Why buy gold? Buy stocks instead!

If it’s the end of the world, Gold is useless, if it isn't Stonks will soar!

Housekeeping: This issue has 5 Premium pieces. A new 2 hour Founders Talk on metals spreads, Metals CTA behavior, Oil and Gas, Commodities, Fed policy, and Crypto. Tomorrow will be a light day for us, so we are frontloading for readers.

We are offering a week free to Premium subscribers. We hope you see the value.

Market Rundown

Good Morning: Markets started the morning sideways and choppy with one exception. Bonds were much weaker. All of that changed about 7:30 when the media started broadcasting risk of nuclear incidents was increasing and suspicions of chemical weapons being used.

Zelenksy said to NATO:

"This morning … phosphorus bombs were used. Russian phosphorus bombs. Adults were killed again and children were killed again," he told the NATO representatives, though without citing evidence

Gold popped and continued to remain firm. Stocks also rallied. Why did stocks rally? We think you buy stocks because as this escalates, the Fed might have to delay its tightening.

The cynical and growingly popular comment we see is: Buy stocks because if it’s the end of the world, it wont matter. This is the flipside of the old carnard: Why buy Gold? If it’s the end of the world, where will you spend it? Forgetting the soullessness of this when not said in jest. It doesnt stackup empirically either

The reason this is unadvisable? If the world doesn’t end and the problem is protracted (Vietnam, Afghanistan, Syria etc) stocks will go down as the Fed has to raise rates. Gold will go up because people will become mores sensitized to stagflation. The world doesnt have to end for your world to be in shambles. The world rarely ends.

Cheers

Premium Previews

Founders: Bacwardation in Gold and Silver

Gold and Silver

COMEX Gold switched ‘buy-to-sell’ in its short-term signal..

Correct, CTAs are selling this week. If the market can absorb it without puking, then its clear sailing. Why? Because the bank traders have no producer selling hitting their book right now.

The week started out soft from this. If material bearish NEWS comes out there will be aggressive CTA selling this time. But until that does, all dips are being bought by banks and funds and treated as noise.

more at bottom

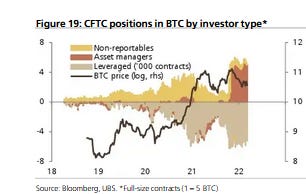

Bitcoin, Ethereum and Defi

Biden's well-flagged Executive Order may have looked 'relatively benign,' but it was emphatically less industry-friendly than the wholehearted embrace some large vested players spun it to be

more at bottom

Oil and Gas

Backwardation is stretched in the majority of commodity markets…

more at bottom

Fed Policy

So, given the 40-year trend of “lower lows” and “lower highs” in interest rates, perhaps it is not surprising that most investors are skeptical about how far the world’s central bankers are going to be able to hike this time round as well.

more at bottom

Zen Moment

Have a good one

If you enjoyed this piece, please do us the HUGE favor of simply clicking the LIKE button!