Housekeeping: Good Morning.

Today:

Premium Analysis: Very special piece of the puzzle just dropped

News: Gold market Recap

Premium Analysis: MUFG Outlook

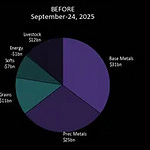

Very special piece of the puzzle just dropped hinting at the Buy-Season allocations

Set to breach the USD3,000/oz handle in 2025

"Fears" where confidence in the USD-backed monetary system is challenged, alongside the 2024 drivers of gold, will catapult bullion higher in 2025

We have the full MUFG analysis includind everything you see below and will share our breakdown of it with premium subscribers noon today.

MORE EXCERPTS AT BOTTOM With Some frank comments on this report

News: Market Recap

Market Recap

Here is a straight recap

Equity Recap:

US equities rallied on Thursday, led higher by tech shares. Large caps lagged small caps: S&P 500 (+0.75%) vs. Russell 2000 (+1.22%). MSCI Emerging Markets (EEM) and MSCI EAFE (EFA) added 0.83% and 0.82% respectively.

Market News:

OpenAI is releasing a new artificial intelligence model known internally as “Strawberry” that can perform some human-like reasoning tasks, as it looks to stay at the top of a crowded market of rivals. Bloomberg

"The European Central Bank has cut interest rates by a quarter percentage point to 3.5 per cent in response to falling Eurozone inflation and signs that the bloc’s economy risks grinding to a halt. FT

"Wholesale prices rose in August about in line with expectations, the final inflation data point as the Federal Reserve gets set to lower interest rates. CNBC

"Microsoft on Thursday said it is cutting 650 roles at its Xbox gaming division, in the latest major round of layoffs to hit the video game industry.CNBC

"US household wealth reached a fresh record in the second quarter, fueled by a steady rise in the value of real estate and Americans’ stock holdingsBloomberg

"Billionaire Steve Cohen’s Point72 Asset Management is preparing to return some capital to investors for the first time, joining multistrategy hedge fund peers looking for ways to restrict their assets after a period of explosive growth. The firm is considering handing profits to clients after the end of the year... The amount could run into billions of dollars." Source: Bloomberg

"General Motors and Hyundai Motor have entered into an agreement to explore “future collaboration across key strategic areas” in an effort to reduce capital spending and increase efficiencies, CNBC

Politics/Geopolitics:

Russian President Putin warned the UK and the US that they will be "at war" with Russia if they allow Ukraine to use long-range missiles to strike targets inside Russia, according to The Times.

US Ambassador to Ukraine strongly condemned Russia's attack on a vessel carrying grain from Ukraine.

Russian Deputy Defence Minister said the China-Russia relationship is a model of nation-to-nation collaboration and is a peace guarantee.

China's Defence Ministry said major countries must the take lead in safeguarding global security and should never interfere in other countries' internal affairs.

Some headlines via NewSquawk or DataTrek

Data on Deck: NFIB, CPI, PPI

MONDAY, SEPT. 9 Wholesale inventories

TUESDAY, SEPT 10 NFIB optimism index

WEDNESDAY, SEPT. 11 CPI year over year

THURSDAY, SEPT 12 PPI year over year

FRIDAY, SEPT 13 Consumer sentiment.1

Final Market Check…

Premium:

***DO NOT SHARE THIS***

The MUFG analysis cites extensive evidence to justify their price calls:

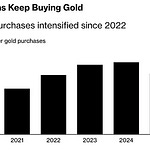

Tripling of central bank buying (more to come)

Central banks turned net gold buyers post-GFC and levels have tripled post-Ukraine war

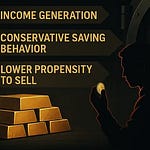

Imminent Fed rate cuts

Fed cuts are poised to bring DM capital back into gold (that has been absent since 2022)

Geopolitical hedge of first resort

Gold offers clear hedging value and wealth preservation against geopolitical shocks

Fiscal and debt apprehensions

US fiscal sustainability (tariffs, taxes, debt) post elections is a burgeoning fear driver

About MUFG.. Western Bank, not bullion bank.. this is a preview of their Buy season thesis. As long as a soft landing is on track, they will push this agenda.. and that means so will other banks.

Also: Every western bank is now remodeling gold not as a dolalr proxy, but as a dollar hedge citing the physical demand as a reason.. They are clearing thepath of western money to plouw in.. The risk.. is this bag holding.. the answer.. probably.. but it will not matter against the secular changes coming

Full report early afternoon

MONDAY, SEPT. 9 10:00 am Wholesale inventories July -- 3:00 pm Consumer credit Aug. $8.9B TUESDAY, SEPT 10 6:00 am NFIB optimism index Aug. 93.7 WEDNESDAY, SEPT. 11 8:30 am Consumer price index Aug. 0.2% 8:30 am CPI year over year 2.9% 8:30 am Core CPI Aug. 0.2% 8:30 am Core CPI year over year 3.2% THURSDAY, SEPT 12 8:30 am Initial jobless claims Sept. 7 8:30 am Producer price index Aug. 0.1% 8:30 am Core PPI Aug. 0.3% 8:30 am PPI year over year 2.2% 8:30 am Core PPI year over year 3.3% 2:00 pm Monthly U.S. federal budget Aug. FRIDAY, SEPT 13 8:30 am Import price index Aug. 0.1% 8:30 am Import price index minus fuel Aug. 0.1% 10:00 am Consumer sentiment (prelim) Sept.