Housekeeping: Good Morning.

Today:

Premium Analysis: UBS Maintains

News: G7 mBridge answer, Russian gold, Tax abolition

Premium Analysis: UBS Maintains

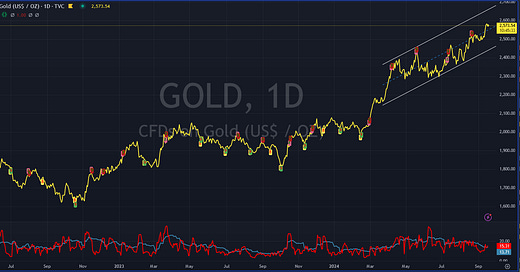

UBS updated its view on Gold on September 12th. In a 2 page note from its CIO it reiterated to clients its current position on Gold post the rally.

UBS maintains a bullish outlook for gold, with projections of USD 2,700/oz by mid-2025.

The current macroeconomic setup, including ongoing central bank purchases and geopolitical risks, supports this forecast.

Investors are advised to maintain an allocation to gold, as it continues to act as a hedge against market volatility.

Related: Swiss Pensions Now Want the Gold

Full analysis here.

News: G7 mBridge answer, Russian gold, Tax abolition

Top commercial banks join G7-led central bank digital currency trial

LONDON, Sept 16 (Reuters) - Forty of the world's leading commercial banks have joined a G7-led pilot scheme with the New York Fed and leading central banks from Europe, Korea and Japan for a new digital currency platform designed to speed up and enhance cross border payments. Link

Russian businesses now using gold to pay Chinese suppliers

Some Russian businesses have begun using gold to pay Chinese suppliers to get around US sanctions and threats of sanctions against Chinese banks affecting Russia-China bank transfers. Link

New Jersey Eliminates Sales Taxes On Gold And Silver

Sound money advocates are hailing their hard-fought victory today as New Jersey’s Senate Bill 721 was signed into law – thereby removing sales taxes on purchases of gold, silver, and other precious metals above $1,000 effective January 1, 2025. Link

Equity Recap:

US equities were mixed on Monday ahead of August retail sales data on Tuesday and the Fed's rate decision and Chair Powell's press conference on Wednesday. Large caps lagged small caps: S&P 500 (+0.13%) vs. Russell 2000 (+0.31%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) added 0.33% and 0.81% respectively.

Market News:

WSJ's Timiraos wrote "Fed Prepares to Lower Rates, With Size of First Cut in Doubt: The central bank usually prefers to move in increments of a quarter point.- NS

"Microsoft unveiled a new $60 billion stock-buyback program, matching its largest-ever repurchase authorization, and raised its quarterly dividend 10%. Bloomberg

"Intel unveiled cost-cutting and restructuring measures, including a two-year pause on planned chip plants in Germany and PolandFT

"Boeing announced sweeping cost cuts Monday as it deals with a strike by more than 30,000 factory workers. CNBC

"Amazon wants its employees back in the office five days a week.WSJ

Politics/Geopolitics:

US Secretary of State Blinken will travel to Egypt today for US-Egypt strategic dialogue.

"Houthi leader: ready to send hundreds of thousands of trained fighters to Hezbollah", via Sky News Arabia.

North Korea's Foreign Minister traveled to Russia, according to KCNA.

Two Chinese Coast Guard ships arrived in Russia's Port of Vladivostok for joint drills, according to RIA.

Some headlines via NewSquawk or DataTrek

Data on Deck:

MONDAY, SEPT 16 8:30 am Empire State manufacturing survey Sept. -4.

TUESDAY, SEPT 17 8:30 am U.S. retail sales

WEDNESDAY, SEPT 18 2:00 pm FOMC interest-rate decision

THURSDAY, SEPT 19 10:00 am Existing home sales

FRIDAY, SEPT 20 None scheduled 1

Final Market Check…

Premium:

***DO NOT SHARE THIS***