Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. It is more like Barron's used to be. Content touches many areas of markets. The index may help.

Founders class: Sunday ***2pm ET*** ( one hour earlier for members in different time zones). a separate post will go out with proper details tomorrow morning

SECTIONS

Market Summary

Technicals

Podcasts

Calendar

Charts

Analysis: GoldFix Analysis

Research: Gold, Oil, Commodities, Macro, Fed

1. Market Summary

Do not go out and buy Gold because you want it to rally next Monday. Buy it next Monday because you intend to own it for the next 5 years of Mondays

There have only been 2 months in the last two years where CPI has printed less than expected. CPI has also risen for 14 straight months.

Sentiment among Americans collapsed to a record low (UMICH) and inflation expectations surged (signaling Fed credibility is plunging).

It is also notable the frequency with which the Biden admin is 'referring' all inflation questions to The Fed suggests Powell is stuck on this path and will take the fall for all the damage in either direction.

S&P 500 and Nasdaq's worst weekly loss since Jan 2021

The S&P 500 is down 10 of the last 11 weeks - worst stretch since the Great Depression

Nasdaq was the worst performer, down 5% on the week

Nasdaq was the worst performer, down 5% on the week

H/t Newsquawk and Zerohedge for data and some graphics.

Sectors:

Financials were slammed on the week

Even Energy stocks closed red

The last time US HY bond prices were this low, The Fed stepped in to buy them in an unprecedented action.

All of this Proves the point once again, it is not the price the fed cares about, just the speed at which it gets to the price.

Commodities:

Bottom Line: commodity rallies are almost all stalling now except for Oil. It is all about WTI now unless China really steps up demand or peace breaks out in Europe. If oil drops, the rally is over for most commodities. Gold will drop as well, but Gold is not a commodity in this sense long term.

Gold surged to its highest in one month

The dollar soared, back up near the cycle highs

Commodities were mixed with copper crapping out

Crude managed modest gains amid all that chaos

Nat Gas was extremely volatile with domestic demand destruction due to LNG fire here resulting in price spikes in Eu.

Bonds:

Bottom line: Stagflationary flattening, Junk gets junkier, Fed may be forced to let long rates rise again.

Market is now pricing in 10 more rate-hikes by the end of 2022 and then 3 rate-cuts following it

The Broken Bond Ladder for why long bond yields are likely to rally now

Stagflation flattening: on the week 2Y Yields up 40bps and 30Y up just 10bps

3s10s and 5s10s both inverted Friday as the yield curve flattened dramatically

2Y Yields topped 3.00% for the first time since 2008

Real yields pushed to their highest since April 2019

Crypto:

Bitcoin fell back below $30,000 but remains in its recent range

Ethereum is looking extremely poor this Saturday

2. Technical Analysis

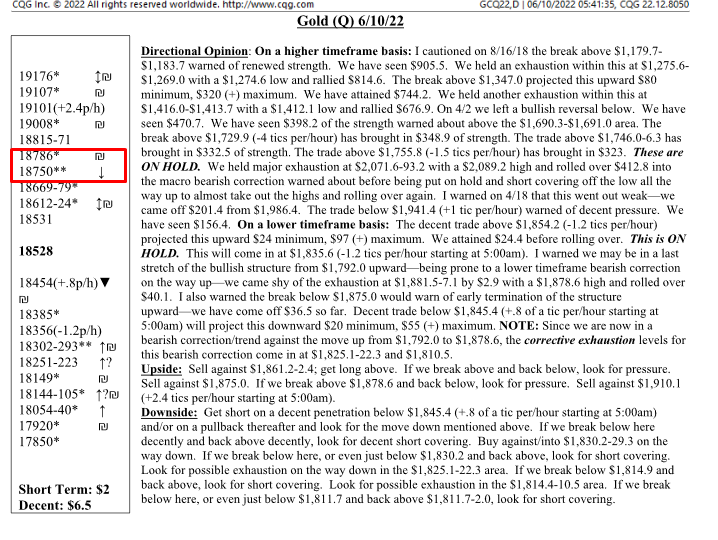

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

Jordan from The Daily Gold circled back to us Friday and we had a nice chat on Friday’s post CPI action and the potential for it being a pivotal moment in the investment world.

Vist The Daily Gold for more analysis

More GoldFix Broadcasts HERE

More Bitcoin Podcasts HERE

4. Calendar

Some upcoming key data releases and market events

MONDAY, JUNE 13

11 am NY Fed 1-year inflation expectations May -- 6.3%

11 am NY Fed 3-year inflation expectations May -- 3.9%

TUESDAY, JUNE 14

6 am NFIB small-business index May 93.0 93.2

8:30 am Producer price index final demand May 0.8% 0.5%

WEDNESDAY, JUNE 15

8:30 am Retail sales May 0.2% 0.9%

8:30 am Retail sales excluding vehicles May 0.8% 0.6%

8:30 am Import price index May 1.2% 0.0%

8:30 am Empire state manufacturing index June 1.0 -11.6

10 am NAHB home builders index June 68 69

10 am Business inventories April 1.3% 2.0%

2 pm FOMC statement -- 0.75%-1.00%

2 pm FOMC projections

2 pm Fed Chair Jerome Powell news conference

THURSDAY, JUNE 16

8:30 am Initial jobless claims June 11 219,000 229,000

8:30 am Continuing jobless claims June 4 -- 1.31 million

8:30 am Building permits (SAAR) May 1.78 million 1.82 million

8:30 am Housing starts (SAAR) May 1.71 million 1.72 million

8:30 am Philadelphia Fed manufacturing index June 7.0 2.6

FRIDAY, JUNE 17

9:15 am Industrial production index May 0.4% 1.1%

9:15 am Capacity utilization May 79.3% 79.0%

10 am Leading economic indicators May -0.4% -0.3%

Main Source: MarketWatch

5. Charts

Friday in Red

Gold

Silver

Dollar

Oil

Bonds

Charts by GoldFix using TradingView.com

6. Analysis: GoldFix Commentary

Friday was definitely pivotal in the spreading feeling that Gold is no longer a second tier asset. The day started out with Gold lower and the dollar higher as traders ( algorithms trading correlations) assumed the number would be high and that would force rates up in the front end to squash inflation.

PRE-CPI SPECIAL NOTE- Went out to all subs before the number

The number came out and the market continued in that vein with long bond yields dropping in anticipation of inflation under control and flights to safety on stocks continuing to drop.

But then something happened. Long Bond yields turned on a dime and started soaring. Implication being that they do not believe the Fed can handle the inflation as quickly as previously thought before it gets more absorbed long term.

Then it got weird.. By weird we mean the market did what it should. Gold pivoted off the lows and rallied $53.10 to finish up 1.2%. The move was simply breathtaking and what is more, Gold stocks skyrocketed even with the major indices getting crushed.

UNLOCKED: CPI EXPLODES- Went out to premium subs when Gold just started turning around at 8:57.. it proceeded to rally $53 off the lows.

Why is that so important to us? …

***More at bottom***7. Research:

Precious

Einhorn, GoldFix**

Oil/Commodities

JPM

Macro / geopolitical

Goldman, MS**, TD

***More at bottom***