Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. It is more like Barron's used to be. Content touches many areas of markets. The index may help.

**Founders class: taking the day off. We will do a spaces on twitter this week to discuss the JPM/ CITI Gold positions in a Q&A format. look for info in this space or on twitter

SECTIONS

Market Summary: Commodity commentary**

Technicals: Special Gold Comment**

Podcasts:

Calendar:

Charts:

Analysis: JPM Owns A lot Of Gold Derivatives

Research: Gold, Mining Stocks, Oil, and more**

1. Market Summary

Stocks were strong (despite European selling) almost entirely on the back of recession anxiety which would imply the Fed backing off rate hikes. But bonds acted like the Fed would continue hiking. Chalk it up to position shuffling for now.

Like most things post Covid, data is also bifurcating like the letter ”K”. Friday’s Payrolls headline print was very strong, and unemployment remained stable yet the household survey was very ugly. See chart below. Overall that data has to be interpreted as bearish for stocks as it at least tells the Fed to keep the brakes on money supply. But stocks are ignoring data as well as Eu selling pressure. Next week is a big week with 9% CPI possible as well as retail sales.

This two week period starting July 1 is the 'most bullish' period of the year for stocks historically also. Seasonally stocks are a buy, and the market is daring the Fed to announce even more tightness. No news will be good news next week we bet.

H/t Newsquawk and Zerohedge for data and some graphics.

Sectors:

Nasdaq led the charge higher on the week

Nas. closed higher for its 5th straight day Friday - its longest win streak since Nov 2021.

Cyclicals dominated off the opening Tuesday to end of week

The S&P 500 closed just a little bit lower Friday breaking its 4-day win streak

This is the 7th Payrolls day of the last 8 that the S&P has closed lower.

Energy stocks had an ugly week.

Defensives/ Utilities ended the week around unch

Value has fallen to its weakest relative to Growth in 2 months.

Cathie Wood must be breathing a sigh of relief

Commodities: Watch Oil

The best explanation for stocks rallying while commodities were weaker for us is this: Commodities are not weaker from US recession fears. That implies Fed rate easing and like stocks, they’d rally. What makes more sense is the growing influence of China’s (lack of) demand being felt due to their still lagging ability to get out of their current slowdown. Finally, as stated several times, it is about oil. And that means geopolitics is having an effect on all commodities now.

Every commodity sold off last week, only oil had the temerity to bounce at all. (Nat Gas doesn’t count.. its an EU commodity now). When commodities like copper and silver sell off and also bounce with oil right now, look out, China is back. But as long as they keep smashing Oil and everything else with paper, and oil keeps bouncing without the other commodities following, be careful.

Looking at commodities empirically, they were too high relative to stocks maybe. More conspiratorially, (European) funds are closing longs from Q2 hits on equities. In the research section below, you will see that Goldman and JPM are still bullish on Oil and Gold. We don’t know if that is a good thing given their history.

Beware Researchers Bearing Gifts

Goldman has been on absolute fire in Oil for over a year. JPM has drafted well on them. Anyway, the banks are telling you to buy the commodity dip. We don’t know if they mean it, or are looking for bag holders for their own positions.

At beginning of rallies we trust these reports as they are beating the ground for their clients to get onboard. We noted this for premium subscribers in November last year in Gold, and then again in Gold in February.

At end of rallies, however, we historically do not. Sometimes we get a super spike that ends lower a month later. Sometimes the recommendation falls out of bed. It is hard to play this way *after* sustained rallies.

The recent JPM $380 oil spike report was based on excellent analysis, but the headline was designed to scare shorts in our opinion. And what did oil do last week right after this report came out? It opened Sunday night strong. But that monday in the US….whooosh for the day.

We have a sneaking suspicion that oil rallies are going to get sold harder as election comes along and we are biased bearish (we were short and profitable 2 weeks ago on this hypothesis), but are reticent to sell flat price this time with spreads remaining so ridiculously strong.

We need a sign from something else and then we will use chart levels to put another trade on. And lets face it, the JPM $380 report caused us to pause in our bearish bias and miss a huge selloff. See how that works? The banks are bastards, lol!

Commodities crushed - want to say rate hikes coming, but its more like geopolitical machinations starting to take hold.

The Bloomberg Dollar Index rose for the 5th week in the last 6 to end with its highest weekly close since the safe-haven spike in March 2020

Oil fell for the 3rd week of the last 4 but WTI bounced back above $100 to close the week

EU NatGas which exploded higher

Bonds:

Dollar up strong - strong enough economy relative to Europe (Fed 'hawkisher' than ECB)

Bonds crushed - strong enough economy, inflation-fighting Fed hawkish

Payrolls headline strong BUT household survey ugly - so is the economy 'strong enough' or a shitshow

The yield curve (2s10s) inverted once again.

Crypto:

Cryptos had a big week with Ethereum leading the charge, up 15%

Ethereum topped $1200 and Bitcoin rallied back up to $22,000

FTX continues to signal it is the whale that will both destroy and rescue those it has destroyed.. kind of like a Wall street bank.

2. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

GoldFix Note: Do not attempt to use price levels without symbol explanations or context. Moor sends 2 reports daily on each commodity they cover. The attached are non-actionable summaries.

Gold

Gold closed well below $1800 for the week, with almost all of the sell pressure occurring during European hours (notable because they also sold stocks then as well). We are not saying it has to rally now. But we are saying if you are short, you are now vulnerable to what happens when Europe stops selling and getting front run by US banks.

Further, Michael Moor indicates that one of his major bear structures is within shouting distance of petering out. As this is gold, historically it bases before rallying if this is in fact the bottom area. We bought very small silver expressed in SLV for a macro trade last week with no immediate target in sight, and are looking to buy Gold on Silver strength for day trading.. But typically, we do not buy dips as day traders.

TECHNICALLY BASED MARKET ANALYSIS AND ACTIONABLE TRADING SUGGESTIONS Moor Analytics produces technically based market analysis and actionable trading suggestions. These are sent to clients twice daily, pre-open and post close, and range from intra-day to multi-week trading suggestions. www.mooranalytics.com

Energy

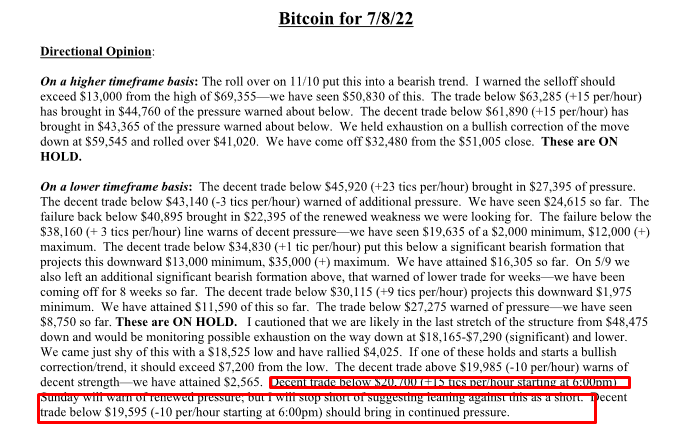

Bitcoin

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

3. GoldFix and Bitcoin Podcasts

GoldFix Broadcasts HERE

Bitcoin Podcasts HERE

4. Calendar

Some upcoming key data releases and market events

MONDAY, JULY 11

11 am 3-year inflation expectations June -- 3.9%

2 pm New York Fed President John Williams discusses move from LIBOR

TUESDAY, JULY 12

6 am NFIB small-business index June 93.0 93.1

12:30 pm Richmond Fed President Tom Barkin speaks

WEDNESDAY, JULY 13

8:30 am Consumer price index (monthly) June 1.1% 1.0%

8:30 am Core CPI (monthly) June 0.5% 0.6%

8:30 am CPI (year-over-year) June 8.8% 8.6%

8:30 am Core CPI (year-over-year) June 5.7% 6.0%

2 pm Beige book 2 pm Federal budget (vs. year-ago) June -- -$174 billion

THURSDAY, JULY 14

8:30 am Producer price index final demand (monthly) June 0.8% 0.8%

8:30 am Initial jobless claims July 9 234,000 235,000

8:30 am Continuing jobless claims July 2 -- 1.38 million

11 am Fed Gov. Chris Waller speaks

FRIDAY, JULY 15

8:30 am Retail sales June 0.9% -0.3%

8:30 am Retail sales excluding vehicles June 0.5% 0.5%

8:30 am Import price index June 0.7% 0.6%

8:30 am Empire state manufacturing index July -1.0 -1.2

8:45 am Atlanta Fed President Raphael Bostic speaks

9:15 am Industrial production index June 0.1% 0.1%

9:15 am Capacity utilization June 80.5% 80.8%

10 am UMich consumer sentiment index (preliminary) July 50.2 50.0

10 am UMich 5-year inflation expectations (preliminary) July -- 3.1%

10 am Business inventories May 1.2% 1.2%

Main Source: MarketWatch

5. Charts

DX: keeps rallying on Europe pain

Gold: Washes on inflation fears receding and EU liquidity crunch

Silver: punished early on by CTAs selling more on back of copper

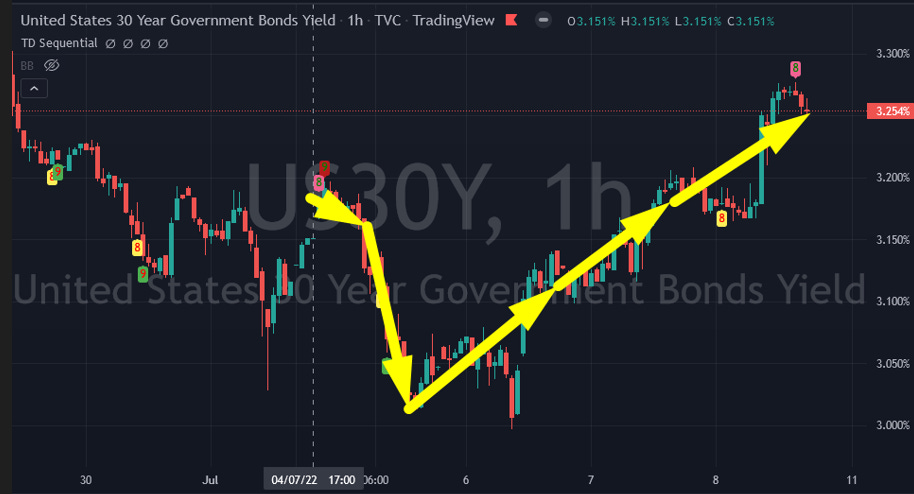

Bond Yields: climbed all week, tough call on why

Oil: Washes out post the JPM $380 fear call, then recovers some

Nat Gas: whipped on LNG issues, rallies again on EU demand

Wheat: no love on the Russian Ruble news. Recovers like crude, but stronger

Bitcoin: Short covering, and a week without any new bad news

Charts by GoldFix using TradingView.com

6. Analysis: Gold

7. Research: What is Money Really?

“The broad cultural ramifications of the nature and significance of money are to be seen in the movements that lead money towards its pure concept and away from its attachment to particular substances. Thus, money is involved in the general development in every domain of life and in every sense strives to dissolve substance into free-floating processes. On the one hand, money forms part of this comprehensive development; on the other, it has a special relationship with concrete values, as that which symbolizes them. Furthermore, money is influenced by the broad cultural trends, and it is at the same time an independent cause of these trends.” - George Simmel, The Philosophy of Money (1900)

Today we included 3 Goldman missives on Gold, 2 of which prem. subs have seen before. For us they are interesting because Goldman is not backing away even in the sell off. While that makes it far from a lock we would mention that they are very good in commodities now, and their last "stubborn" call was oil was a buy after the last 2 violent dips. So maybe they are on to something.

We find the most recent report (What Will It Take...) an echo of the June 14th one on Gold as a Wealth/Fear trade. and included it as well for comparison.

What Will It Take For Gold To Shine Again- excerpt

Gold to $2500 from last week (prev)

Gold: Fear/Wealth Gold trade in June (prev)

Money Forecast Letter

TD on the data week ahead

Stifel on Ca Mining Stocks

Week in China

Continues at Bottom