Weekly Part I: Goldman Sets Table for the Next Bull Market Leg

The Commodities Supercycle Unpacked

Housekeeping: Tomorrow will be the last Founder’s class for a couple weeks as we gear up for the fall teaching semester. Once the students there are settled in, Founders will resume Sunday Masterclasses again.

Founders Class And Weekly Feature

Hi All. This current post will do double duty. The research here will also serve as subject for discussion in tomorrow’s Founders Class, which we think will be a special one.

Part 2 sent tomorrow will have the usual research and data in it. But we wanted to give this a thorough standalone treatment. Especially with commodity markets in a big dip and some of us wondering if there is another leg higher coming or if inflation is beaten.

Tomorrow’s class is very important in our opinion for those of you who get and read reports from us and elsewhere for investing and trading.

We will use a current comprehensive report that involves Gold, Oil, Copper and a very strong successful thesis Goldman has been promoting in 2021-2022 and before that in 2003-2007

Here is a sample page of the report with our markups ( in blue) for distribution in Sunday’s Class…

Personally, this should be helpful in trading as well as regular investing decisions, and general users of research. Not to mention we will actually look at trades based on their recommendations. This will be a structured interactive conversation.

Lecture Notes for handout and complete mark up of report will be given as well Research and Zoom link at bottom.

Here are some topics we will discuss in detail.

Goldman’s Latest Commodity Report

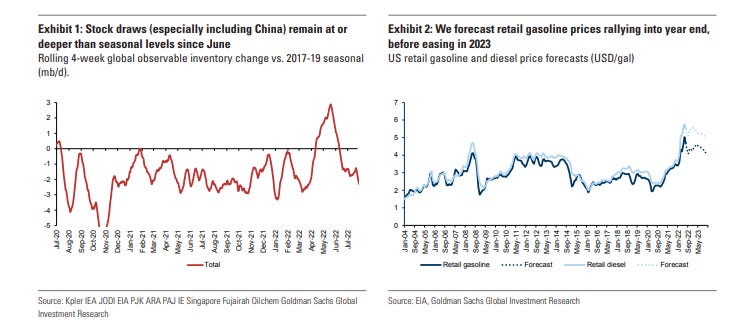

The only rational explanation in our view is destocking as commodity consumers deplete inventories at higher prices, believing they can restock once a broad softening creates excess supply, a dynamic apparent in metals and agricultural markets today.

Yet should this prove incorrect, and excess supply does not materialize as we expect, the restocking scramble would exacerbate scarcity, pushing prices substantially higher this autumn potentially forcing central banks to generate a more protracted contraction to balance commodity markets.

Gold and Silver- What is true and what is not. Very important

They are still very bullish, but recommending to clients to sell volatility right now. Hmmmm…

Gold balances between growth worries and real rates. Early this year we raised our 12m gold price forecast to $2500/toz on expectations that the US recession fear will boost gold investment demand. We argued that during past periods of Fed rate hikes recession risk was a more important driver of gold than real rates. This was indeed the case over the past 20 years.

Part of the reason why recession risk worked so well was that real rates struggled to increase in a weak growth environment because the Fed was very sensitive to growth risks. Yet we underestimated market’s willingness to give the Fed credit in its ability to drive inflation back to its target….

more at bottomCommodities Markets prices are too low for the Backwardation- What to look for

Something has to give. And if it gives the right way, GS will run the table again. What to avoid while waiting.

Today, equity and commodity markets are signaling to investors more persistent demand and higher commodity inflation, while rates and inflation curves are signaling an impending slowdown and softening of the economy. Until we see real commodity fundamentals soften, we remain convicted of the former, not the latter. We forecast S&P GSCI to rally 23.4% by year end.

During slowdowns when the yield curve is ‘flattening’ into backwardation, commodity markets should be softening into contango. Equally, commodity markets tend to tighten most in the expansion phase of the business cycle, turning into backwardation as future rate expectations rise and the yield curve ‘steepens’ into contango.

more at bottom