Housekeeping: Good Morning.

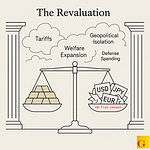

“Begun, the Mineral Wars have. ”

Topics:

China’s Gold ETF Outflows Meet Equity Enthusiasm

Fed Decision Day: Why a Rate Cut is very Unlikely

Market Analysis:

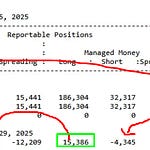

Bloomberg Notes China Record Gold ETF Outflows

Sideways Gold Meets Rising Stocks

Chinese gold ETFs saw record outflows in July as retail investors rotated into rising domestic equities. Bloomberg framed this as gold "stalling," but structural forces suggest otherwise. China’s accelerating M1 money supply supports both equities and gold, exporting inflation and challenging Western central banks’ 2% targets.

Full analysis in Premium Post: Bloomberg Notes China Record Gold ETF Outflows

Fed Decision Day: Why a Rate Cut is very Unlikely

The Federal Reserve is not expected to adjust interest rates at its upcoming July meeting. Despite persistent calls from some officials to ease policy, the broader committee appears inclined to keep the federal funds rate unchanged.

Bottom Line: Unemployment Isn’t High Enough, And Inflation is creeping up Again

Related Posts:

Coming Soon:

We’ll let you know

Data on Deck: Fed Week/ Employment, PCE

MONDAY, JULY 28 None scheduled

TUESDAY, JULY 29 Consumer confidence

WEDNESDAY, JULY 30 2:00 pm FOMC interest-rate decision

THURSDAY, JULY 31 PCE index June

FRIDAY, AUG 1. U.S. Employment report July1

Charts and Final Market Check: Gold/Silver chart under 90 gets you 79