Housekeeping: Anyone who signs up right now gets a free premium week as a trial run. If you get something out of it, pls support it. Thank you. Prices increase tomorrow. Lock it in annually if you like it.

Founder’s Class : 3 p.m. SUNDAY. CoT and Market prep chat. Zoom Link here: Password: (usual one). See you then!

SECTIONS

Market Summary: weekly recap

Technicals: active trading levels

Podcasts: GoldFix and Bitcoin

Calendar: next week

Charts: related markets

Premium divider

Analysis

Research

1. Market Summary

If you believe that the West can craft sanctions that maximize pain for Russia, while minimizing financial stability risks in the West, you could also believe in unicorns.- Z. Pozsar contributing architect to the 2008 GFC bailout

The main drivers of US markets this week were Geo-political events in Europe. It would help to run down global markets to give what is happening in the US context. War, sanctions, and economic isolation may seem like it is working. But in a global economy, it all scales up into something bigger left unchecked.

US equities had a tough week, technically seeing much more volatility than Europeans, chopping up and down 2-3% every day, and unable to hold any gains that were achieved during the pumps.

Nasdaq was the week's biggest loser.

SPACs, ARKK, Unprofitable Tech got destroyed

This is the most fearful the market has been since the lows of March/April 2020 collapse.

The Russian invasion gives the Fed perfect cover to deflate the asset bubble. Therefore we don't expect them to materially do anything to protect against this plunge until the S&P gets to 3800-4000.

Sectors

Energy and Utes outperformed

HY spreads at their widest since Nov 2020 indicative of stock risk

Financials were destroyed

Commodities

see chart section for graphics

Bitcoin managing to cling to some of the post-Putin gains (but fell back below $40k).

Biggest jump in Spot Commodity prices since Sept 1974

Gold saw more safe-haven flows

It's likely no wonder as energy costs in Europe exploded this week to a record high (with EU NatGas trading at an equivalent $370 barrel of oil).

Gas prices at the pump exploded higher this week - the 2nd biggest jump ever - and look set to go even further given the price of crude and wholesale gasoline. Zerohedge Source

Bonds

Bonds were bid on the week

The yield curve collapsed this week

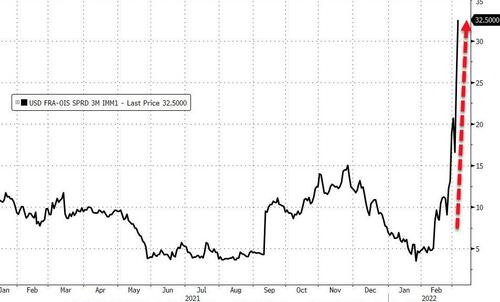

Stresses are starting to show in the financial system with FRA/OIS spreads blowing out

The FRA/OIS spread reflects how comfortable banks are lending money to each other. The reason it is of importance is because a large component of it is European based. It measures how cheap or expensive it will be for banks to borrow in the future as tied to London rates (LiBOR). The higher it is, the less comfortable they are transacting with each other. It is a measure of interbank trust. Right now it is about 50% of the peak we had in March/April 2020.

GoldFix Friday WatchList:

Complete Watchlist Here

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Bitcoin

Energy

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

4. Calendar

Some upcoming key data releases and market events.

MONDAY, MARCH 7

3 pm Consumer credit Jan. $24 billion $19 billion

TUESDAY, MARCH 8

6 am NFIB small-business index Feb. 97.4 97.1

8:30 am Foreign trade deficit Jan. -$87.3 billion -$80.7 billion

10 am Wholesale inventories (revision) Jan. 0.8% 0.8%

WEDNESDAY, MARCH 9

10 am Job openings Jan. 11 million 10.9 million

10 am Quits Jan. -- 4.4 million

THURSDAY, MARCH 10

8:30 am Initial jobless claims March 5 220,000 215,000

8:30 am Continuing jobless claims Feb. 26 -- 1.48 million

8:30 am Consumer price index Feb. 0.7% 0.6%

8:30 am Core CPI Feb. 0.5% 0.6%

8:30 am CPI (year-over-year Feb. 7.8% 7.5%

8:30 am Core CPI (year-over-year) Feb. 6.4% 6.0%

1 pm Real domestic nonfinancial debt (SAAR) Q4 -- -2.8%

1 pm Real household wealth (SAAR) Q4 -- 1.4%

2 pm Federal budget deficit Feb. -- -$311 billion

FRIDAY, MARCH 11

10 am UMich consumer sentiment index (preliminary) March 62.3 62.8

10 am Five-year inflation expectations (preliminary) March -- 3.0%

Main Source: MarketWatch

5. Charts

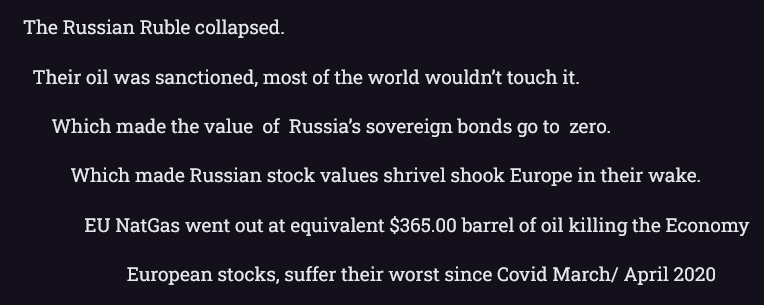

Russian Ruble

European Nat Gas- in oil terms, over $350 dollars

Dollar Index

Gold

Silver

Wheat

Charts by GoldFix using TradingView.com

Zen Moment:

Disclaimer:

Nobody is telling you to do anything here. Anybody who tells you to do something without first intimately knowing your personal situation is irresponsible at best and manipulative at worst. Anyone who acts on other people’s opinions without first doing an inventory of their own situation shouldn’t be surprised if they lose money.

6. Premium: Barrick Gold

Some takeaways of a recent interview Barrick Gold CEO Mark Bristow

They intend to step into Canada aggressively

In 2021, Barrick announced a new joint venture with the PNG (Papua New Guinea) government for the Porgera mine, where the Government will own 51% and Barrick and Zijin Mining 49%.

GOLD is guiding to stable gold output in the 4.5-5.0Moz range for 10 years, with a potential growth spike in 7-8 years.

more below the divider

7. Premium: Analysis

Premium beneath the divider

Technician- Stock Bottoming?

Legendary technician, Goldfix subscribers know him from previous metals reports, lays out why he is not doom and gloom on stocks

Bank- Geopolitics Likely to Add Inflationary Pressure:

Most of what we’ve been reading has been playing down inflation risks form the Russian invasion. This counterbalances that somewhat

Bank- CTA Report for Metals and Oil

Technician- Uranium Technical Thesis and Update, Copper Breaking Out

These are not Goldfix opinions. But we read and note them for our own decision process. We provide, you decide. Sunday Founders discussions are where we comment on the validity of these type of reports