Housekeeping: Sunday’s Founder’s Class will be 3 p.m. ET. Zoom Link Here. Topics for discussion here. Founders use usual password please. See you then.

It is a long, dense post intended to be read like a weekend magazine or a Sunday paper. Please note some sections have also changed order.

SECTIONS

Market Summary: weekly recap

Technicals: active trading levels

Podcasts: GoldFix and Bitcoin

Charts: related markets

Calendar: next week

Premium Divider

Precious Research and Analysis

Market research

1. Market Summary

The whole week was more than just a little bit whippy with strong rallies as previously opined here last week. This because the deep selloff 2 weeks prior to the Fed meeting handcuffed Fed to trot out speakers and talk markets back to stability. So volatility increased until about Thursday after noon

The lunatics controlled the asylum until Wednesday 2:30. After the Fed made their decision and broke their silence at that time, the crazies went back underground. Markets continued to whip, but on lighter volume. Program traders live for this and took stonks back up to unchanged on the week.

Volumes dried up and market volatility began to subside. Most importantly the “right” markets began to levitate again. There is a split in sentiment now and that is a concern, although not a big one yet.

Recall Friday the markets did an about face and rallied on everyone all of a sudden thinking the Fed wouldn’t hike so much this year. This week started with markets re-rethinking Friday’s happy expectations. Stocks sold off again at first.

This was the news dip-buyers needed to reassure themselves uber-hawkish Powell wouldn't execute on his plan to crush inflation into a recessionary environment. We told you it would be whippy.

Translation: the lower stocks went before the meeting the less chance the Fed would announce a hike simply because they had no way to “talk the markets up” before hand. This means the lunatics get to buy stocks because the Fed will bail them out again even if only temporarily.

We have one word for the dip buyers- stagflation, and it may leave Powell impaled on the horns of an upcoming dilemma. More on that beneath the fold. But things worked out well as they frequently do.

Other good news is that US COVID cases are following the same trajectories at UK and South Africa.

Nasdaq was up 3% Friday (from down 1% pre-open).

The S&P was up 2.5% Friday (from down 1% pre-open).

Russell 2000 closed up almost 2% today from down 2% pre-open.

The Dow, S&P, and Nasdaq finished unchanged on the week

Worst start to a year for the S&P 500 since 1939

Nasdaq is down 5 straight weeks, longest losing streak since 2012

Small Caps are down 22% from their highs

a 25% chance of 50bps hike in March- kills inflation and scares the crap out of people

Data for analysis excerpted from this zerohedge post.

Sectors

Growth stocks were flat on the week as Value was bid

Both Defensive and Cyclical stocks were hammered equally this week

Today's bounce was not really triggered by a short-squeeze as the size of the swing higher is very modest and unsustainable..

Tech and Consumer Discretionary are down hard MTD...

Commodities

Real yields continue to rise (to their highest since June 2020 - but still negative), and have recoupled with gold.

Notably, if real yields keep rising, then valuations are going to come under significant pressure

The dollar soared higher for the 5th straight week (best week since June 2021)

Commodities were very mixed this week with most lower by hawkish tilts (Silver slammed 8% on the week)

Crude rallied on geopolitical tensions

WTI came very close to $89 intraday during the week, its highest since Oct 2014 (up for the 6th straight week in a row)

NatGas went supersonic this week amid chaotic settlement and a new cold front, breaking above the early Jan highs (and up 19%, its best week since Aug 2020)

Bonds

Rate-hike expectations shifting dovishly lower helped send stocks soaring

Credit markets saw very little of the chaotic chop in stocks this week

Treasury yields were extremely mixed on the week with the short-end exploding higher and long-end actually coming all the way back to unchanged

The yield curve was crushed this week, triggered by The Fed's hawkish tilt

Stagflation Fears Will Cause Volatility Until March

Next week companies will resume stock buy-back programs. This, now that the Fed is done, should underpin any strength we get for the next few months. Volatility, to the extent we get it, will be an expression of doubts of that.

To the extent we have continued volatility like last week, we feel it will be largely a manifestation of the increasing fear that the Fed is on the horns of a dilemma. Raising rates is increasingly looking like a policy error. Not raising rates is very seriously looking like an inflation problem.

The Fed jsut cannot afford to have to abandon rate hikes at this time. They must quell inflation. BUT: the fed must also be able to ease rates in the near future to keep pace with China. Recall last week:

No matter what the Fed says and the markets do next week, or next month; if stocks crater slowly, then they will start another QE in 2 years or so. Once inflation looks calmed to them, it will happen again. But if we crater too fast, they will have to do something right away. Why? China is moving counter to our cycle.- Source

Between now and when the Government actually does something, markets are going to do what they do. Traders are going to make things look emotional. Either the Fed solves the problem, the markets solve the problem (forcing the Fed hand), or politics dictates a bad solution. But for now, it is worth looking briefly at what we mean by some of this.

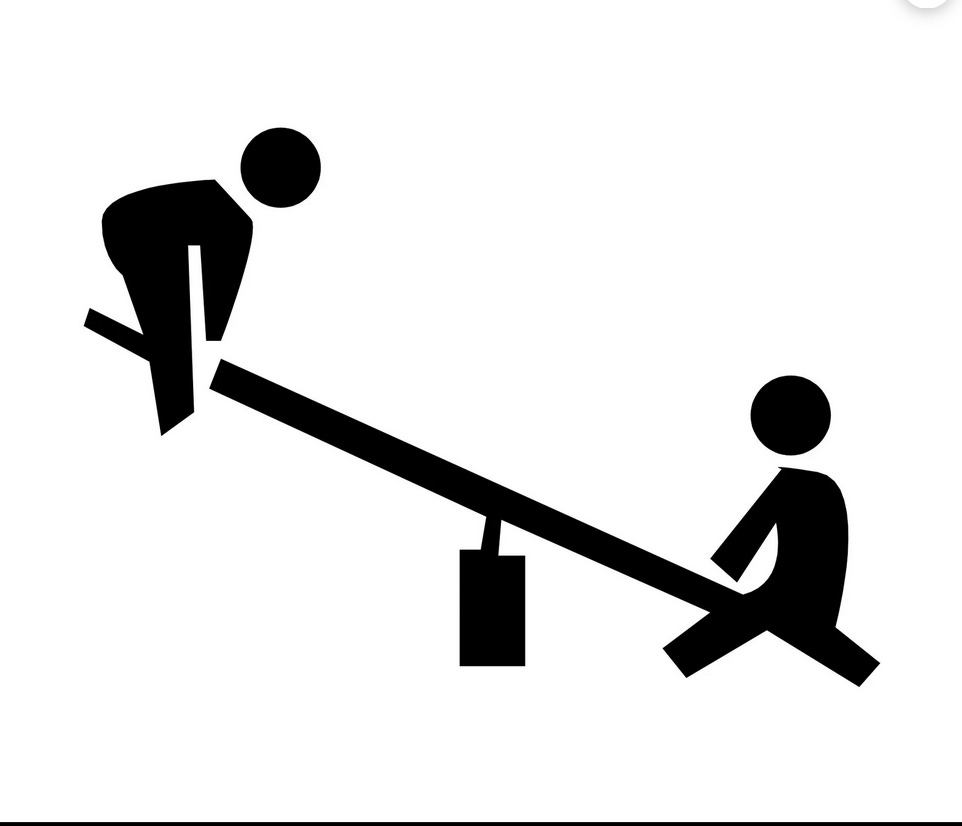

THE YIELD CURVE TEETER-TOTTER

We frequently talk of Bond yields as if they are on a see-saw. Here’s a little more of that concept for your reading “pleasure”.

The following chart depicts the difference in yields between the shorter term bond market and the longer term bond market.

***Continued beneath the fold***

GoldFix Friday WatchList:

Complete Watchlist Here

Crypto Weekend:

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or out of context. Moor sends 2 reports daily on each commodity he covers. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Bitcoin

Energy

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

This past week several GoldFix posts were featured in contributing editor articles on Zerohedge. These three include the best of the podcast analysis on the week broken into shorter clips. For a complete list use the links at bottom of section

"Where's Gold trading? Seventeen-Eighty-F*cking-Five" - Podcast | ZeroHedge

Next Two Countries To Buy Bitcoin Are Friends of China | ZeroHedge

Video: State Street on GLD Outflows and Outlook | ZeroHedge

4. Charts

Nasdaq

Dollar Index

Bonds

Silver

Crude Oil

Gold

Charts by GoldFix using TradingView.com

5. Calendar

Some of the upcoming week’s key data releases and market events

MONDAY, JAN. 31

9:45 am Chicago PMI Jan. -- 64.3

11:30 am San Francisco Fed President Mary Daly speaks

12:40 pm Kansas City Fed President Esther George speaks

TUESDAY, FEB. 1

9:45 am Markit manufacturing PMI (final) Jan. -- 57.7

10 am ISM manufacturing index Jan. -- 58.8%

10 am Job openings Dec. -- 10.6 million 10 am Job quits Dec. -- 4.5 million

10 am Construction spending Dec. -- 0.4%

WEDNESDAY, FEB. 2

8:15 am ADP employment report Jan. -- 807,000

10 am Home ownership rate Q4 -- 65.4

THURSDAY, FEB. 3

8:30 am Initial jobless claims Jan. 29 -- N/A

8:30 am Continuing jobless claims Jan. 22 -- N/A

9:45 am Markit services PMI (final) Jan. -- 57.6

10 am ISM services index Jan. -- 62.3% 10 am Factory orders Dec. -- 1.6%

10 am Core capital equipment orders (revision) Dec. -- N/A

FRIDAY, FEB. 4

8:30 am Nonfarm payrolls (month to month) Jan. -- 199,000

8:30 am Unemployment rate Jan. -- 3.9%

8:30 am Average hourly earnings (month-to-month) Jan. -- 0.6%

8:30 am Labor-force participation rate 25-54 Jan. -- 81.9%

Main Source: MarketWatch