Housekeeping: Good Morning.

“The Gold reset is a process, not an event”

Today:

Discussion: Goldman Raises its 2024 Target again

Premium: Goldman Raises Early 2025 Target on 500% Increase in Physical Demand

BONUS: WHY SILVER IS WEAK

Discussion: Goldman Raises its 2024 Target again

As the gold price keeps breaking records, we formalize our gold pricing framework, and flesh out the drivers of our bullish forecast that gold will rise about 10% to $3,000 by December 2025.

Financial & monetary authorities (Fear)

Investors (Interest rates).

Speculators (Safe haven).

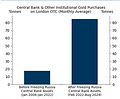

While the gold price-to-rates relationship remains intact in changes, the fivefold increase in our nowcast of central bank demand in the London OTC market since Russia invaded Ukraine has reset this relationship in levels. We Assume Central Bank Purchases Will Moderate to a Monthly Pace of 30 Tons, Structurally Higher Than Pre-Freeze Levels

Continues in Goldman Raises Early 2025 Target on 500% Increase in Physical Demand

News/Analysis:

Equity Recap:

SPX -0.33% at 5,814, NDX -0.79% at 20,388, DJIA -0.22% at 42,142, RUT -0.23% at 2,233.. US stocks were ultimately pressured in the midst of earnings season and the NDX underperformed owing to the weakness in semis as AMD's earnings offset the strong results from Alphabet, and with Super Micro shares plummeting after its auditor Ernst & Young sent it a letter of resignation.

Market News:

Meta Platforms Inc (META) Q3 2024 (USD): EPS 6.03 (exp. 5.24), Revenue 40.59bln (exp. 40.27bln). Expects Q4 total revenue to be in the range of USD 45bln-48bln (exp. 46.3bln). Co. shares were lower by 3.1% after-hours with some desks questioning the Co.'s growth outlook amid potential AI-related losses

Microsoft Corp (MSFT) Q1 2025 (USD): EPS 3.30 (exp. 3.10), Revenue 65.6bln (exp. 64.51bln). Microsoft Cloud revenue 38.9bln (exp. 38.11bln). Co. shares were lower by 3.7% after-hours following its disappointing cloud growth forecast

Amgen Inc (AMGN) Q3 2024 (USD): Adj. EPS 5.58 (exp. 5.11), Revenue 8.50bln (exp. 8.52bln)

Politics/Geopolitics:

Israeli officials said Israel and the US had reached preliminary understandings on the principles for a political settlement to end the war in Lebanon, according to Axios’s Ravid.

US envoy Hochstein is working on drafting an agreement between Israel and Lebanon, while the army will withdraw from Lebanon within a week and will resume its operations if the agreement is violated.

CNN cited a senior source familiar with Iran's intentions who stated that the Israeli attack would be met with a "decisive and painful response", while the source did not provide a date but said it would "likely take place before the US election".

Israel Broadcasting Corporation reported that Tel Aviv is considering launching a large-scale pre-emptive attack against Iran, according to Sky News Arabia.

White House said the US will support Israel if Iran does respond.

North Korea launched a ballistic missile towards the East Sea which set a new record, while North Korean leader Kim said the missile test was appropriate military activity as their enemies' dangerous moves have emphasised the need to strengthen the nuclear force and North Korea will never change its stance of strengthening its nuclear arsenal, via KCNA.

South Korea's National Security Council plans to designate new sanctions on North Korea and South Korea's military said the US is to respond to North Korea's missile test by deploying strategic assets for drills, according to Yonhap.

South Korean Defence Minister said Russia could aid North Korea with technology for tactical nuclear weapons and ICBMs in exchange for North Korean troops.

White House said the US condemns North Korea's intercontinental ballistic missile test, but noted North Korea's intercontinental ballistic missile test did not pose an immediate threat to US personnel, territory, or its allies.

Japanese PM Ishiba will hold a national security council meeting and Defence Minister Nakatani said they will closely cooperate with the US and South Korea over North Korea's missile launch.

Data on Deck: PCE and NFP/Unemployment

MONDAY, OCT. 28 None scheduled

TUESDAY, OCT. 29 S&P Case-Shiller home price index

WEDNESDAY, OCT.30 Retail and Trade

THURSDAY, OCT. 31 PCE , Core PCE index Oct.

FRIDAY, NOV. 18:30 am U.S. employment report