachs

Market Rundown

Good Morning.

Premium: Morgan Stanley on Oil and Russian Oil replacement analysis at bottom.

Markets are now reacting dynamically and efficiently to news events, as opposed to data. For now we will just give you the facts here, and the research we are reading. If you have questions, ask.

The dollar is down 27, Bonds are weaker, stocks are mixed, Gold is very strong, Silver is also strong. Oil is up 4%. Grains, Crypto, and base metals are very strong. Markets will move aggressively on news and rumors of news now.

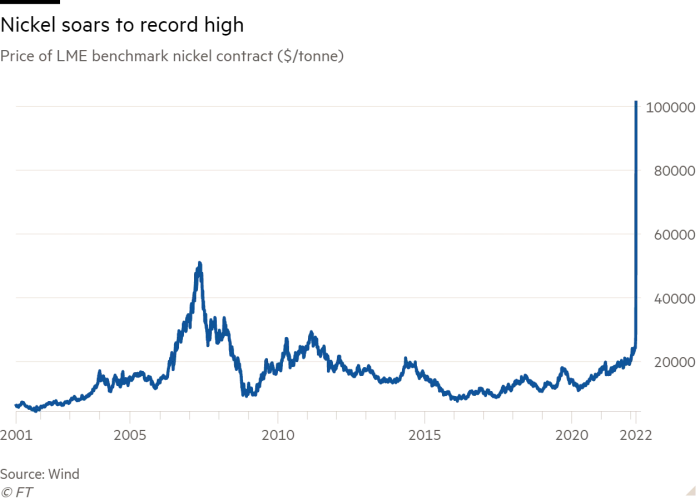

Nickel Explodes and It means a lot

The headline market today is Nickel. Base metals are ripping higher with the fuel for these rallies being wherever large players had some sort of short position on. Exchanges are panicking and raising margin requirements. This is basically deleveraging markets. If you don’t have enough capital in your account, you have to put more in, or close your position out.

China is bad tactically

Watch how china tycoons are getting eviscerated now. Their brand of capitalism is suffering because of their lack of tactical expertise. Here’s the crazy part: The CCP doesn’t care.

Silver Stability

Those of us of the Silver persuasion may be wondering “When Silver’s turn?” Do not expect that. It may happen but know that most of the shorts in Silver are banks that the government backstops.

Right now the most important thing to US government is keeping a lid on domestic volatility. This is even more important than the energy thing. Perception of stability is paramount now.

That means they will not let a bank blow up that is short silver. Could it happen? Of course. Don’t bet on it until the dust clears on all the Chinese blow ups.

US Oil

Biden will likely announce today some moves to embargo Russian oil. This will simultaneously be wit ha public call for increased US production. We expect renewed Keystone pipeline activity, Venezuelan inroads, and more. The world is splitting along geographic lines at a n increasing rate now. Markets are now bifurcating as this reality sets in

Goldman on Energy:

"The EU will soon announce its energy roadmap and has reportedly shifted its short-term focus from decarbonization to energy security, likely relying for now on more coal, more nuclear, and gas generation, and overall allowing for more carbon emissions"

Says it all right?

cheers

Zen Moment

Have a good one

If you enjoyed this piece, please do us the HUGE favor of simply clicking the LIKE button!

Post Excerpt

***Premium Beneath the Fold***

Paid content below this line