Weekly: Silver CTAs, Dumb as a Stampeding Wildebeest Herd

Plus Goldman Sachs on Inflation and Russian Nat Gas Disruptions

Goldman on last week’s PPI, and Nat Gas cutoffs. We run down Gold correlations, and Silver stampedes.

UPDATE: we just found out it’s spelled WILDEBEEST… ahhhh

Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. This post is more like a magazine. Content touches many areas of markets. The index may help.

Founder’s Class : preview link here

SECTIONS

Market Summary

Technicals

Podcasts

Calendar.

Charts

Premium divider

Analysis

Research Recap

1. Market Summary

Could it be that stocks finally bottomed Thursday?

Equities rallied to end the week after a gruesome performance Monday to Thursday. This was the longest negative stretch since 2008. The S&P has dropped 10 of the last 14 weeks.

Several factors look good. To summarize: Longs are not panicking (options say this); China Covid seems to be easing; and Fed speakers were not so brutal (Powell) for a change.

H/t Newsquawk and Zerohedge for data and graphics

While it's probably too early to call it the end of the bear market we could be at least ready for a bounce. Some Wall Street strategists were hopeful:. Here’s one:

“There was a sense of calm in the markets, but again without any fundamental news to suggest this is perhaps the bottom,” wrote Fawad Razaqzada, an analyst at City Index and FOREX.com.

The sense of calm alluded to above is no doubt a function in part of the aggressive hedging before the selloff actually happened these past two plus months. Options behavior suggests that there will not be a panic low. Why? It seems that many institutions had hedged for this possibility by buying puts. Which means they have not been sellers of stock in the downdraft.

Professionals bought puts on the way down in anticipation of the rate hikes and are seemingly sanguine about risk right now. We’d think that there will be shorts covering positions if the market peeks above 4000 for any length of time.

Still this does not imply the downside is done. It does imply that the smart money is acting smart for a change. Which then suggests that a rally, if it comes, could be wicked because hedged longs are patient longs.

So who is selling this other than retail? Speculative short sellers, who can and frequently do get their faces ripped off on seemingly no news. Now imagine if there is relief from the Ukraine. Then we’d be talking.

Powell also reiterated his support for raising rates at the June and July policy meetings but reassured that bigger hikes are off the table for now. That’s good for bulls.

Stocks and Bonds have come off enough these past 3 months for Jerome to stop talking like Volcker. plays right into the concept discussed here in reference to Zoltan’s call to arms on volatility last month

While we are not betting, if we were forced to, we’d say the stock market should be higher Monday. The clincher for us was stocks being up with oil ripping higher again on Friday. If that couldn’t put a damper on equities, then it may be clear sailing for a day or two.

Final comment: how annoying is it that the Fed behavior is all that moves the market anymore? Once upon a time we studied companies, earnings, and industries. Now it’s all about monetary policy. Everything is up or everything is down.

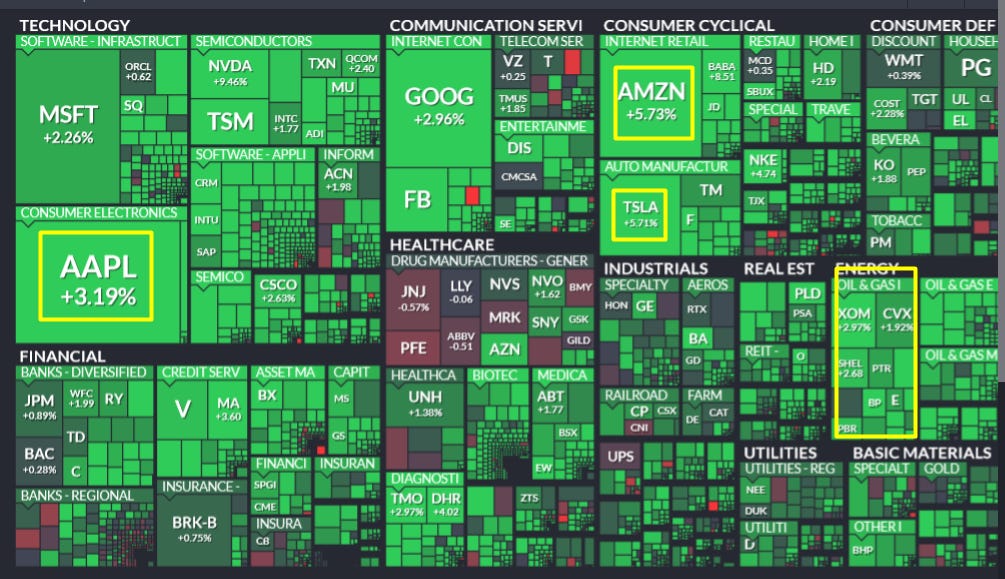

Sectors:

Friday

The Week

Commodities:

Gold extended its recent plunge and closed at the lowest level since February. More on that below

Silver had been lower 17 days straight. More on that below as well.

Crude oil, gasoline diesel, prices again rallied hard on optimism from China's COVID situation

Oanda notes, "the crude demand outlook is not going to fall apart as the US enters peak driving season and as European air travel remains solid. The focus for much of the week has been on the EU’s inability to reach agreement on a Russian oil ban, which suggests we won’t have an immediate shock to the oil market."

Dollar to its highest level since the pandemic panic March 2020 scramble

Bonds:

On the week, bond yields were lower slightly, but started creeping back up on Friday. The back end continues to go higher as a deterrent to mortgages, house prices, and stock prices in general. The market is no longer in danger of inverting right now. It is in “bear steepening” mode. And we think that is what the Fed wants to happen between now and the next rate hike.

Crypto:

There was some much needed stability on Friday in cryptos; which suffered their worst week in years. The Terra and Luna algo-stables imploded, leading to tens of billions in losses in what can be called a peg attack not unlike past ones on British Sterling, various LATAM currencies in the 1990s and Asian currencies in 1997-1999.

The attack was characterized as an isolated incident. But Tether, had a hiccup as well.

Insert DoKwon here

GoldFix Friday WatchList:

Complete Watchlist Here

2. Technical Analysis

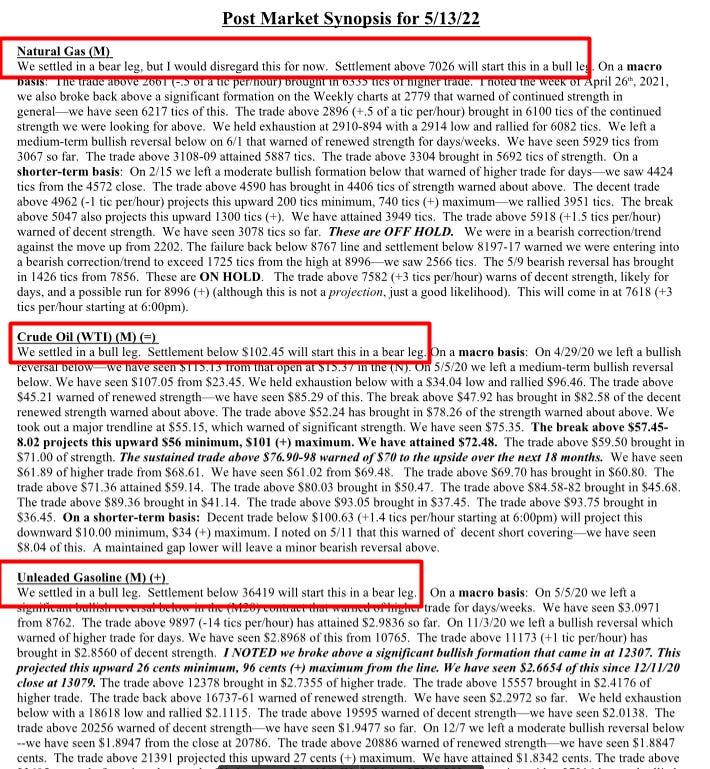

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

More GoldFix Broadcasts HERE

More Bitcoin Podcasts HERE

4. Calendar

Some upcoming key data releases and market events

MONDAY, MAY 16

8:30 am Empire state manufacturing index May--24.6

TUESDAY, MAY 17

8:30 am Retail sales April--0.8%

8:30 am Retail sales excluding vehicles April--1.5%

9:15 am Industrial production index April--0.9%

9:15 am Capacity utilization April--78.3%

10 am NAHB home builders' index May--77

10 am Business inventories (revision)March--1.9%

WEDNESDAY, MAY 18

8:30 am Building permits (SAAR)April--1.87 million

8:30 am Housing starts (SAAR)April--1.79 million

8:30 am Philadelphia Fed manufacturing index May--17.6

THURSDAY, MAY 19

8:30 am Initial jobless claims May 14--N/A

8:30 am Continuing jobless claims May 7--N/A

10 am Existing home sales (SAAR)April--5.77 million

FRIDAY, MAY 20

8:30 am Advance services report Q1

Main Source: MarketWatch

5. Charts

Gold

Silver

Dollar

Oil

Bonds

Wheat

Charts by GoldFix using TradingView.com

6. Analysis

Gold and Stocks. Reality check

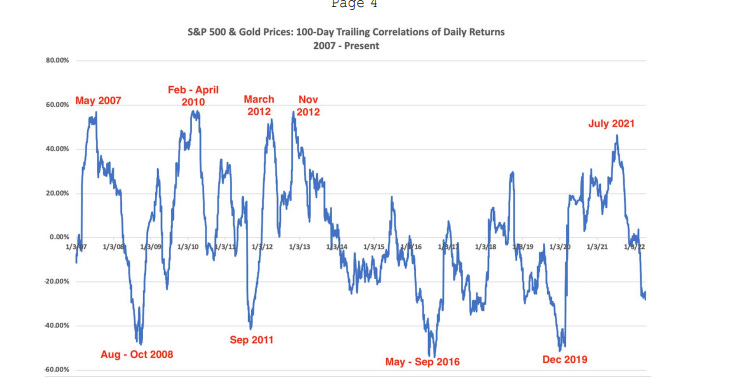

The correlation of gold prices to US large cap equities (S&P 500).

Historically post the GFC, Gold's counter relationship with Stocks gets to about negative 40% before regressing to the mean. That mean it’s basically zero on average. ( 1st graph)

But that average of zero varies widely based on events (2nd graph)

Since the GFC: Gold has not net-net been a diversifier. It has moved with stocks. This is in no small part from QE we imagine.

Gold as a hedge of equities had been destroyed by QE. Lets see how it does in QT

Gold and Stock Correlations.

A few data points to set the stage:…

Premium continues below this line