Bridgewater

Compounding wealth in a future that looks very different from the recent past.

The world is changing quickly, and the future looks likely to be very different from the recent past. In this special edition of Connecting the Dots, I want to share our thoughts on an approach that is designed to help investors reliably compound their wealth.

To build and protect wealth, I believe in crafting a resilient portfolio—without playing defense. One of the biggest insights that has driven my investment decision making over the past four decades is that you don’t need to bet on knowing how it will all turn out. Investing wisely is about preparing for a range of outcomes: you don’t need to give up on equities, retreat to cash, or go into a defensive crouch. Instead, you can shift some of your capital from equities to diversifying investments that can cushion you if and when stocks experience a drawdown.

Below, I’m sharing with you our latest research on the shifting environment and how to navigate uncertainty, including through Bridgewater’s All Weather approach. I hope you enjoy.

Investing in a New World:

Capturing Opportunity and Weathering Uncertainty

US equity investors have experienced an extraordinary run. Now the world is changing, with new variables at play, from the AI boom to Trump presenting distinct opportunities and challenges. How can investors position to continue capturing great returns, given the wide range of ways the world could play out? This paper explores these questions and introduces Bridgewater’s All Weather® approach designed for investors seeking to reliably compound their wealth.

I. Perspective on the Extraordinary Investment Environment We’ve Been In, and What Might Lie Ahead

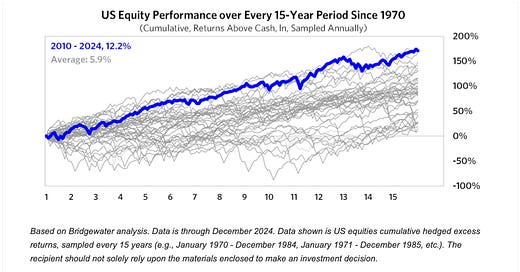

Out of any 15-year period to be invested in equities dating back to 1970, the one we’ve just lived through was the best. Stocks (especially US stocks) have been on a relentless tear, with any dips quickly fading into memory. Returns have been more than double the average. This run-up has enriched investors greatly. How can investors lock in gains and continue to capture great returns as the world evolves?