Housekeeping: Good Morning.

**Please excuse the false starts today**

Today:

Premium Analysis: Powell Killed His Credibility This Week

News: Gold and Silver Charts

Premium Analysis: Powell Killed His Credibility This Week

Yesterday, in Powell's 50bps Cut is Contradictory we summarized Michael Every’s post Fed Decision comments as follows

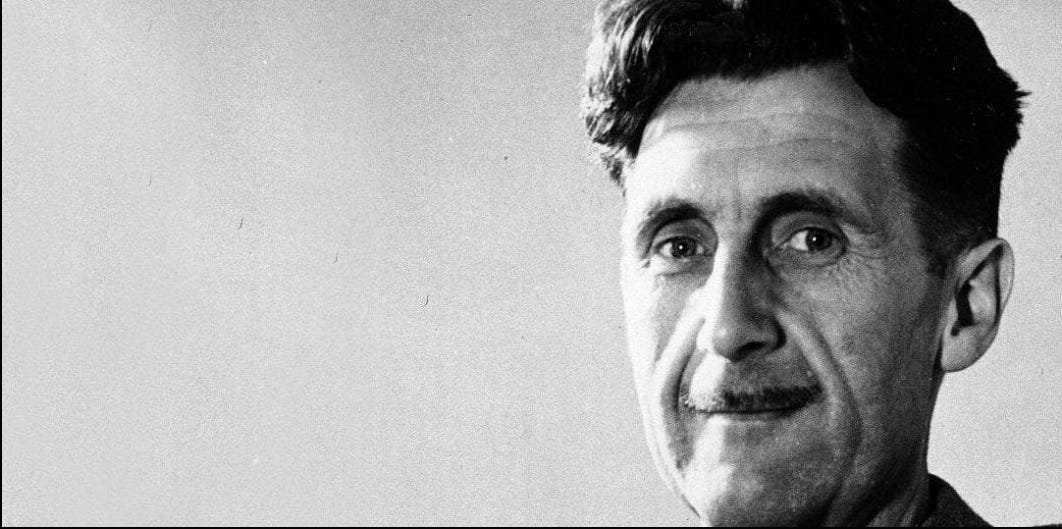

Michael Every and his partner in crime today Philip Marey wrote a polemic worthy of Christopher Hitchens praise post Fed Cut. Their target? Jerome Powell.

No lie, these are powerful no BS observations on Powell’s rate-cut decision alternating betweeen bottom line analysis and sharp sarcasm

On Fed Credibility:

The Fed’s decision to cut rates by 50bps is contradictory against its assertion of economic strength.

“Really? A 50bps cut as a message that the economy is strong? So, if they cut by 75bps the economy is booming? ….1984: WAR IS PEACE; FREEDOM IS SLAVERY; IGNORANCE IS STRENGTH.”

On Market Behavior:

Market rally driven more by expectations of Fed support than underlying economic fundamentals.

If cutting 50bps and saying all is well was problematic for Fed credibility, so are its happy projections for markets that have already priced a lot of ‘BAD IS GOOD’ news in.

On Political Agenda:

The Fed seems to be prioritizing short-term political stability over long-term economic strategy.

Powell had incentive to deliver a big pre-election cut because Trump won’t reappoint him as Fed Chair and may remove him prematurely; his only chance of another term is to please Harris.

On Geopolitics:

The cut seems to have ignored geopolitical risks relating to the ME

“The Fed isn’t considering the Middle East at all”

ZH does a great extended comment on the work titled: Rabobank Goes Apeshit On Powell's Orwellian Rate Cut.

Full Rabo analysis at bottom

News:

Gold’s New All Time Highs and Silver’s Return to Center Stage

Equity Recap:

The S&P 500 and Dow Jones Industrial Average closed at record highs on Thursday, one day after the Fed cut near-term rates by 50 bps. Large caps lagged small caps: S&P 500 (+1.70%) vs. Russell 2000 (+2.10%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) rallied 2.12% and 1.98% respectively.

Market News:

"FedEx cut the top end of its full-year profit outlook and reported quarterly earnings below expectations on softer demand for package deliveries Bloomberg

"Mercedes-Benz lowered its full-year outlook, a move triggered by the further deterioration of the macroeconomic environment, specifically in China...: WSJ

"Sales of previously owned homes fell 2.5% in August from July, to a seasonally adjusted annualized rate of 3.86 million unitsCNBC

"Darden Restaurants on Thursday reported weaker-than-expected quarterly earnings and revenue . CNBC

"Nike chief executive John Donahoe will retire next month in an abrupt leadership change: FT

"The EU’s incoming competition chief has signalled a new era in how Brussels polices dealmaking FT

Politics/Geopolitics:

Israel conducted dozens of strikes in south Lebanon in a major intensification of bombing,

Hamas source told Al-Arabiya that they are keen to reach an agreement in Gaza.

The US doesn't expect an Israel-Hamas deal before the end of US President Biden's term, according to WSJ

"Russia warns of 'dire consequences' if Israel launches large-scale military operation in Lebanon", according to Al Arabiya.

Russian Foreign Minister Lavrov said they see how NATO is increasing its manoeuvres near the North Pole and that Russia is ready to defend its interests militarily, according to Asharq News.

China Defence Ministry spokesperson said US arms sales to Taiwan seriously violated the One-China principle and provisions of China-US joint communiques

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, SEPT 16 8:30 am Empire State manufacturing survey Sept. -4.

TUESDAY, SEPT 17 8:30 am U.S. retail sales

WEDNESDAY, SEPT 18 2:00 pm FOMC interest-rate decision

THURSDAY, SEPT 19 10:00 am Existing home sales

FRIDAY, SEPT 20 None scheduled 1

Final Market Check…

Premium:

***DO NOT SHARE THIS***