**Weekly: Central Bank(s) Buying Again

"This leaves us with one explanation –that the latest XAU rally reflects growing demand from central banks."

Housekeeping: After new ATHs last week, a special communication was called for. This comprehensive report covers Gold and Silver from almost every angle thought of as traders and students of the markets, including but not limited to major bank research excerpts you cannot get anywhere else.

This will catch you up and prep you for the coming week.

Enjoy

P.S. New monthly subscription rates will increase next week. Annual and Founders will remain the same for now.

Summary

Macro Markets

Gold and Silver Price Action

Investor Activity

Trading Cohort Activity

Bank Research Excerpts

CA*, GS,* ING*, BOA, DB

Technically Speaking

Risk Comment

1- Summary

Gold is now up for 8 straight days and 14 of the last 17.

The longest winning streak since July 2020...

Silver was no slacker either even on days when the gold buyers sold Silver to keep Gold in place just long enough to add to longs.

Let’s look at the related market backdrop contributing to the rally.

2- Macro Markets

US Economic data disappointed non-stop all week… Every one of these below was a miss

Actual / Forecast

Factory orders Jan. -3.6%/ -3.1%

ISM services Feb. 52.6% / 53.0%

ADP employment Feb. 140,000/ 150,000

U.S. wholesale inventories Jan. -0.3%/ -0.1%

U.S. unemployment rate Feb. 3.9%/ 3.7%

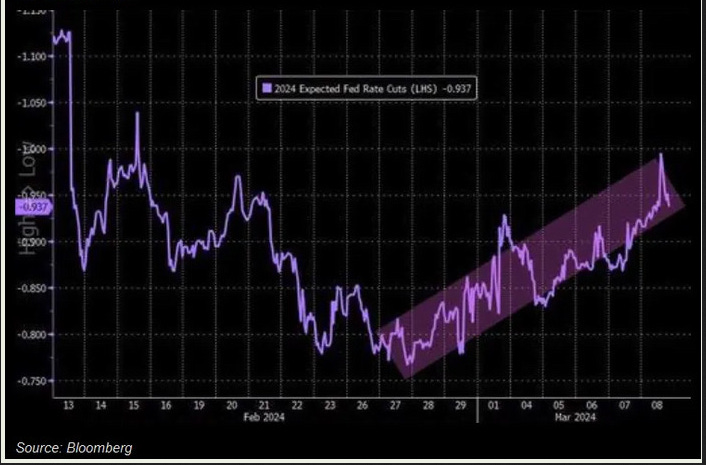

Bad economic news was viewed as good news for almost everything as rate-doves assumed once again the Fed was going to cut sooner rather than later. The market's expectations for rate-cuts in 2024 ticked back up to 4 rate-cuts (from 3).

Chart indicates market now discounting 4 rate cuts once again…

We shall see that was ground zero for buying of Bonds, some stocks, Gold, Silver, and Bitcoin.

The 10Y Yield dropped down to almost 4.0% (closing below its 50DMA) at its lowest in almost six weeks...

The dollar was down for the sixth straight day Friday, ending the worst week in three months for the greenback…

But, while yields were lower on the week, stocks were more mixed with Nasdaq actually net down on the week as NVDA spoiled the party.

NVDA lead the swoon, wiping out 5.5% in 4 hours at the end of the week…

The rest of the tech market then followed suit…

Which brings us to Gold and Silver.