"Bitcoin Will Displace Gold In The $15 Trillion Non-Confiscatability Market"

Part 3 of “The Intrinsic Value Of Bitcoin And Gold, Finally Explained”

Introduction:

Find attached Part 3 of the report comparing Gold to Bitcoin. No comments, opinion or counterpoints were added. Subscriber comments and questions below will be addressed in Part 4. Links to Parts One and Two are also at bottom

[ Full Disclosure: We disagree with certain premises here and will substantiate them in Part 4. We are most definitely biased pro gold, but also know that. We also own Bitcoin and were some of the first TradFi folks to “get it” back in 2017.

More recently, Vincent Lanci (VBL) wrote and refined many of the questions and liberally prepped the moderator (Daniela Cambone) for her Bitcoin debate between Michael Saylor and Frank Giustra as an expert on background during production.1 ]

"Bitcoin Will Displace Gold In The $15 Trillion Non-Confiscatability Market"

Executive Summary [Trade Rationale]

The total market value for non-confiscatability is $15.3 trillion, of which gold comprises 89 percent and cryptocurrencies just 11 percent.

In the next few years, as the non-confiscatability market grows to around $20 trillion and cryptocurrencies increase their share to around 20 percent, the bitcoin price could rise to well north of $100,000.

While we should expect a near-term countertrend move, the structural uptrend in bitcoin that started in November 2022 is still intact.

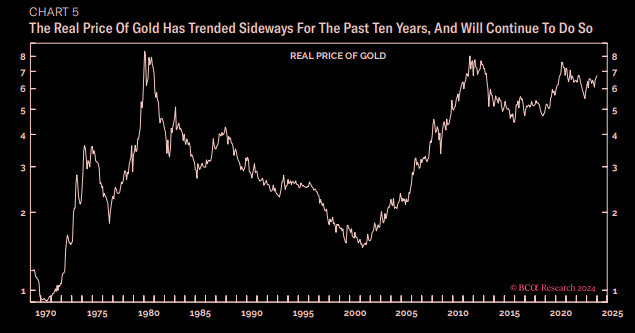

As cryptocurrencies gradually displace gold in the non-confiscatability market, the real price of gold is likely to stay in the sideways range that it has been in for the past ten years.

Tactical recommendation: Short gold.