Hartnett Plants Flag, Declares Regional Banks Broken- (ZeroHedge Edit)

ZeroHedge Edit

Since ZeroHedge introduced us to his analysis (this week's is “Fed Hiked Until It Broke Regional Banks") Hartnett has been a little bit of a puzzle to read1 This week however, a structural pattern finally revealed itself. Below, his current report is broken down into what we hope will be easier to digest.2 From there, if you subscribe to ZH premium, you can read their weekly deep dive as we do and get a lot more out of it. Anyway, lets dig in...

Market Returns, Main Story

Macro Trends Manifesting Now

Financial Excess Leads to Debasement, Default, and De-Rating

Stocks Are Strong But Narrow

Hartnett’s Actionable Bottom Line: Sell it After Last Hike

Supportive Analysis

How Selling the Last Rate Hike Looks Historically

Key Flows

Notable Charts

1- Market Returns, Main Story

Authored by Goldfix, ZH Edit

As of Thursday's close Hartnett sees the following asset performance year-to-date best to worst:

Crypto +57.8%

Gold +11.5%

Stocks +7.6%

Investment grade bonds +4.9%,

High Yield bonds +4.5%,

Gov’t bonds +3.6%

Cash +1.4%

US dollar -2.1%,

Commod -10.9%

Oil -14.5%

BOA’s head analyst has been tracking events waiting for the one that would allow him to say without a doubt that something was broken due to Fed hiking as it always does. Today he put his flag down in regional banks and thus updates his now famous chart in red.

Regarding the "breaking" part: Lets face it, destroying the 2nd and 3rd biggest banks in US history in 3 weeks has to count for breaking something beyond repair. Hartnett is correct again. But this time— so far—it is Yellen and her FDIC pals on the fiscal side using spit & glue to keep things together. Powell has kept his printer holstered.

“Fed hiking cycles always ‘break’ something…this time US regional banking system”

The obvious question about Powell's Printer is.. when will the easing start? To which Hartnett implicitly answers further down in the report when he says “[I]nflation to severely limit Fed’s reaction function".

We take that to mean: We’re not sure if/when Powell eases, but even if he does, it cannot be on the (230bp) hopeful path markets thinks it will be’. More on that at bottom

2- Macro Trends Manifesting Now

Next the Macro Analyst runs through some other less time-sensitive ideas on his radar taking shape

Financial Excess Leads to Debasement, Default, and De-Rating

In previous reports Michael fleshed out reasons for ongoing ideas and updates readers on where he stands as needed. This one is pretty cut and dry. The money spent due to the pandemic and subsequent fiscal excess is a tipping point of sorts as the US compares to some of its peer countries

[Pandemic] driven 2020’s fiscal excess [was] inflationary. It leads to default (like the banks), debasement (just getting started), de-rating of US assets compared to peer countries.

That last one refers to the leveling of global assets as our asset inflation drops while theirs stays more stable.

Defaults are here…

Here's a statement made several times in different forms by many people going back to 2021 describing these painful risks Hartnett describes. Bottom line. This tweet combines 1970s inflationary history lessons, Zoltan's secular stuff, and Hartnett's current Macro analysis to generate the government's policy plans:

PSA 2: the last time they did these in combo was the 1970s (YCC was WW2 iirc) https://t.co/7n9JvcD7Ci

— VBL’s Ghost (@Sorenthek) May 6, 2023

For perspective, Michael notes our $31.4tn debt is big as the combined GDPs of Japan, Germany, India, UK, France, Italy, Canada, Brazil, Russia, Australia, Korea & Mexico! That must lead to either direct debt reduction or higher interest rates on bonds to compensate for debt risk. But since neither of those will happen, debasement is the path

Stocks Are Strong But Narrow

US tech vs S&P 500 are back at Feb '00 & Jan '70 highs and that is good, but market breadth is very grim so far (Apple and MSFT the whole mkt?).

3- Hartnett’s Actionable Bottom Line: Sell it

The economist notes in crisis times, like the bank failures experienced now, the Fed is always the “Reaction Hero” for Wall St. Right now the Street is anticipating a 230bps in Fed cuts this year already. He thinks that is likely too much. Especially since he expects “inflation to severely limit Fed’s reaction function in 2023” . Hartnett's conclusion, therefore remains3: Sell the last rate hike.

Before looking at trade ideas, here is the main part of his original opinion as documented here:

Hartnett grouped stock moves post a final rate hike to by inflationary vs disinflationary eras. Here is what he found: Stocks fell in the 3 months after every last hike in the '70s/'80s (Table 2 below)…“We think that last hike happens in 2023 as negative feedback loop from higher unemployment to day traders, retail, consumers, corporations likely very pronounced…”

When is the last rate hike is our question. Did we just have it, or will there be more in June and July? Maybe Powell knows this as well, and will remain quiet when it finally comes. Anyway. He is sticking to his guns. Sell the last rate hike.

4- Updating Supportive Analysis

Here the Analyst updates readers on current concepts and data relationships generating or contraindicating his ideas. Collectively these seem to function as an Either/Or barometer

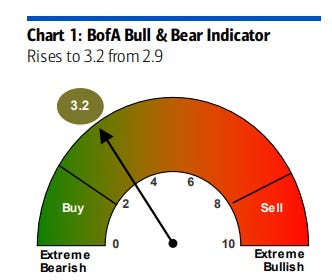

On Bull or Bear?: No Chance of Easing Until Recession

"New structural bull market requires big Fed easing, and big Fed easing requires big recession"

On Recession vs. Resilience: Fading Resilience

The big story of 2023 remains recession but we do not have one yet....But we believe US recession now imminent due to yield curve changes last week. Payroll ain’t negative yet, so no recession yet , but April JOLTS data showed 1st signs higher rates/banking crisis hurting labor market. [ Edit- ignoring Friday's payrolls too which will be revised downward next month anyway- VBL]

On Ceilings vs. Fiscal Stimulus: Stagflation is the result

The outcome of the debt ceiling debate in D.C. debatable and he offers a hedge if you feel the need. His main focus is the ever present Anti-Goldilocks combo of higher debt combined with decreasing marginal utility of adding debt

The US fiscal deficit is now an impediment to any meaningful fall in long-term interest rates. Meanwhile the US economy is unlikely to benefit from the next $800bn of government spending next 12 months.

Taken together he sees higher debt keeping a floor under rates, and diminishing returns on newly spent money.

On Inflation vs rate-cut debate: Bank bailouts will fade, then Powell will be pressed to cut this summer

Continues..

How Selling the Last Rate Hike Looks Historically

Here are his data findings for treasuries, stocks, gold, and the dollar followed by his added opinion paraphrased— in italics afterwards.

Buy Treasuries: Treasury returns positive 9/10 times after last hike, avg 7% returns 3 months post-last Fed Hike in inflationary cycle—Yes we agree, long Treasuries