Visualizing the Cost of Europe’s Energy Crisis

PLUS: WHAT TO LOOK FOR IN A BOTTOMING STOCK MARKET

What is the Cost of Europe’s Energy Crisis?

Submitted by Goldfix with additions; Authored by Elements

Much like the US experienced an Oil-instigated trade shock in the 1970s, Europe is experiencing a classic “negative trade shock” in no small part due to their (self inflicted) Natural Gas crisis where: all prices goods are rising, currencies are weak, current-account positions are deteriorating, and real incomes are under enormous pressure. Meanwhile, the region’s central bankers are merely focused on the “nominal effects” of this adjustment. But the knock-on effects could devastate Europe for a decade, much like the Oil crisis destroyed the US for years. Without Russian gas, Europe will need a reduction in energy demand of at least 15-20% based on average temperatures for this year alone.

What follows is a summary of the risks, the costs, and ramifications of the current situation in the EU.

Europe is a Mess

Europe is scrambling to cut its reliance on Russian fossil fuels. With Putin cutting the region’s access to Russian gas, Europe is facing a difficult winter. Utility bills are set to soar, as energy providers raise their prices and seasonal demand increases. Outright shortages, power cuts and sectoral “lockdowns” are all possible. And- Even if there are sufficient supplies for the winter – which is uncertain – the energy squeeze could return in 2023.

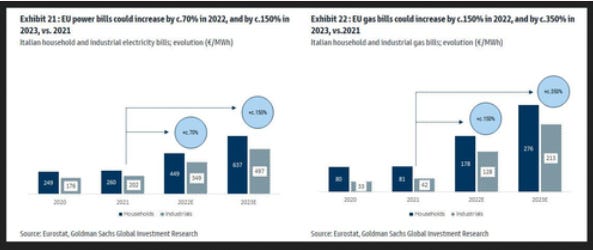

Utility Bills Are Exploding in the EU...

Source- Zerohedge Europe's Nightmare Scenario Comes True:

As European gas prices soar eight times their 10-year average, countries are introducing policies to curb the impact of rising prices on households and businesses. These include everything from the cost of living subsidies to wholesale price regulation. Overall, funding for such initiatives has reached $276 billion as of August. With the continent thrown into uncertainty, the above chart shows allocated funding by country in response to the energy crisis.

The Energy Crisis, In Numbers

Using data from Bruegel, the below table reflects spending on national policies, regulation, and subsidies in response to the energy crisis for select European countries between September 2021 and July 2022. All figures in U.S. dollars.

Germany is spending over $60 billion to combat rising energy prices. Key measures include a $300 one-off energy allowance for workers, in addition to $147 million in funding for low-income families. Still, energy costs are forecasted to increase by an additional $500 this year for households.

In Italy, workers and pensioners will receive a $200 cost of living bonus. Additional measures, such as tax credits for industries with high energy usage were introduced, including a $800 million fund for the automotive sector.With energy bills predicted to increase three-fold over the winter, households in the U.K. will receive a $477 subsidy in the winter to help cover electricity costs.

Meanwhile, many Eastern European countries—whose households spend a higher percentage of their income on energy costs— are spending more on the energy crisis as a percentage of GDP. Greece is spending the highest, at 3.7% of GDP.

Utility Bailouts

Energy crisis spending is also extending to massive utility bailouts. Uniper, a German utility firm, received $15 billion in support, with the government acquiring a 30% stake in the company. It is one of the largest bailouts in the country’s history. Since the initial bailout, Uniper has requested an additional $4 billion in funding. Not only that, Wien Energie, Austria’s largest energy company, received a €2 billion line of credit as electricity prices have skyrocketed.

Deepening Global Crisis

Every macro forecast for Europe – and, indeed, most recent projections for the wider global economy – has included some variant of the phrase “assuming Europe’s energy crisis doesn’t get materially worse”. This assumption was crucial for maintaining even a mildly constructive view on the region because it meant Europe would be able to make it through the winter without a serious economic crisis.

It's Worse than the 1970's now...

What does Europe's energy crisis mean for the rest of the world? As we have seen, countries with a strong degree of energy independence – such as the US – are less exposed to the direct consequences of the crisis. While the aggregate energy bill has increased in the US, it has clearly decoupled from the situation in Europe and remains well below the level seen in the 1970s. But big energy importers, particularly in the developing world, are in a far more precarious situation. The immediate risk is that shortages during the winter will force European suppliers to bid up the price of LNG and other energy resources in global markets, which would have serious knock-on effects elsewhere.

Is this the tip of the iceberg? To offset the impact of high gas prices, European ministers are discussing even more tools in early September in response to a threatening energy crisis. To reign in the impact of high gas prices on the price of power, European leaders are considering a price ceiling on Russian gas imports and temporary price caps on gas used for generating electricity, among others.

Price caps on renewables and nuclear were also suggested. Given the depth of the situation, the chief executive of Shell said that the energy crisis in Europe would extend beyond this winter, if not for several years.

Bottom Line

Putin’s blockade of Russian natural gas has awakened a major sleeping risk for the European economies. Utility bills were always set to balloon during the winter, but now there are likely acute energy shortages. The outcome depends on forces outside policymakers’ control – namely, winter temperatures and the ability of the private sector to reduce its energy consumption.

Without Russian gas, Europe needs to consume 15-20% less energy. Unfortunately, even if Europe avoids blackouts and partial lockdowns, supply conditions are set to remain tight through 2023, producing a multi-year crunch. Governments are, of course, under enormous pressure to address the situation, which is why they are scrambling to provide liquidity to utility companies, send cash to households and businesses, and even cap retail energy costs.

The cost to the public finances is likely to be huge (at least 5% of GDP per annum), several multiples of what governments have announced so far. Yet it is not clear the authorities can avoid these actions. Without a massive support program, Europe faces an economic crisis as bad as the one the region successfully dodged in 2020, at the start of the COVID pandemic: households would slash their discretionary spending and many companies – particularly SMEs – would face bankruptcy. Inevitably, a large easing in fiscal policy complicates the task of central banks, which are focused on the inflationary consequences of the crisis. “Terminal rates” would drift higher, allowing the ECB and the BoE to continue raising interest rates to levels that seemed unthinkable less than six months ago. Europe’s “policy mix” is shifting in a decisive way, which is another reason to think the long macro “supercycle” has reached a major inflection point.- via TS Lombard Original Elements Post

S and P Technicals

MS: what to look for in a bottoming stock market