Super-Backwardation: Cushing hub still weeks away from effectively running out of crude despite SPR

We are still pretty close to scraping operational bottom of the Cushing barrel

Housekeeping: Moor Technical excerpts at Bottom

TL; DR

From the below analysis we can infer:

Cushing inventories are the best measure of supply risk in US Oil

Cushing is lower now than when SPR releases started

Neither is Midland Texas Oil (which feeds Cushing) based on export data and Basis spreads.

When SPR stops releasing, there may not be much (any?) Midland oil available for Cushing refilling.

If Cushing does not get topped off as SPR draws stop, further political machinations aside, the risk on both spreads and flat price could be what JPM had called a “Super-Backwardation” event

The problem we had when SPR draws began last year is still with us, and it is a matter of time until the Oil industry starts paying closer attention to Cushing as it did before the SPR releases started.

Have We Forgotten About Cushing?

Contributions VBL

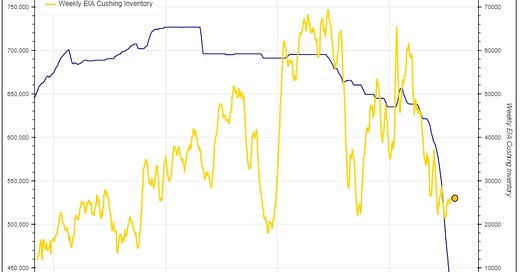

US Cushing inventory has, and continues to impact WTI prices and spreads. However, this bedrock relationship has been somewhat neglected by unprecedented releases from the US SPR this year. Our interest today is in putting that Cushing-WTI relationship in perspective again to see if here are any differentiating clues as to the ongoing supply situation.

Why Cushing Matters

Cushing measures the day-to-day supply/demand balance. The SPR historically has been used as a backstop in emergencies, or disruptions to the day-to-day balance caused by weather, infrastructure or politics. This year, while it is technically an emergency, the SPR use has been much more in both volume and scheduled regularity than the usual temporary crutch for inclement weather.

Due to the release of 180 million barrels this year from the SPR (to combat the impact caused by the Russia/Ukraine conflict), Cushing inventory reports have largely taken a back seat as a headline story to those released SPR barrels. After all, SPR storage (with a max capacity of 714mm barrels) dwarfs Cushing's 76.6MM barrel max capacity, and therefore has potential for a much larger effect on price from incoming oil. But our focus is on the fact that while the SPR gets drained, Cushing is not getting topped off. This leaves the SPR to do the lion's share of the work.

Toward that end, it's time to remind ourselves of the importance of the Cushing hub in the US:

As the delivery point for the NYMEX Light Sweet Crude contract, Cushing is a focal point of the most actively traded crude oil contract in the world.

The storage tanks in Cushing, Oklahoma, require a minimum level of oil to maintain normal operations, which traders generally believe is around 20 million barrels.

Cushing’s inbound and outbound pipeline capacity is well over 6.5 million barrels daily, hence why it is called the Pipeline Crossroads of the World.

Cushing's drop started prior to SPR release acceleration; Yet SPR supply has not stopped Cushing's hemorrhaging.....

SPR is Not Helping At All

As of October 14, the SPR now stands at 405 million barrels after releasing some 190mm barrels since the start of the year. Last Wednesday, Biden authorized another 15 million barrels be released, leaving open the possibility of further withdrawals in the upcoming months. However, minimum legal requirements tell us that, the US has, at best, another 100 million barrels that they can release into the market before legal minimums set in.

Yet even with a massive utilization of the reserve, the Cushing inventories stand lower (at 27mm barrels) than they were when the SPR selling started. Worse, according to trader's takes as well as news media analysis back when Cushing was a headline darling, we are pretty close to scraping operational bottom below 20MM Cushing barrels.

Where is All That Oil Going?

Which leads us to ask: if no oil is going into depleted Cushing storage, where is this SPR oil going? It's being refined locally or exported is the answer. It is being consumed, not stored commercially. Therefore, the correlation between prices, spreads, and SPR inventory has not been conclusive.

What IS conclusive though, is the long-standing relationship between Cushing inventory and market direction. It is a reliable relationship that seems to have been forgotten, but needs to be addressed.

Background: When Cushing was In Focus

Weekly EIA Cushing inventory stats used to be the bellwether for market direction. However, this year's SPR releases have muddied the waters and shifted the focus away from the actual inventory we have commercially available.

To remind ourselves of the importance of Cushing inventory drawdowns, let's look to some historical reference in articles past. In October of 2021, Seeking Alpha ran an article with the headline "Cushing hub could be weeks away from effectively running out of crude" in which they stated:

" Bloomberg analysis explains that the Cushing storage tanks require a minimum level of oil to maintain normal operations, which traders estimate at ~20M barrels, but stockpiles have dropped by more than 4M barrels in two weeks to 31M and likely will keep falling fast due to soaring, pent-up demand all over the world."

The article went on to further state that: "J.P. Morgan analysts say Cushing could be just weeks away from effectively running out of crude, based on current rate of draws, which could cause WTI spreads to spike to record highs in a "super backwardation scenario."

Fast forward a year and Cushing inventories are even lower, at 26.2M barrels. Yet we don't hear a peep about 'running out of crude at Cushing' because all the focus has turned to the SPR. Maybe it doesn’t matter? Turns out it does.

So what is the relationship between the SPR and Cushing?

The Cushing SPR Relationship

Currently, Cushing inventory stands at 26.2 million as of October 14, 2022. Note in the charts above and below Cushing inventory levels are LOWER now than they were when the above article was written. Hence the question about where the oil is going.

So far we have established that SPR drawdowns are not benefiting Cushing inventories ostensibly. The argument can be made the SPR use is slowing Cushing draws and they would be much bigger had we not used the emergency oil. But the sheer volume of emergency draws is large, and it is slightly alarming that Cushing, the normal day to day storage facility, has not yet been topped during these events.

As mentioned above, Cushing inventories are closely (inversely) correlated to both market direction and calendar spreads (aka, storage spreads). Here's a finer point on that to consider.

Cushing Supply and Price

If we were to ignore SPR draws and focus once again back on Cushing inventories we see those correlations have held true. Here is a graph showing that storage against the M1/M3 spread for clarity with that Oct 2021 article date marked off for measure.

The inverse correlation between Cushing and Spreads remains strong....

Spreads are significantly stronger in line with what you'd expect given the Cushing depletion. While we may not have super-backwardation yet, we certainly have spreads obeying the supply side fundamentals more than the SPR oil "printing" side.

If you feel spreads are sticky, then here is your proof. Spreads are mirroring Cushing still, not SPR info. That is indicative of a market not quite comfortable with Cushing inventories, even if many analysts continue to focus on SPR graphs with eye-popping slopes headed to zero, but still just measure known events. The unknown remains Cushing and the day to day when this drawdown is all over.

Strong relative spreads are a real measure of the uncertainty that some participants feel in getting their oil 30-60-90 days from now, and reflects their willingness to pay for that convenience premium to run their businesses. These participants aren't looking at how much oil is being released; they are looking at how much they can get their hands on.

Another trip down memory lane from March 2015 also reminds us of how inventory levels at Cushing also inversely correlate to flat price. In this case, Cushing inventories were increasing which drove flat price lower.

"Crude stocks at Cushing have continuously been rising since October 2014 when stocks were close to ~19 million barrels. This week, stocks at Cushing increased 2.3 million barrels (or MMbbls) to 51.5 million barrels."

....As does the relationship between Inventories and Flat Price

The point of the above two charts is this: Whether up or down markets, the relationship between WTI flat price and M1/M3 spreads are both strongly inversely correlated with the inventory in Cushing Ok.

It has been said that Cushing's importance to the market has waned in recent years as producers send more inventories to the U.S. Gulf for export, but it is still robust and a far better proxy for US traders than SPR draws which are regular and knowable.

Domestic prices are tied to how much oil we actually have during supply shocks, not how much we send overseas. Clearly we have less because we are sending more but the point is: the SPR is not such a big driver of price in the short term. More so based on the fact that none of that SPR is getting to Cushing.

Demand Pull for Midland’s Oil Keeps Cushing Low

So if it isn't going to Cushing, where is it going? And, what will happen to spreads and flat price when SPR releases end using the Cushing levels as our guide? We know that production is not yet increasing. Given the location of the US SPR storage sites, namely along the US Gulf Coast, this oil is either being consumer locally or exported.

Cushing vs SPR locations. Shorter to Europe form SPR than from Cushing…

The Russian invasion of Ukraine has boosted the world’s demand for US crude, and traders are acknowledging that more oil is being rerouted from Cushing to the Gulf Coast for export. Exports were up to 4.1 million barrels per day for the week of October 14 which is well above this year's average of 3.4 million barrels per day. Stockpiles now stand at roughly 26% of capacity.

Typically this would cause Texas Midland oil to trade at discount in order to attract more barrels back to Oklahoma and solve the shortage. But that is not the case. And this further confirms that Cushing is driving spreads and price.

Satellite Analysis of Cushing Confirms Fears

Storage tanks in Cushing are notable for their floating tops. Satellite imagery is often used to measure the shadows and use a mix of trigonometry and geometry in order to determine just how full the tanks are. The lower the level of the tank, the longer the shadow cast from the wall to the top of the tank. This is how people are able to keep a finger on the pulse of supply.

Lately, the shadows on the tops of the floating storage tanks have been long. While just 2 years ago we were staring down the (full) barrel of an oil glut, we are now in the midst of a potentially problematic shortage.

Midland versus WTI-Cushing

Midland crude is trading at more than a $2.00/bbl premium to Cushing barrels alluding to the fact that more people are taking oil straight out of the Gulf Coast. This implies that the situation may actually get much worse before addressing the supply issues.

Put simply, the Midland (SPR) Oil is not sitting around in a parking spot. If it were, Midland would be trading much lower than it is relative to Cushing. Even the spread between WTI and Brent is working against domestic storage.

The basis between Texas and Cushing is not reflecting the drawdown in SPR. Specifically as noted in the spread between ICE Midland WTI American Gulf Coast and ICE WTI at Cushing. The ICE Midland contract represents US crude production with a delivery point in Houston deliverable into the MEH and ECHO terminals. Midland premiums relative to Cushing have been increasing this year due to external demand.

Midland Price Premiums mean no Oil for Cushing...

Not only are individual monthly spreads increasing, so is the spread on a calendar strip basis.

This suggests that the pull for exports is stronger than the pull for domestic storage. Even though Cushing inventory levels have stabilized at lower levels, this is largely due releases from the SPR muting the issue. SPR releases have limited the impact of exports on Cushing inventory levels.

So, how are we going to get oil back into Cushing? How are these levels going to fare once SPR releases slow and/or simply are used to combat the occasional price spike? What about when or if SPR inventory begins to be replaced by outright purchases in the open market?

Bottom Line

If you believe Cushing inventory levels have been held at bay this year due to US SPR releases, then it should be something to consider going forward when these releases come to an end. Where is the oil going to come from? Midland/WTI spreads should tighten and WTI calendar spreads should strengthen.

We saw perhaps our first glimpse of this dynamic in last week's EIA data in which weekly SPR releases slowed (to 3.6M barrels, compared to 6.5M per week average over the last 5 months) leading to a commercial inventory draw of 1.7M barrels.

Speculatively speaking: if the market is somewhat lulled into thinking we can print oil forever, and the Fed tightening has deterred domestic fund long spec positions (it has) without really stopping the inelastic needs of real energy users (it hasn't), and nothing is solved in Ukraine/Russia.. what happens after Midterms if Cushing remains near bottom scraping lows?

Counter this: maybe an export ban or some other moving part will be utilized to earmark the last SPR oil released for Cushing. There is always a way for a politically charged event to defer a problem even if it may do more damage later.

For more charts, see our Cutting Room floor.....