Wall Street Talk of Revaluing US Gold Is Drawing Attention — and Skepticism

PLUS: James Grant Weighs in

Wall Street Talk of Revaluing US Gold Is Drawing Attention — and Skepticism

Jack Ryan, Yvonne Yue Li and Saleha Mohsin

(Bloomberg reporting) -- The gold market attracts its share of fringe ideas, and in recent weeks one of them — that the US should revalue its gold stockpiles — has gripped Wall Street.

The idea isn’t under serious consideration among US President Donald Trump’s top economic advisers, according to a person familiar with the matter.

Nevertheless, some gold market participants have taken their cue from Feb. 3 comments by Treasury Secretary Scott Bessent that the government would “monetize the asset side of the US balance sheet” and create a sovereign wealth fund.

The speculation centers around the idea that the US Treasury could re-peg its gold holdings at a higher level, a move that would generate quick cash for a government eager to run more efficiently. In summary: The US government should revalue its gold reserves from the $42-an-ounce set in 1973 to current prices, allowing the Treasury Department to monetize the sudden balance-sheet boost of about $750 billion, thereby reducing the need to issue bonds.

Such a move would likely require approval from the US Congress.

Unlike most countries, the US’s gold is held by the government directly rather than the Federal Reserve. The Fed holds gold certificates corresponding to the value of the Treasury’s holdings, and credits the government with dollars in return.

At the current official price of $42 an ounce, those certificates are worth $11 billion to the Treasury. But gold has been soaring to repeated record highs of late — approaching $3,000 an ounce. If the US government’s gold was marked-to-market, that would surge above $760 billion, creating a one-time windfall.

Beyond simply revaluing the US’s gold stocks, Stephen Miran, Trump’s nominee to lead the White House Council of Economic Advisors, has floated the idea of selling the stash. By selling the gold for dollars, and then exchanging those dollars for foreign currencies, the administration would strengthen “undervalued” currencies, an outcome Trump has signaled he wants, Miran wrote in a November report. Swapping bullion, which does not yield interest, for foreign government bonds would also create an additional income stream for the government, he added.

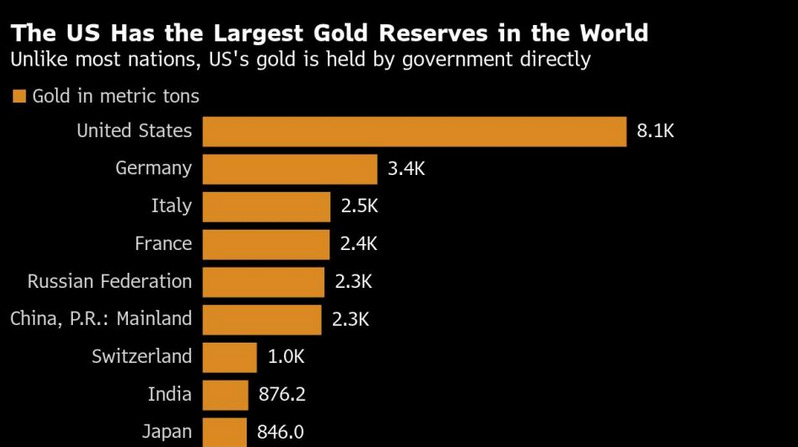

While it’s probably statutorily permissible, selling national bullion reserves to buy foreign exchange instruments could be politically costly, Miran wrote. Offloading even a portion of the 8,133 metric tons of gold held by the US government would likely hurt gold prices.

Here is more info from our own research:

WE WONT SELL THE GOLD IF 1973 REPEATS

Nobody knows what will be done if anything or how it will be done, but the above is the most appropriate way given the information available

James Grant’s Interest Rate Observer weights in on what to do with the windfall profits and how those profits should be monetized as of Feb 14th 2025

Buy bonds instead: $780 billion, un levered, could buy 16% of the outstand ing public debt maturing in 11 years or longer. But the narrative is the thing. Announce that you, Scott Bessent, heir to the office of Hamilton and Albert Gallatin, are restoring the U.S. dollar to its constitutional gold (and silver) stan dard roots. Remember, you have sold not one ounce of gold, only borrowed against it. The loan is a sweetheart: zero-percent interest forever (there is no maturity date).

How it Would Happen if it Did

Revalue Gold >> Borrow 800BN at 0% >> Buy 5% US Debt

Mark Gold to a more realistic price- Reset the Gold

Borrow (not sell) against the Reset price- Monetize the Gold

Retire US Debt with the windfall - Reduce the Debt

When The US Did it Last

1973: 1- Gold revaluation increased book value by about $2 billion. 2- That one time "write up" was transferred to the Treasury General Fund and spent-- (Treas stated its use was to reduce the deficit) 3- No physical gold was sold; it was an accounting entry converted into fiscal spending power.

More Detail:

-government raised the price of gold on its books from $35 to $42.22 per ounce.

-The "writing up" from this revaluation was monetized — it was treated as revenue by the U.S. Treasury and used to (allegedly) reduce the budget deficit

-the Treasury’s fiscal position updated to "receive" received around $2BB in what is officially termed a windfall event.

Here’s Our Own take

Does this tie into bond side of Hartnett’s BIG? Would purchasing that much bonds drive price up and yields down?

Monetize revalued gold means using it as collateral.

CDO? Sound familiar?

Except no one trusts USG UST to actually own physical gold and no one trusts USG to convey said gold at maturity or under any other circumstances -- USG would cash (fiat) settle any claims on its gold.

Maybe salesman trump could sell these CDOs to CBs or SWF but only by threatening or bribing SWG or CB officials. Maybe make "gold backed"🤭 bonds tax free for americans and the sheeple will buy some-- a complete con. Gold-INDEXED bonds or CDOs is more accurate.